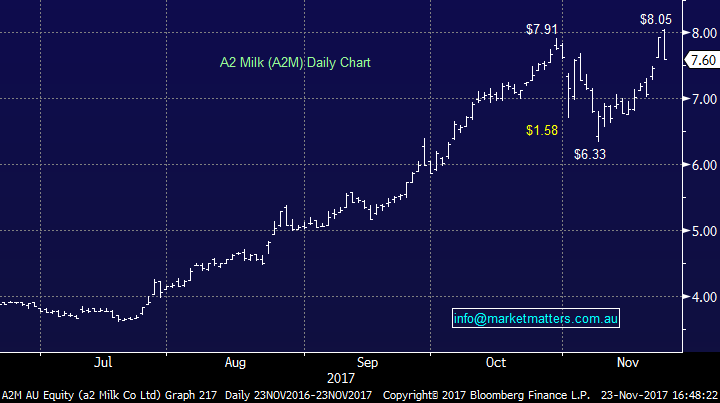

Markets in a holding pattern as the Poms bat in Brisbane (CCL, A2M, PFP, QBE)

WHAT MATTERED TODAY

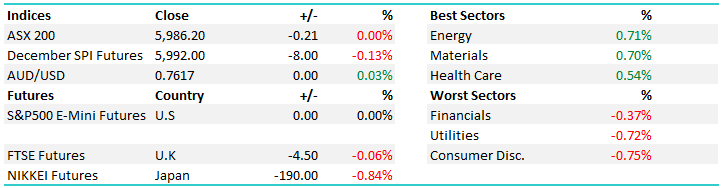

The Ashes kicked off in Brisbane with the Poms batting on a lovely flat wicket – 2 for 128 at time of writing in a rain impacted day of play. A typical slow start from the poms getting only a couple of runs an over from the outset and with some luck, the Brisbane sunshine kicks up a notch over the next few days…In terms of the mkt today, another choppy session for the ASX with buyers stepping into weakness but again, sellers kept a lid on any move that looked like tickling the 6000 mark – seems that level is still the sticking point for our market and ideally we want to see the mkt back to 5850 region before building enough momentum to go again – and have a decent push through.

Apart from a few very tentative forays above the level, we’ve basically seen the mkt trade for 9 long years below it – it’s a very strong region of resistance and understandably is taking some time to sustain any strength above it. Once we do see such a decent, long standing level broken we typically trade strongly on the upside and that’s where our 6500 target in short order comes into play. We had that same theme play out for May to Oct of this year – the mkt tracking sideways for almost 22 weeks, oscillating in a ~200pt range before the sustained breakout and +7% gain in about 6 weeks. Markets are funny things, filled with funny people and investor psychology is a big driver of where markets trade – and right now, it simply feels like we need a shallow pullback before winding up again and having a crack above 6000.

On the mkt today, most buying was focussed again in the Energy sector which was also the case yesterday while the retailers saw some selling – Nick Scali (NCK) which is in the MM Income Portfolio getting touched up by 1.72% to close at $6.85. A range on the mkt today of +/-20 points, a high of 5991, a low of 5971 and a close of 5986, off -0.2pts or flat.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

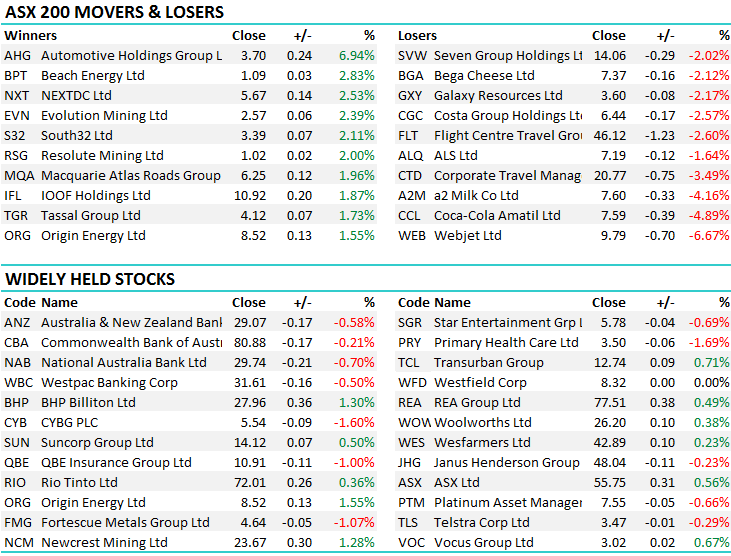

TOP MOVERS TODAY

1. Coca-Cola Amatil (CCL) - tumbled nearly 5% today after their investor day yesterday. Hidden in the presentation was guidance to flat earnings for FY18, also announcing they would bring forward $40mil in expenditure to 2018 that was originally expected in 2019/20. The earnings news wasn’t so bad, the consensus expectation was for earnings to fall over FY18, however the market clearly didn’t like the sound of an increase in costs at a time when top line is also under pressure. Sugar is bad which we all realise, but for me, nothing beats a full strength Coke, but I’m clearly now in the minority. From an investment sense, nothing to like here – the trends are poor, the turnaround taking too long and no doubt will cost too much. CCL fell to a 9 year low today.

