Markets supported as trade talks progress (VOC, BWX)

WHAT MATTERED TODAY

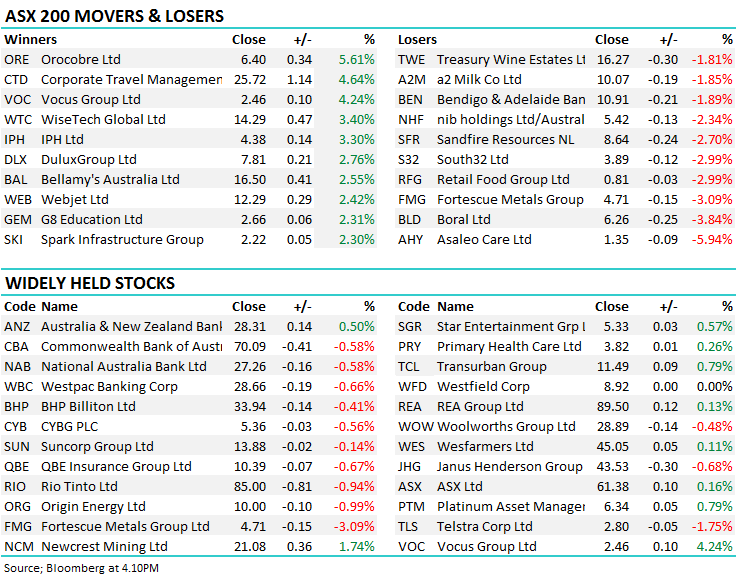

It was shaping up to be a lower open to trade this morning before US Futures came online and rallied – the S&P up by +0.60% while the Dow Futures put on +200pts on the back of easing trade tensions between the US and China. The US Treasury Secretary Steven Mnuchin suggesting on Saturday that "We are putting the trade war on hold. Right now, we have agreed to put the tariffs on hold while we try to execute the framework." So – the trade war on hold for now = positive for stocks although I doubt this will be the last of it. Typical Trump – goes hard, imbeds himself into a better negotiating seat then gives a little of the ground back that he’s just taken. The North Korean Dictator seems to like that tactic as well – sort of seems to work!

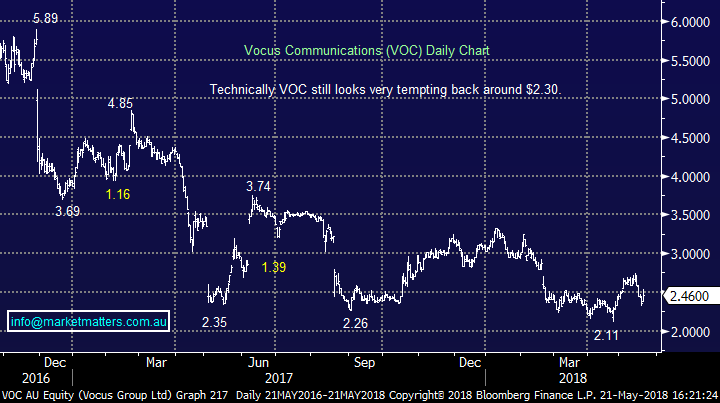

Our market opened well then gave back some of the earlier optimism – Commonwealth Bank (CBA) again on the nose flirting with the $70.00 handle throughout the day eventually closing at $70.09 down 41c, while Westpac and NAB were also weak. Elsewhere, CSL lead a strong run for healthcare names on the back of a flow of broker upgrades on the back of Fridays earnings uplift. We’re now seeing some BIG optimistic target prices for the stock that seems to continue kicking goals – Citi now looking for $215 TP – we’ve gotten this stock wrong, owned it, made money but it’s a drop in the ocean of what could have been! Still, we’re not there and have no appetite to chase.

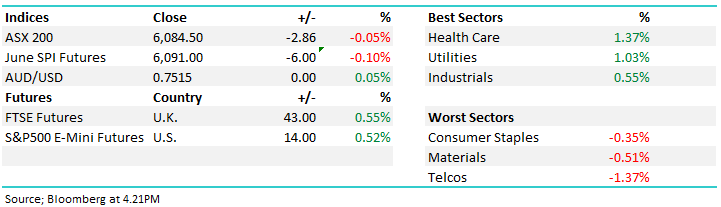

Overall, the S&P/ASX 200 index lost -0.05 percent to close at 6084, down -3pts for the day.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; CSL the main focus today with bullish broker notes dominating play, although most simply playing catch up to the share price…stock added another 1.73% today to close at $186.12

Elsewhere….

- APA Group Resumed at Ord Minnett With Buy; PT A$9.55

- Computershare Downgraded to Sell at Morningstar

- Vocus Upgraded to Buy at Morningstar

- Boral Downgraded to Underperform at Credit Suisse; PT A$6.40

- Asaleo Care Cut to Underperform at Credit Suisse; PT A$1.30

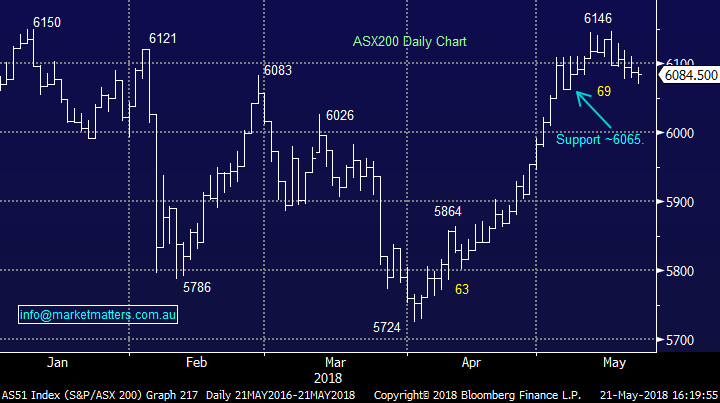

Vocus Group Ltd (VOC) $2.46 / +4.24%; the stock popped on the appointment of Kevin Russell into the top job today as MD & CEO of the group. Mr Russell comes with good experience in the Australian retail telecommunications market, having been the retail executive at Telstra, and CEO of consumer at Optus. He was also in the top job at Hutchinson Three UK between 2007 & 2011, starting at a time when the business was under fire running heavy losses, before turning it into a solid business over his time – experience he will no doubt lean on in his new role at the battle hardened Vocus. The appointment is short term positive for the company, we like the stock technically however Vocus will come under pressure if it fails to deal with current debt levels – the risk of a capital raising remains high.

Vocus (VOC) Chart

BWX Limited (BWX) $4.41 / - ; Was in a trading halt today after receiving a bid from the current CEO John Humble and the Finance Director Aaron Finlay with the support of private equity firm Bain Capital. For those not familiar with the company, they make and sell skin and hair care products under brands like Sukin, Mineral Fusion, DermaSukin and a number of others – the bride knows them well! The stock has had a tough run on the back of weak earnings but this is a strong bid at $6.60 a share, although still below the recent peak. The is subject to a few conditions but it’s a bold move from the CEO! I liked this stock, have never owned it – always seemed too expensive which means we missed the up, but also the down.

BWX Limited (BWX) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/05/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here