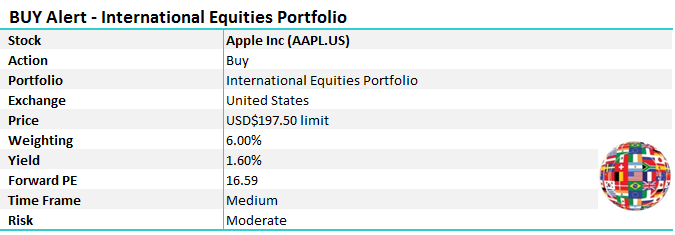

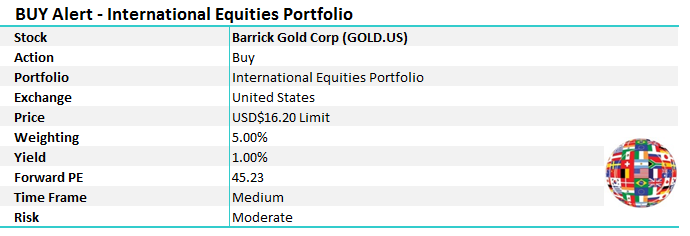

Markets cool as June 30 approaches **Buy AAPL US & GOLD US** (BIN, CSR, AMP,SFR)

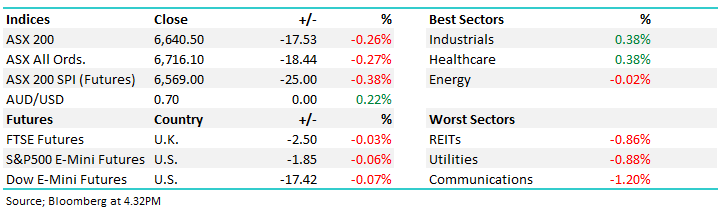

WHAT MATTERED TODAY

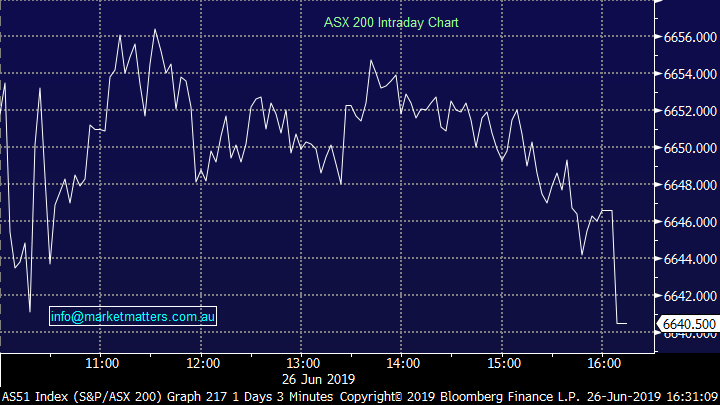

It felt like some EOFY shenanigans started to play out today with some big lines through on the futures early lifting the market up from its knees into a midday high before drifting lower into the close. Stocks that are tax loss candidates remained in focus and it felt like sellers took an opportunity to offload the dogs and have funds settled before June 30 – a couple of our stocks hit on the back of that.

Asian markets were fairly mixed – ditto for US Futures as both regions await what’s now being touted as the G2 summit between Presidents Trump & Xi..

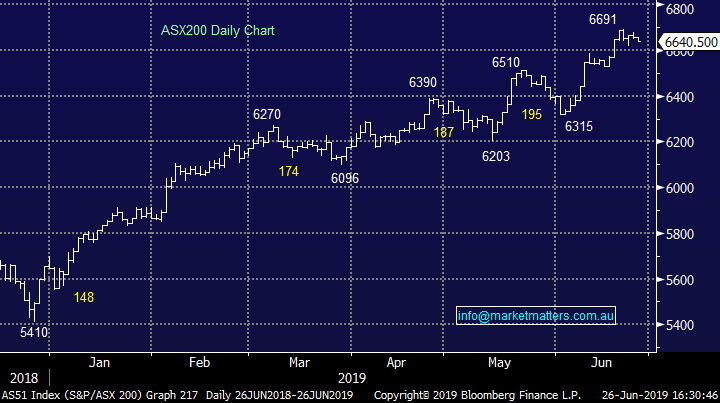

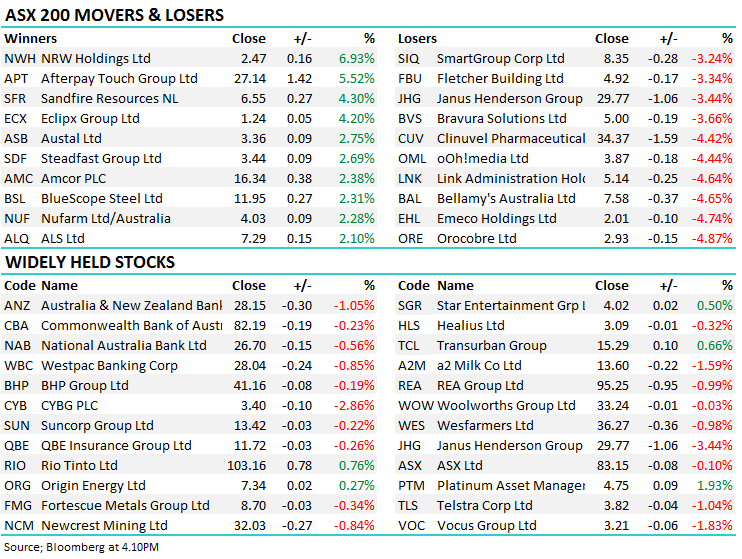

Overall, the ASX 200 fell -17 points or -0.26% to 6640. Dow Futures are trading down -17pts / -0.07%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

