Markets rallies into the weekend (AHG, IVC)

WHAT MATTERED TODAY

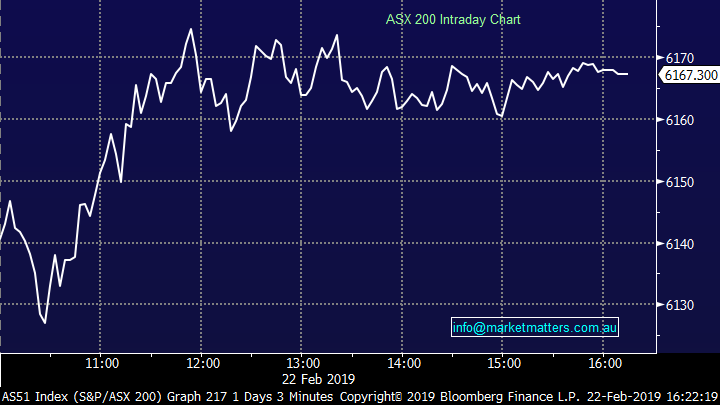

The market was strong early putting on a quick +30pts between 11-12 despite the overnight weakness across international markets – as we often say, the market can’t go down when the banks are being bought and that was the case again today – the early gains were held for the rest of the session.

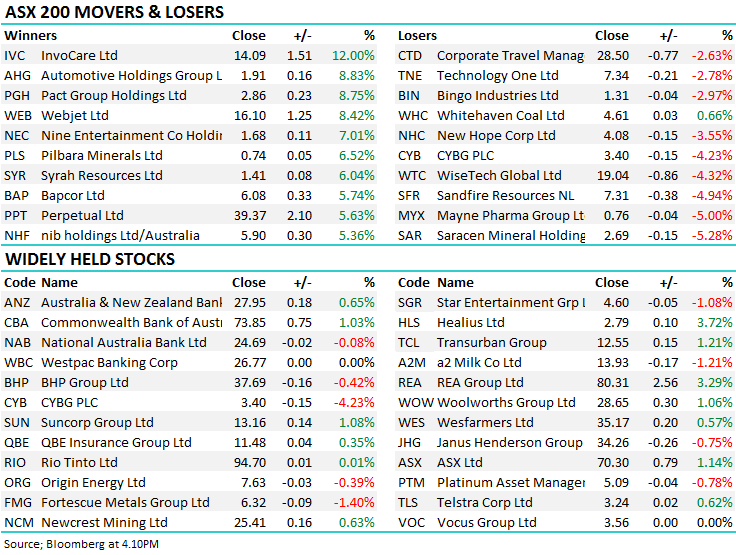

One of the key themes that has been obvious during reporting season to date has the been the performance of the ‘dogs’ – companies that have been having a tough 12 months from a share price perspective are being bought aggressively into weakness as the market searches for ‘perceived value’ – Pact Group (ASX::PGH). A stocks on our radar an example today adding more than 7% while Nine (ASX:NEC) was also up a similar amount. Fund managers are clearly leveraged plays on equity markets and we’re seeing money flow into this area of the market – Perpetual (ASX:PPT) one of the main beneficiaries here during the week adding more than 10% and is now closing in on the ~$40 handle.

Reporting continues next week, although at a slower pace - QBE which is in in the Growth Portfolio reports on Monday – they never seem to report well however they’re in a turnaround phase so we’re giving them the benefit of the doubt for now. IVE Group (ASX:IGL) which sits in the income portfolio is also out with results, and while we don’t own it, Bluescope (ASX:BSL) is a stock worth watching – it’s clearly been on the nose for the past 12 months.

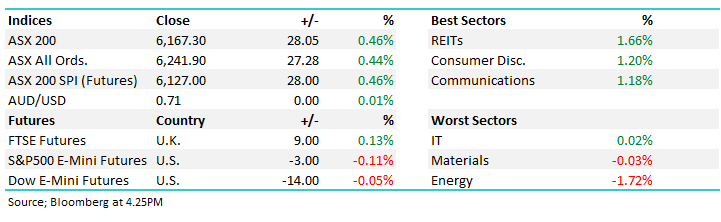

Overall today, the index closed up +28pts or +0.46% to 6167. Dow Futures are trading down -15 points / -0.06%.

