Market up but not convincingly so… (CBA, JHG, GMA, BWP, CAR, CIM, NCK)

WHAT MATTERED TODAY

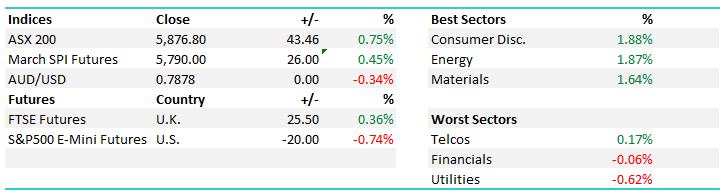

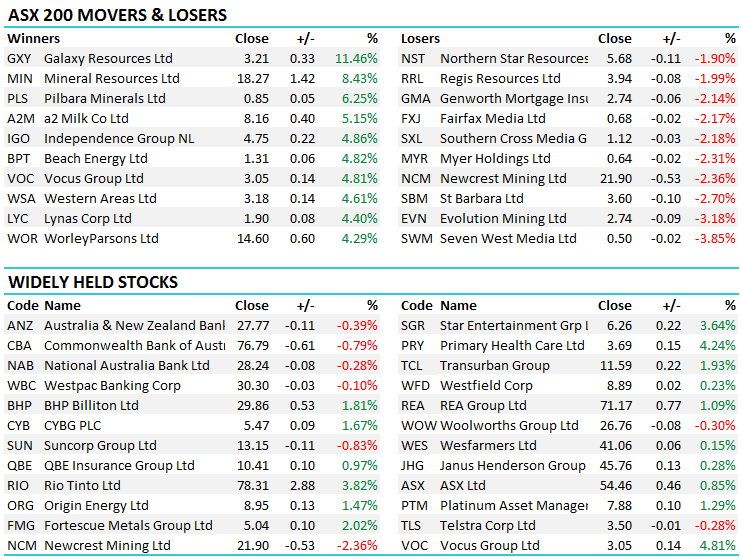

The overnight lead from the US market was an optimistic one this morning – we were initially (sharply) higher on open, the ASX 200 hitting a 5938 as the match unwound only to see more selling tick in throughout the day – closing near the session lows at 5876 – some -62pts from the daily high. Still, a 43pts gain for the mkt is still what the Dr ordered after yesterday’s ~200pt decline with the stocks we bought yesterday, Macquarie, RIO, Oz Minerals, Janus Henderson & BHP all looking like good plays today. Janus was disappointing after being up +4% early only close +0.28% higher by the end of trade. RIO was particularly strong which was the case amongst most of the miner which makes sense in an inflationary environment.

At time of writing (4.50pm) US Futures are trading down 0.81% so looking at a negative lead in the US this evening (for now)

A lot of company reports through today;

Genworth (GMA) a bit light on and the stock fell -2.14% (we own for income but currently under review)

BWP Trust (BWP) was reasonable with slight upgrades expected – the stock up +2.78% - we don’t own nor do we like the sector however would be interested around $2.80

Carsales (CAR) missed by around 4% in terms of earnings – the stocks was weak leading into the result and fell another 1.74% today – no interest at present

Cimic (CIM) the old Leightons did well however they had been trollied the last few days by ~6%

Nick Scali (NCK) which we own was better on most metrics bar sales growth, so the mkt sold it off slightly, we have Anthony Scali in shortly for a chat. Guidance of 5%-10% growth ok but mkt positioned slightly higher

Janus Henderson (JHG) good result on first work through, earnings better than consensus but costs creeping up – mkt liked it early, opened up +4% but sold pretty quickly there after

RIO just out now….

(Bloomberg) -- Rio Tinto reported underlying profit for the full year that met the average analyst estimate.

- FY underlying profit $8.63 billion, estimate $8.69 billion (range $8.04 billion to $10.06 billion) (Bloomberg data)

- Final dividend per share $1.8000

- FY cash flow from operations $13.88 billion

- FY revenue $40.03 billion

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

**Please note; In the Income Report today, the portfolio suggested prices as at 06/02/2017 which was clearly incorrect. Prices on the portfolio were as at 6pm last night (6/2/2018) while prices in the body of the report were as at 11am today. We apologies for any confusion**

CATCHING OUR EYE

1. Commonwealth Bank (CBA) 76.78 / -0.79%; Reported first half 2018 numbers this morning and the headline result missed consensus however there was a lot of noise in relation to the $375m AUSTRAC provision for civil penalties + $200m expected regulatory, compliance and remediation costs which makes it hard to mark the result against market expectations. They also sold their Life Business during the period so have discontinued operations from that, so comparisons on a like for like basis are hard, but here goes;

- They reported NPAT $4,906m versus consensus of $5,195m

- Cash NPAT came in at $4,871m versus consensus of $5,219m

- Cash EPS 280cps versus consensus of 300cps

- Interim dividend 200cps consensus 206cps - implying % payout ratio (fully franked, in line with guidance of 70% in any first half).

So these numbers are light on. In terms of net interest margin, they printed 2.16% which was strong, CET 1 capital was good at 10.4% and all else appeared okay. The weaker than consensus result seems to be due to AUSTRAC costs which were taken as cash items, and I bet most analysts thought they would be considered non-cash. Strip out AUSTRAC, the result seems fine and nothing of real concern. The outlook is a bit mixed with positive global and local growth trends offset by market volatility and low wage growth – however those comments were made following yesterday’s global moves!

Commonwealth Bank Daily Chart

2. Janus Henderson (JHG) $45.76 / +0.28%; I thought this was a good Q4 result, good in terms of earnings, as was the case with MQG performance fees the main driver however the mkt clearly had an issue with expense growth (12-14% yoy) + they will be taking the cost of investment research onto P&L as result of new European rules known as MiFID II, however they were rubbery on what it ‘could be’ – uncertainty not ideal however I understand their caution! Lucky MM is ahead of the curve here and simply charges a flat fee for our notes – something the investment bank / research world will soon be following!!

Janus Henderson Daily Chart

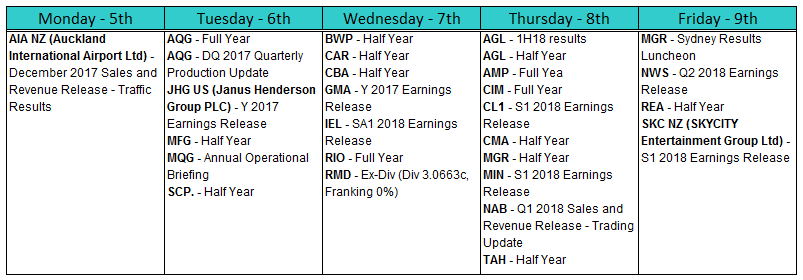

REPORTING THIS WEEK

Another BIG day tomorrow

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/02/2018. 5.19PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here