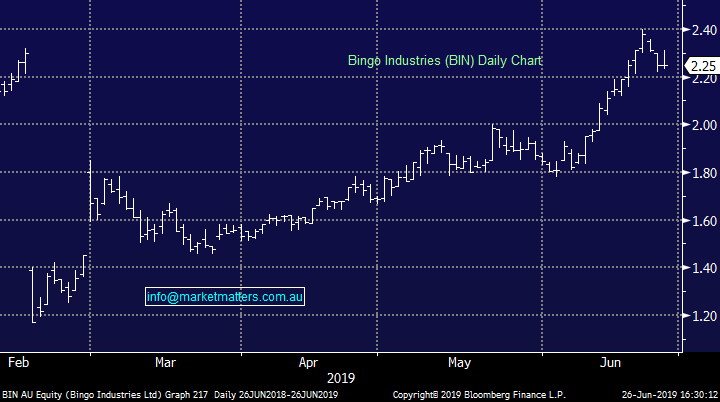

Bingo (BIN) flat: Held a site tour today for a group of analysts plus they released an investor presentation before trade this morning. It’s just finished so more wash up tomorrow however a couple of key points bearing in mind the stock was a lot quieter than expected today, eventually closing flat.

· No updated guidance provided with their last update on 1st May 2019 still relevant

· Not a huge amount of ground breaking news really, although more positive than anything. Growth in landfills and recycling positive, growth in infrastructure positive offsetting weakness in residential construction, however at their last update in early May they said, headwinds in multi-dwelling residential construction have continued in 2H FY19 and are expected to continue throughout FY20 – so no new news on this front today.

· Price increases have been a focus in recent times and it looks like they will get price increases in FY20 while they’ll also get an uplift from the QLD waste levy in FY20

· All up, a lot of moving parts – most were positive however the big variable remains residential construction - and this is the main reason the market has a big short position in the stock (about 11%).

MM is sitting on a ~60% profit here – we now have this position on a short lease.

Bingo (BIN) Chart

CSR -1.98%: Building materials company CSR has held its AGM today and the stock fell early before recovering from the lows. The commentary was fairly negative – construction activity / demand for building materials has been weak while they also spoke a lot about the impost of high power prices. The company has a 25% in the Tomago aluminium smelter in Newcastle – it employs about 1000 people and that smelter uses around 12% of electricity consumption in NSW each day. To put higher prices into context, CSR's aluminium business was hit with $61 million in higher electricity costs in 2018-19. CSR’s outlook was also reasonably muted, the company saying…Volumes in the two months of this financial year ending 31 March 2020 remain broadly consistent with the final quarter of last year. Recent reductions in interest rates, improving credit availability, stable tax policies and first homeowner support have boosted hopes for an improvement in consumer confidence and demand for housing. The timing of any positive impact is difficult to predict.

Clearly not all beer and skittles today for CSR, however the stock is priced for it, trading on 13x. We hold in the Income Portfolio & remain comfortable following today’s AGM

CSR Chart

AMP +1.97%; traded higher today but it did set all-time lows yesterday when it briefly traded to the $2.00 level. AMP was today hit with a class action from Slater & Gordon in regards to the fees being charged on pension funds. Lawyers for Slater & Gordon have rounded up 2 million customers of AMP and will allege the trustees of the AMP pension fund products over paid for administration services which were provided by – you guessed it – other entities within the AMP group.

This class action is not the only problem for AMP – it’s not even the only class action currently being put forward with shareholders taking action on the company’s disclosure of the issues raised within the Royal Commission. In today’s Income Note we linked an interview with Shaw & Partners’ Banking Analyst Brett Le Mesurier in which he also discusses his view on AMP. Click here to view.

AMP Chart

Broker moves; Sandfire (SFR) staged a strong recovery to claw back a large chunk of yesterday’s 11% drop on the back of its move to takeover Botswana copper junior MOD. Shares were hit on plans to offer scrip to MOD shareholders which valued the company at ~45c, nearly a 50% premium on the previous close. Analysts were a little more supportive of the deal than the sellers were yesterday – the current Sandfire mine is set to run dry in 2022, and the deal may reap a new 12-year mine for SFR to plunder leading to a potential re-rate. Two analysts upgraded on the news / subsequent price drop.

This ones starting to look interesting

Sandfire (SFR) Chart

ELSEWHERE…

· Collins Foods Downgraded to Hold at Morgans Financial; PT A$8.20

· Myer Upgraded to Neutral at UBS; Price Target A$0.59

· Virtus Health Downgraded to Hold at Morgans Financial; PT A$4.87

· Metcash Upgraded to Hold at Morningstar

· Abacus Property Downgraded to Sell at Morningstar

· Sandfire Upgraded to Hold at Morgans Financial; PT A$6.98

· Sandfire Upgraded to Overweight at JPMorgan; Price Target A$8

· Altura Downgraded to Sell at Canaccord; PT A$0.1

OUR CALLS

2 US Listed International Buy Alerts

**No changes across domestic portfolios today**

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.