Markets continue to play by the March script…

As we’ve outlined on numerous occasions of late, March is typically a fairly quiet period for the market as investors digest the recent reporting season and reposition for the next quarter. This year was a little different with the US Fed raising interest rates and offering guidance that was more dovish than the market was positioned for (2 more rate hikes rather than 3), and that has impacted the US dollar and global bond yields, two of the more important factors that ultimately play into the performance of different sectors on our market.

There was an interesting article in LiveWire this morning from Ben Griffiths from Eley Griffiths, and it sums up how we at Market Matters typically view markets. The article suggests that while investors must be across company specific fundamentals, it is equally important not to lose sight of the big picture. “We’ve always found, through years of investing, that you need to have the backdrop set about right. What are the big macro drivers that are going to influence allocation decisions and certain sectors within your portfolio.” Griffiths says that having an eye for how sectors are performing in offshore markets can provide early indicators for emerging trends in the domestic market. (source LiveWire Markets)

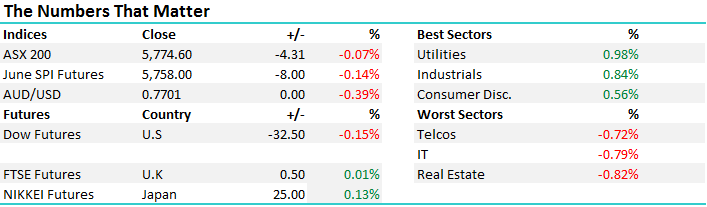

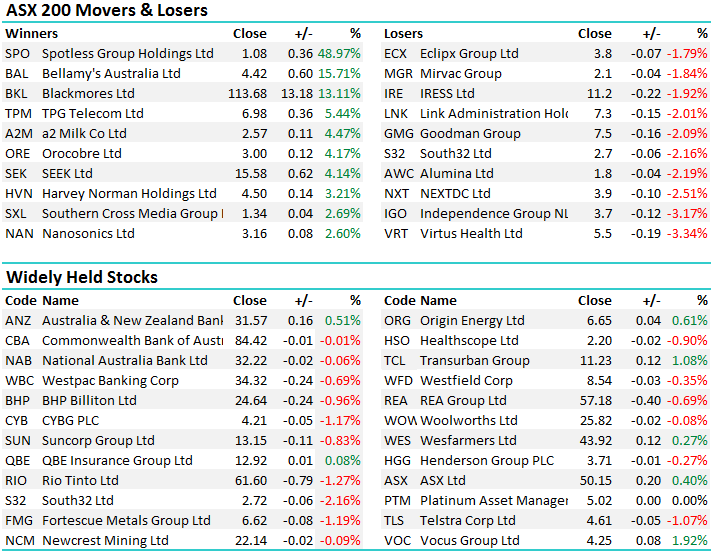

At the moment, major overseas stock markets continue to tread water while sector rotation continues, last night the Dow finished down 8-points while financials fell 0.8% but resources gained 0.6%. The Emerging Markets (EEM) continued with their recent surge rallying another 1.3%, making fresh highs since mid-2015, unfortunately the local market will struggle to maintain its strong positive correlation with the EEM's until global financials can end this current period of weakness. The $US also remains under pressure as it struggles to hold the psychological 100 area on the Dollar Index – which is a supportive trend for commodities. These are themes that have a big bearing on asset prices, sector allocation and finally what stocks should get our hard earned $$.

In terms of our portfolio, we’ve increased cash by reducing our exposure to the $US through a few recent sales of US earners. We do think the market goes higher in April and for that reason we are looking for opportunities but at the moment we’re finding them few and far between. A number of stocks we hold are trading a tad below our target levels, or we like them longer term, while stocks we want to buy, have not yet fallen enough. We’re sitting tight for now.

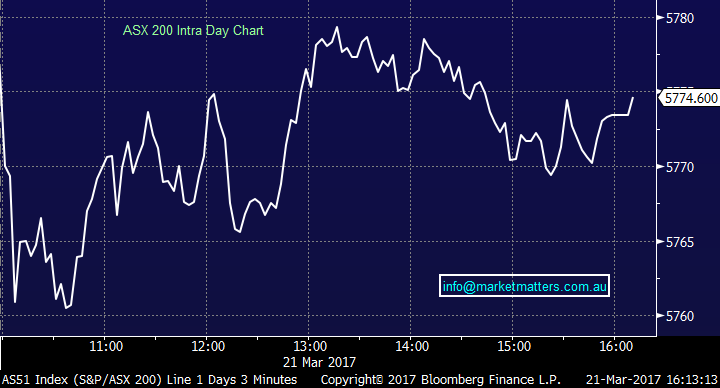

On the market today, we had a choppy session intra-day with a few data points impacting short term sentiment, but overall we closed slightly in the red with a range of +/- 19 points, a high of 5779, a low of 5760 and a close of 5774, off -4pts or -0.07%..