Coco-Cola Daily Chart

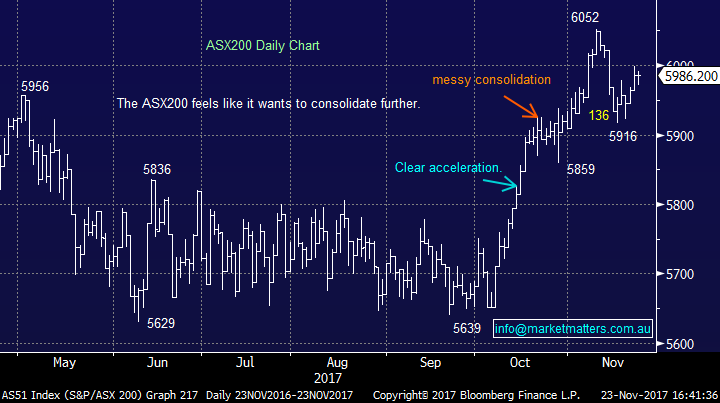

2. Propel Funeral (PFP) – a new listing today and the stock was HOT with its listing price at $2.70 - PFP opened 29.63% higher to $3.50, hitting highs of $3.60, before finishing its first session up 22% to $3.30 PFP provides a broad range of service across the death care industry and is the second largest operator against its competitor, InvoCare (IVC) – a stock which listed 10 years ago at $2 and now trades at currently $17.65 – and its very expensive trading on a PE of 32x, with a forecasted yield of 2.58%.

To give some context about how funeral operators make money – below is a breakdown of the earnings mix with $1.1bn spent annually.

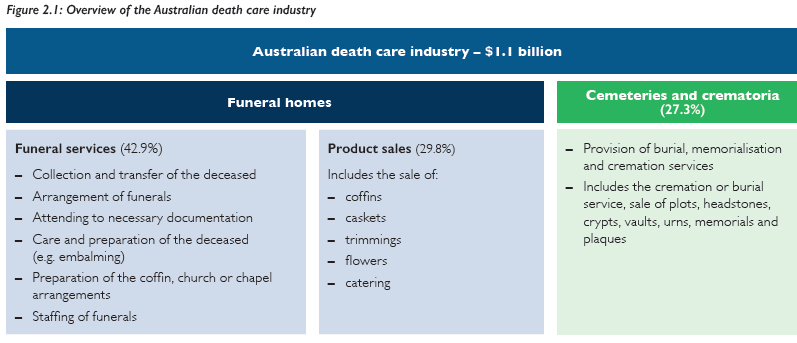

4.. Elsewhere, A2 milk (A2M) traded higher in early trade before being sold into late in the session to close down -4.16% to $7.60. As we suggested yesterday and again this morning – volatility will likely tick up here which is a sign that a topping pattern is starting to play out. We had a quick 2 week trade in A2 that we closed yesterday and booked 20% however now caution is clearly warranted. To be clear, we think this is a great story but mkt positioning is sooo bullish here – the good news is known, every tip sheet is calling this one higher so likely that it won’t.

A2 Milk (A2M) Daily Chart – key reversal today on the chart

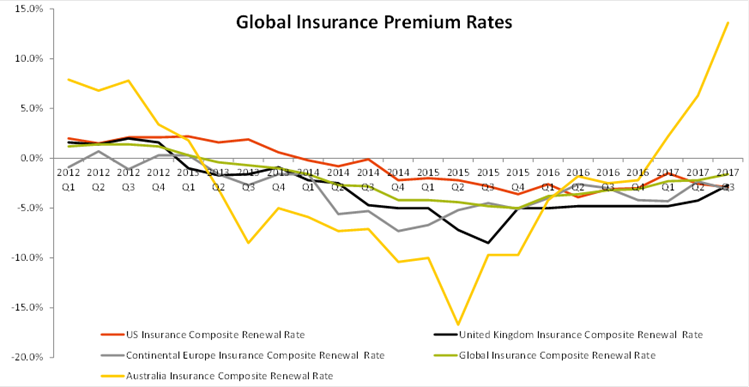

Interesting take on insurance premiums out yesterday with Australia doing particularly well while the international scene is becoming ‘less bad’ – prices actually going in the right direction which has been rare in recent years. We have a large overweight call in the insurers and we like these trends…

OUR CALLS

No movements across our portfolios today…sitting pretty for now in most of our positions although we are concerned about NAN – needs to hold $2.60 or we’re likely to cut it.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/11/2017. 4.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here