Markets breakout on further government support – tech leads the way (BHP, OSH)

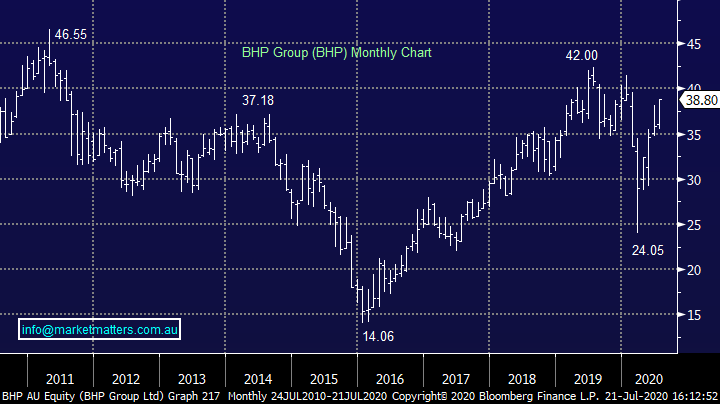

WHAT MATTERED TODAY

A very bullish day for stocks today with the ASX keying off positive vaccine results overnight, a move higher in Asian markets + US Futures that ticked up throughout the day, however it was news around the extension of Job Keeper / Seeker payments that seems to have gotten the bulls firing and despite the supports tapering somewhat post September, they are being extended in what seems to be a fair and orderly way – those who need it, will still get the majority of it – or at least that’s my first read of it.

I provide a quick wrap of trade today on a 3 min recoding below:

Today’s move higher was naturally broad based, only 16 stocks closed down and that was mainly in the more defensive areas of the market, on the flip side, it was unsurprising to see technology stocks shine after the Nasdaq stormed higher overnight

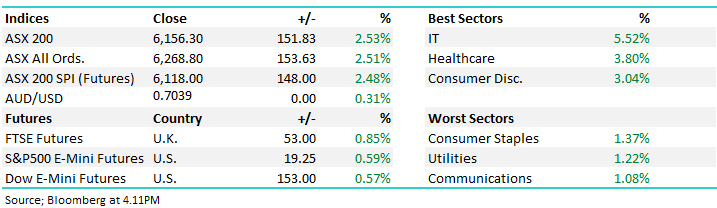

Overall, the ASX 200 added 151pts / +2.53% to close at 6156. Dow Futures are trading up +153pts / +0.57

ASX 200 Chart

ASX 200 Chart – the break away from the 6000 handle is now bullish

CATCHING MY EYE:

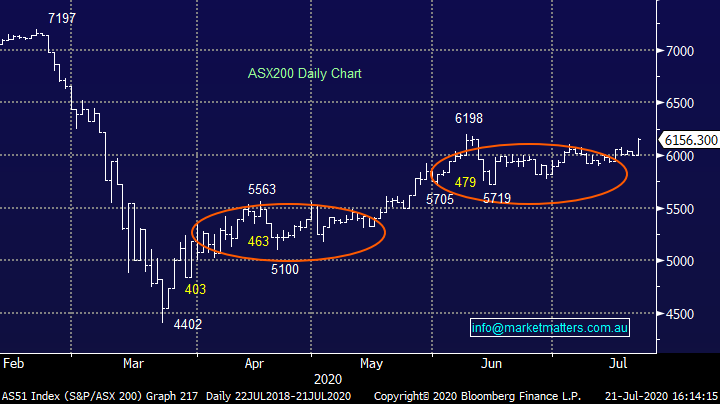

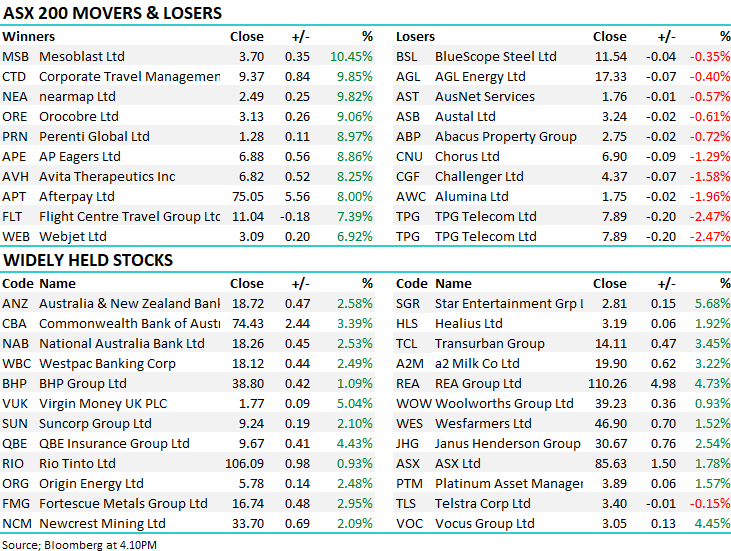

BHP Group (BHP) +1.09%: performed in line with peers – which underperformed the market – on the back of their 4th quarter production numbers. For the bulk, they were largely as expected, particularly in the key profit drivers. BHP’s largest earner is Iron ore with around 60% split at the EBIT level and the company delivered as expected here with 67mt produced for the last 3 months for their best quarter of the year. Copper, the next cab off the rank in terms of EBIT contribution, was marginally below the streets number though BHP was given some wiggle room here given COVID shutdowns impacting their Peru mine. The other two key copper mines – Escondida & Olympic Dam – both saw higher production rates in the quarter to make up for some of the shutdown with 1,724kt of copper scraping in to the lower end of previous guidance. The two smallest earners – petroleum and coal – finished the year with a miss and a beat respectively, but largely uncared for by the market. For the most part it was a good set of numbers from the big Australian. FY21 guidance does look light on but not a huge concern for investors at the moment. Eyes will be on the full year results out in a matter of weeks – a record quarter of iron ore sales in Q4 could see BHP once again beat dividend expectations – a positive thing in a market which has been starved of yield. We remain bullish BHP

BHP Group (BHP) Chart

Oil Search (OSH) +4.32%: while energy names were broadly higher today, Oil Search stood out above the pack on a decent quarterly. While production fell 1% in the second quarter, revenue was smashed 26% for a first half total of $US625.6m, 19% on last year given the steep slide in energy prices in the period. They maintained full year production guidance of 27.5-29.5mmboe but lowered cost guidance but $US1-2/boe which the market liked given the boost it gives earnings in a low oil price environment.

At just $US9.5-10.5/boe, OSH is an extremely low-cost producer and is in good shape to weather another slide in oil prices if it comes, particularly after raising near $US700m in the half. While CAPEX is also being pinned back there was not changes to the current Alaskan and PNG project timelines, though Oil Search will likely look to push out production start dates for both projects at the strategic review later in the year. Overall a good quarter in a tough environment, but we prefer others (BPT, WPL) in the space for now.

Oil Search (OSH) Chart

BROKER MOVES:

· Dexus Cut to Neutral at Macquarie; PT A$9.23

· Netwealth Cut to Sell at Ord Minnett; PT A$9.55

· Helloworld Raised to Buy at Ord Minnett; PT A$2.45

· Star Entertainment Raised to Equal-Weight at Morgan Stanley

· CSR Raised to Overweight at JPMorgan; PT A$4

· Boral Cut to Underweight at JPMorgan; PT A$3.25

· Whispir Cut to Neutral at Evans & Partners Pty Ltd; PT A$2.85

OUR CALLS

No changes today

Major Movers Today **TPG Code change needs correcting**

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.