Markets enters short term ‘tipping point’ (GMA, ILU, A2M, REA, SYR, TRS)

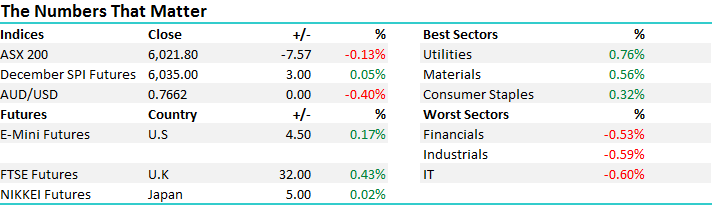

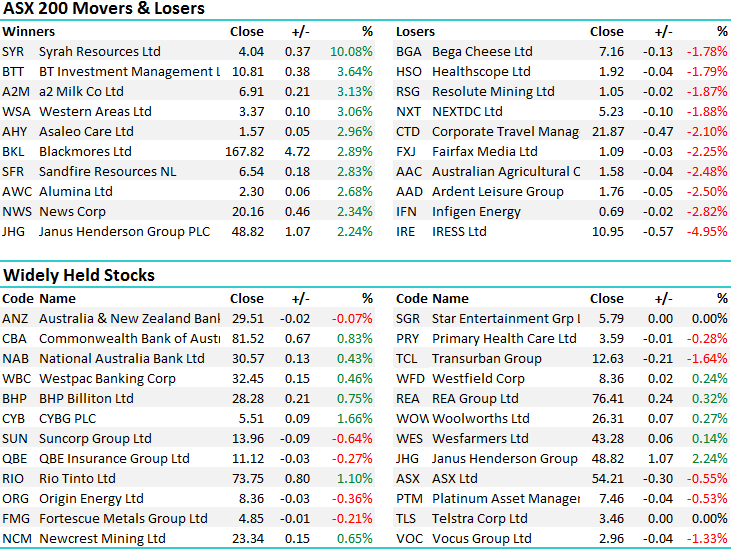

The market had a go at selling off on a few occasions today and failed - the buying in the match which saw the index up +8 points from 4pm to 4.10pm highlighting that there was simply a void of sellers in what proved to be a pretty quiet day of trade. Overall, the Material stocks did best, BHP and RIO bucking weakness in their overseas counterparts on Friday, probably a result of higher Iron Ore prices in Asian trade today while most weakness was felt in the IT space – a tight range today of +/- 18 points, a high of 6029, a low of 6010 and a close of 6021, down -7pts or -0.13%. As we wrote on the AM report, we continue to think a short term pullback seems likely but to date, it’s been stubborn – another example of that today.

ASX 200 Intra-Day Chart – BIG +8pts move in the match

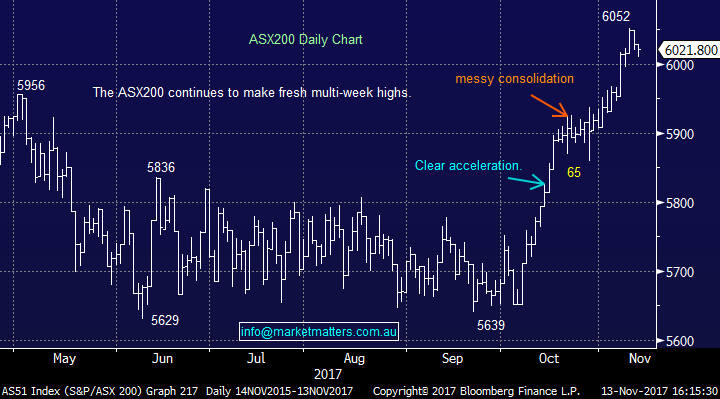

ASX 200 Daily Chart

Not a lot of company news, although a few of the growth stocks presented at a UBS conference and rallied on the back of it – A2 Milk (A2M) - one we hold which said the right things and rallied +3.13% while Syrah (SYR) topped the boards after they talked a very big story – the stock ending +10% higher hurting some of the shorts which are ~21% of their register.