ASX 200 Chart

ASX 200 Chart

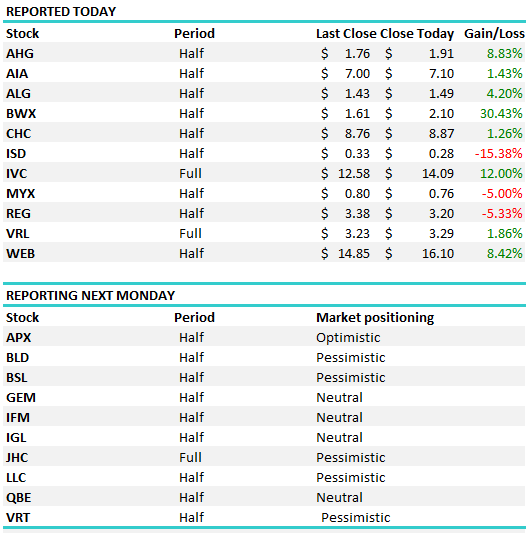

Reporting; Another solid week of reporting with two massive days thrown in on Wednesday & Thursday – a slower docket today however we still saw some big moves play out from companies where the market was positioned on the pessimistic side of the ledger.

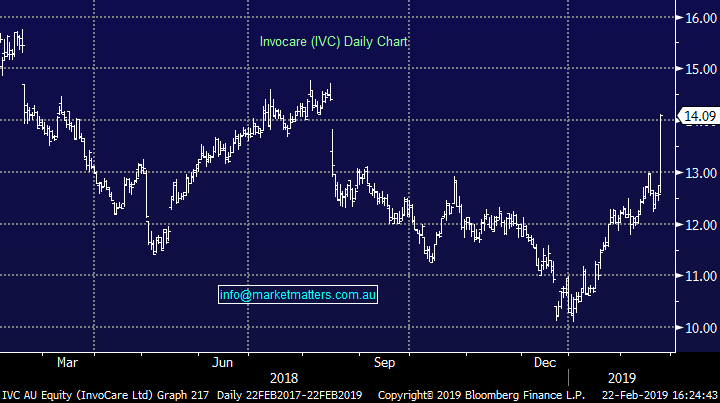

Funeral operator Invocare (ASX:IVC) +12% a case in point here rallying hard as shorts scramble to exit. Nearly 13% of IVC was short sold, making it the 5th most shorted stock on the ASX. They had (before today) 14.5m shares sold short and to put that number into context, around 2.2m shares traded today.

InvoCare (ASX:IVC) Chart

Other stocks to do ‘less bad’ today were Automotive Holdings (ASX:AHG) +8.83% after reporting an underlying profit today that missed expectations while they also failed to declare a dividend – which is a prudent decision in my view. They had some big write downs however that had already been announced to the market, so not new news. They also downgraded FY19 guidance for profit of $52-$56m down from $56-$59m however the market was already at $56m beforehand. Simply another example of a beaten down company finding some love after not reporting a disastrous result.

Automotive Holdings (ASX:AHG) Chart

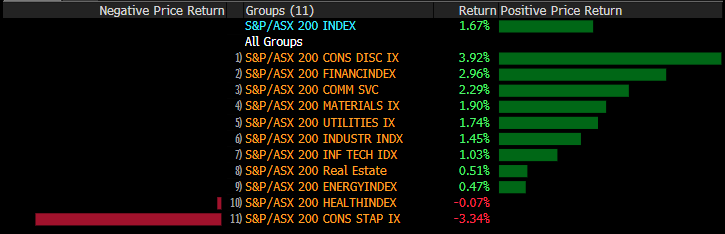

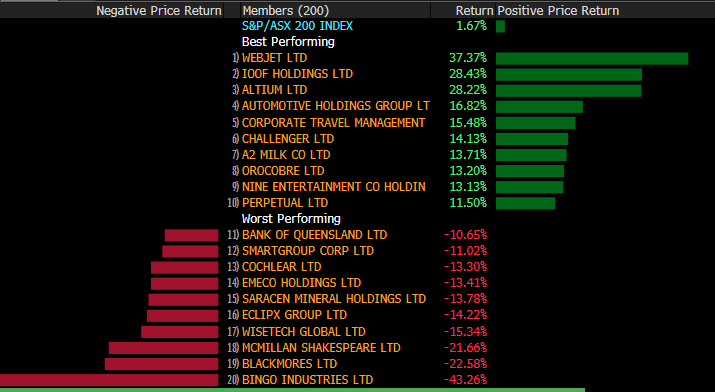

Sectors this week;

Stocks this week; Huge moves under the hood

Some of the stock specific events we covered during the week…

Is Wisetech (ASX: WTC) a wise investment after today’s slump?. Click here

IOOF jumps on a reasonable half year. Click here

Market turns down the volume on Cochlear. Click here

Woolies doesn’t live up to the hype. Click here

OUR CALLS

No changes to the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/2/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.