Markets hit hard but they will bounce!

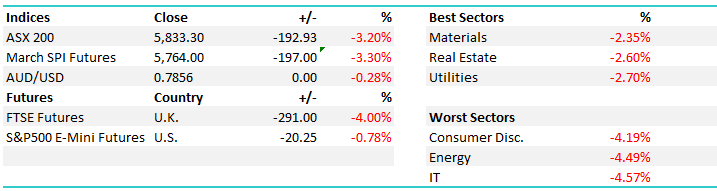

WHAT MATTERED TODAY

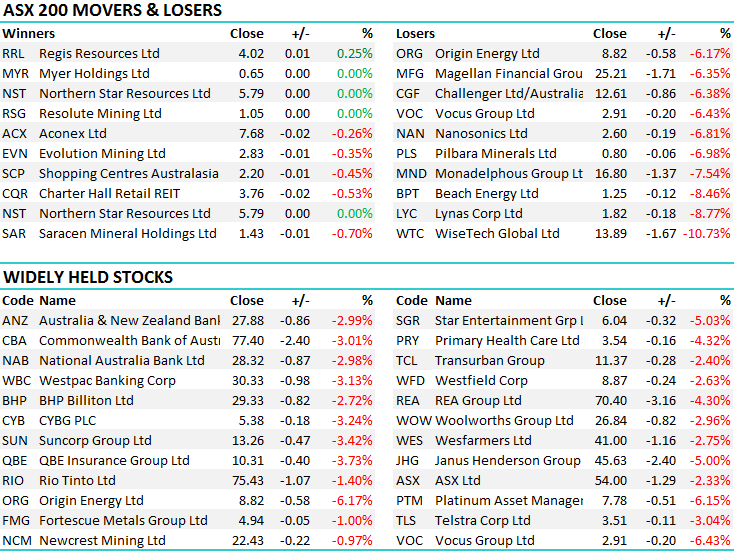

Another massive day for Aussie stocks and the busiest we’ve had on the desk for a few years courtesy of a big drop in the US market overnight plus we had follow through selling via US Futures today while Asia was a sea of red – the Nikkei off 5%, stocks down 3.35% in Hong Kong, while they fell 3.1% in China – our mkt almost felt okay compared to elsewhere however a day where the mkt falls ~3% is always going to rattle the cage! US Futures at their worst were down ~3.51% during our session however as I tap away they’ve recovered strongly and are now down 0.56% at 5.38pm - a strong recovery from the lows and a decent lead in to tonight’s session however as we saw today / last night, selling can become self-perpetuating as weak equity longs – leveraged positions and global funds around the world are forced to unwind their short volatility positions.

News today that Credit Suisse was taking a massive bath on a fund that shorted volatility rocked the market during our session and was probably the main catalyst for the uptick in scale and aggression of Futures led selling in the States. Anyway, the simple take away from this theme is that the greater the level of complacency on the way up the more violent the sell-off is when it finally comes. While we’ve been ‘cautious’ the US market for some time prompting us to maintain high cash levels in our portfolio’s, there’s no real escape for such a savage sell-off that has transpired over the last few sessions. From an investment standpoint, we hold cash to ensure flexibility which allows us to buy market weakness / panic when it unfolds. We bought 4 stocks today in the Platinum Growth Portfolio and 1 stock in the Income Portfolio which I’ll cover later, however at this stage the buying / levels we were filled feel reasonable. While no-one knows where this selloff will finish, buying on the back foot as stocks come down to our targeted levels makes sense to us.

Interestingly, we had targets on the stocks we picked up today that a few weeks ago looked very optimistic, however the market has a tendency to move sharply, and the patient can be rewarded. A few things to look at that gives me some comfort here. Credit spreads aren’t widening (much), day 1 of the sell-off in the US was just that, indiscriminate selling, while day two was simply a movement of funds from equities back into bonds – which suggests rotation rather capitulation. Margin positions in the states are high, cash was low and the mkt was simply too bullish. The fact money moved from equities to bonds and not simply to the sidelines overnight is a reasonable sign.

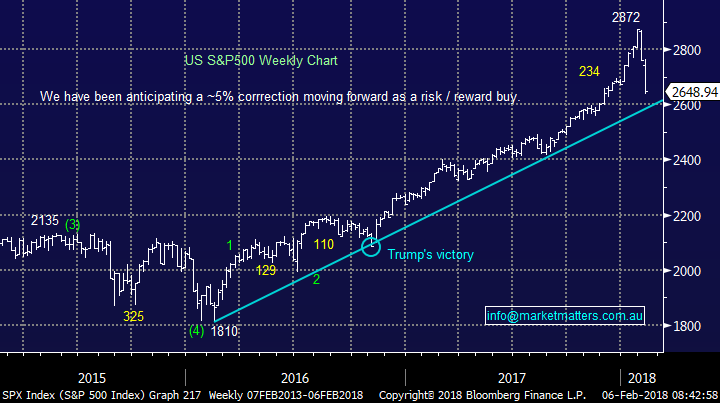

Our bearish downside target for the ASX 200 was the 5900/5950 range, and today the market punched through that courtesy of US Futures with the market closing down -192pts or -3.20% at 5833 – so clearly our downside targets have been hit and exceeded – however for now, we still view these levels as an opportunity rather than a time to panic, with the caveat that we’ll obviously be watching overseas trade tonight with interest. In terms of the S&P 500, our downside target is satisfied and we’re now looking for the market to find support around current levels – probably after trading lower on open tonight.

In terms of our portfolio’s today, the Growth Portfolio was weak losing 2.80% but better than to overall market while the Income Portfolio showed its defensive qualities, down around 1.7%, or about half the markets drop. We’re comfortable with our positioning in both. Watch out for the AM report tomorrow as we expand our thoughts further.

S&P 500 Weekly Chart

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

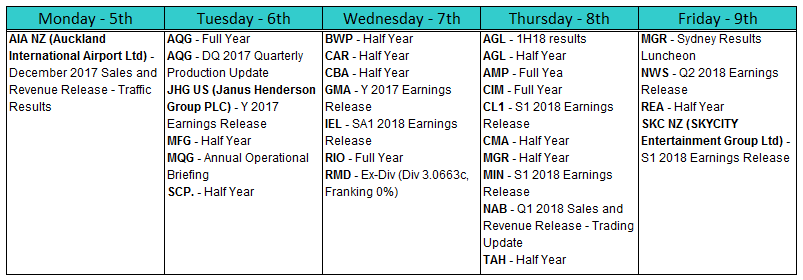

REPORTING – a BIG day tomorrow with CBA, GMA & RIO

OUR CALLS

We used the global sell off to buy some stock today across both portfolio’s. We added Macquarie (MQG) , Oz Minerals (OZL), Rio Tinto (RIO) and added to Janus Henderson (JHG) in the Growth Portfolio, while we added BHP to the Income Portfolio. We also trimmed our exposure to Newcrest (NCM) in the Growth Portfolio to increase cash slightly. Our expectation is that we’ll sell the remaining NCM to once again increase cash in the Growth Portfolio back up above 10%.

Macquarie gave an operational update today announcing a 10% lift in annual profit expectations, driven by higher revenues out of the Asset Management business thanks to a strong level of performance fees. The business remains solid, the bank is over capitalized and growing, and it also provides some leverage to a rising USD which mirrors our view that it will begin an uptrend after bottoming out recently.

Tonight we see Janus Henderson (JHG) report, while CBA and RIO report tomorrow.

Macquarie Daily Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/02/2017. 6.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here