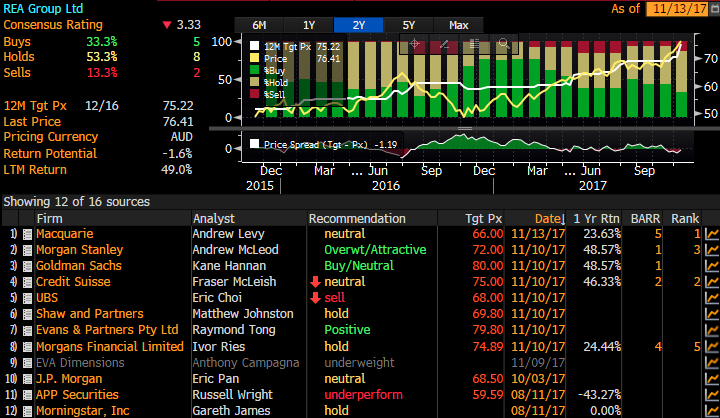

Elsewhere, REA Group (REA) had a volatile day after delivering results on Friday, the mkt digesting over the weekend with moves flowing through today. UBS put it on a sell, our friends at Shaw still have it on a hold (just) however REA management did their best to hose down market expectations around forward growth – the concept that ‘it gets harder from here’ was the undertone of management commentary… Goldman’s on the other hand have maintained the rage on this stock – an $80 price target the most bullish in the mkt. we don’t own REA Group and on 36x we think too much upside is now built in, particularly given it seems their business is now more leveraged to Sydney / Melbourne property mkts which are coming off the boil. The stock closed up +0.32% at $76.41 today.

Genworth (GMA); Staying with the housing theme, and a stock that ‘should’ be struggling is Genworth (GMA), which we have in the Income portfolio. They had another good session today adding +1.95% to close at $3.14, and are now up +12% in the last week or so. As we wrote early last weekish, MQG put out a bullish note on GMA exploding some of the myths around the stock. Anyone looking at GMA superficially would see a declining trend in earnings, big exposure to housing etc which is right, however it’s a capital return story over the coming years…Expect it to range trade and be choppy, delivering a good income along the way.

Genworth (GMA) Daily Chart

Iluka Resources (ILU); Iluka held an investor day Friday with some good commentary on the Titanium Dioxide and Zircon markets that I didn’t get a chance to mention on Friday. Effectively the company saying that both markets have bottomed and turned higher, with most momentum now in Zircon which it the main driver of earnings for ILU. They said there was an ‘emerging supply gap’ which is a positive for prices, they’ve managed to pay down a lot of debt in recent times and ‘if’ we get the commodity tailwind that has been blowing behind the others of late, we will get a sharply higher SP for ILU.

We like the commodity complex here, we probably sold too prematurely however if history serves as any sort of a guide, opportunities will certainly present themselves in the future – hopefully a few later in November…If we price ILU on 1.1x NPV we get the company worth $11 (versus $9.55) close today, while assuming a commodity price tailwind, 1.5x NPV is realistic which spits out $15. Certainly one to watch for a catalyst after recent consolidation.

Iluka (ILU) Daily Chart

The Reject Shop (TRS) – I was talking about this with a few of the guys on the desk this morning, and it looked interesting. 1. They are repositioning themselves into a niche area, specifically targeted cheap product that cannot be replicated online (think washing detergent and the like). 2. They are becoming specialists is that area and their shops are busy 3. Its cheap (12x) and pays 5.7% FF…and management have proven themselves over the years. It’s an illiquid stock but buying today was pretty aggressive.

Building on our comments from this morning, the retail sector is made up of many different areas - there are things that will not be impacted by AMAZON but have been priced like they will. The mkt hates TRS (still) with a consensus target price of $4.63, and the only bulge bracket to think it’s worth more than $5 is Morgan Stanley with a $5.35 PT. The stock closed up 9.14% today at $5.73.

The Reject Shop (TRS) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/11/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here