ASX 200 Intra-Day Chart

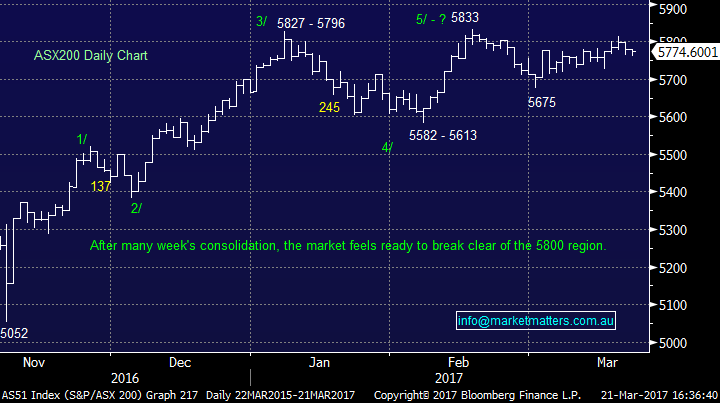

ASX 200 Daily Chart

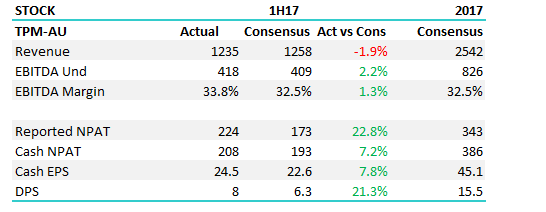

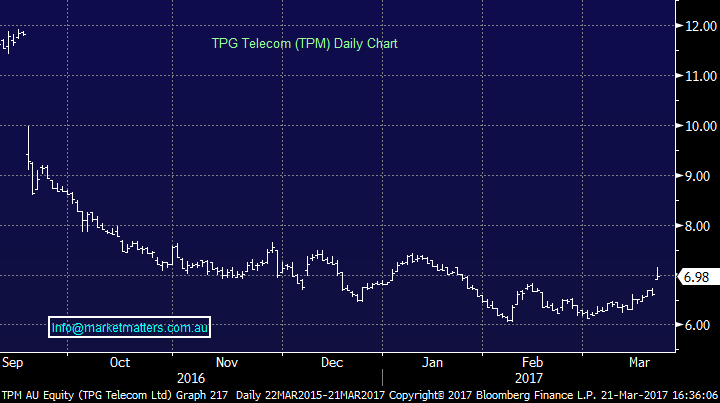

TPG Telecom (TPM); Reported first half results this morning and the stock rallied strongly – ending the session up +5.44% to $6.98 after hitting a high of $7.15. We recently sold a short term trading position in TPG for a slight profit but clearly exited too early in hindsight. That said, there were two main looming risk events for TPG on the horizon, one being todays result and the second on the 4th April with the auction for spectrum, which TPM will need to be an aggressive player in if they’re to build a greenfield mobile network as they have alluded to. In our mind, these were two risks that we’d rather not take and they formed the basis for our decision to exit the position.

In terms of the result, they produced cash underlying profit of $208m, EBITDA $418m, EPS 24.5cps and an interim dividend of 8cps – which was all very good and well above consensus as outlined below. Importantly, they reconfirmed guidance for the full year for earnings of $820-$830m

TPG Telecom (TPM) Daily Chart

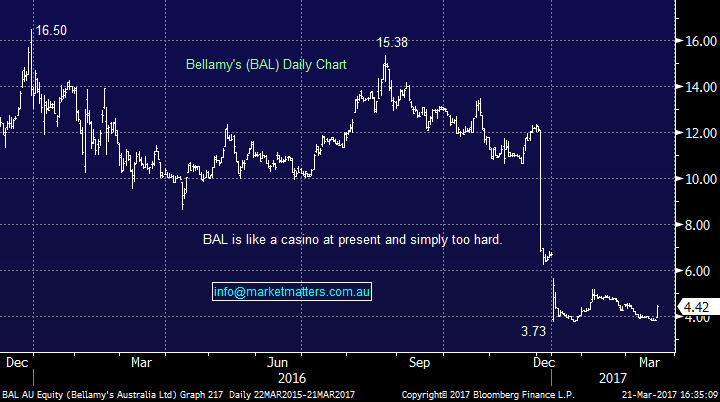

Elsewhere, the China exposed stocks copped a bid today (Blackmores +13% & Bellamy’s +15%) on news that China has delayed indefinitely the new-cross border e-commerce laws which were providing a huge amount of discontent amongst the Aussie providers of vitamins, milk powder and cosmetics. Clearly the news came as a surprise (a positive one) for those stocks but continues to show how much these companies rely on favourable Govt news flow.

Bellamy’s (BAL) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here