Market up but early optimism fades (IPH, STO, FPH)

WHAT MATTERED TODAY

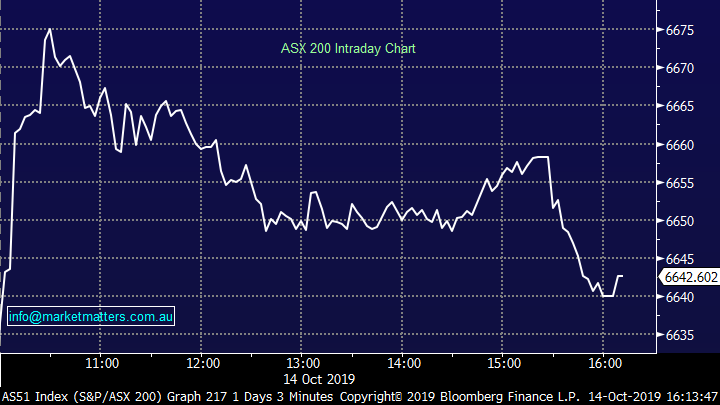

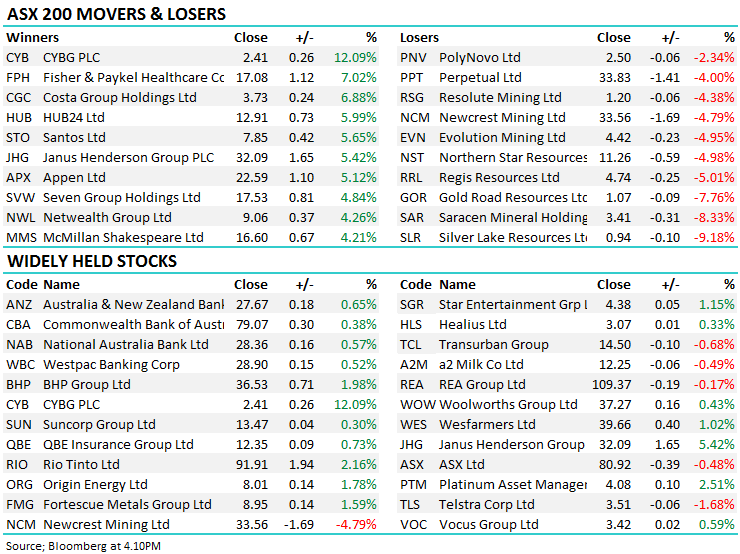

It was always going to be an interesting session today following the mini-breakthrough in China – US Trade negotiations on Friday, and ultimately the market has traded largely as expected. The height of optimism was early on with the market peaking up +70pts following strength in the US on Friday night, strength in US Futures this morning and a buoyant performance from Asian markets today, however as the session wore on, buyers lost steam and the market closed more than 30pts below the early highs. Energy saw most buying thanks largely to a strong performance by Santos (STO) while the Communications sector lagged, along with the other more ‘risk off’ areas of the market.

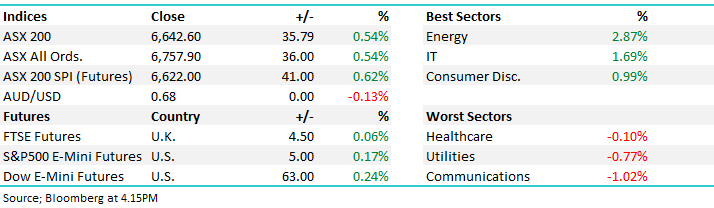

Overall, the ASX 200 closed higher today, up 35pts or +0.54% to 6642, Dow Futures are trading up +63pts/+0.24%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Latitude IPO: News out this morning that the year’s biggest IPO was forced to re-price down below the lower end of the previously guided range. They were hoping to get it away between $2.00 - $2.25 however now it seems $1.78 is the price. We covered Latitude here confirming we wouldn’t be taking up the deal. This has been an IPO large on re-packaged spin and today they said that the price was cut to ensure a high quality register and strong secondary market support. The pricing is actually now a lot more attractive than it was at $2 representing 11-times profit and 5.8 per cent dividend yield.

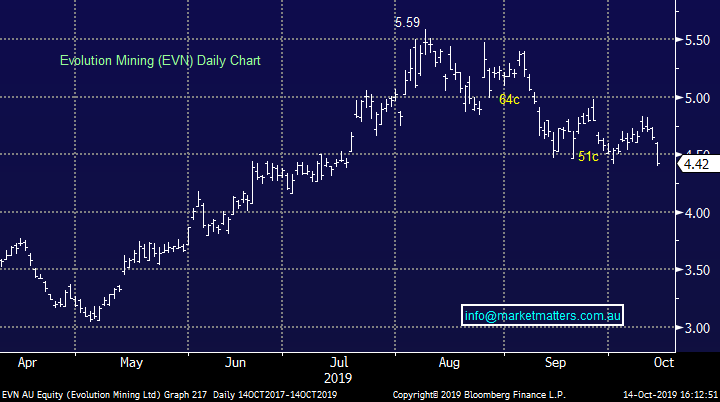

Gold: Hit on the back of China – US trade improvements and we’ve seen some steep declines across the local players today, NCM hit by -4.79%, Evolution (EVN) down -4.95%, Saracen’s (SAR) off -8.33% and OceanaGold (OGC) down by -2.06%. The price of Gold dropped back below $US1500/oz and that has clearly got the market bearish the precious metal. Separately, Credit Cuisse out today with a Gold note calling Evolution their preferred large cap pick while St Barbara is first choice among the mid-caps. In the small cap area they prefer Alacer (ALQ) over Perseus.

While prices are clearly weak today, we remain fairly comfortable with EVN and NCM in the MM Growth Portfolio.

Evolution (EVN) Chart

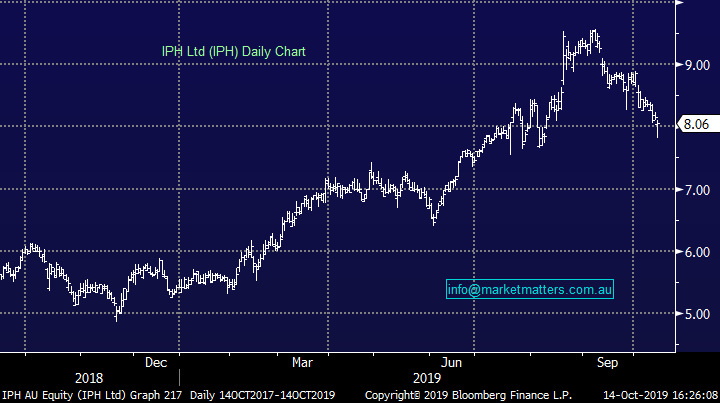

IPH (PIH) -1.23%: We flagged Intellectual Property business IPH Ltd (IPH) in the weekend report on Sunday as an interesting technical buy after it pulled back more than 15% over recent weeks. The stock traded down to $7.81 low today before closing back up above $8 – the stock now looks bullish.

IPH Ltd (IPH) Chart

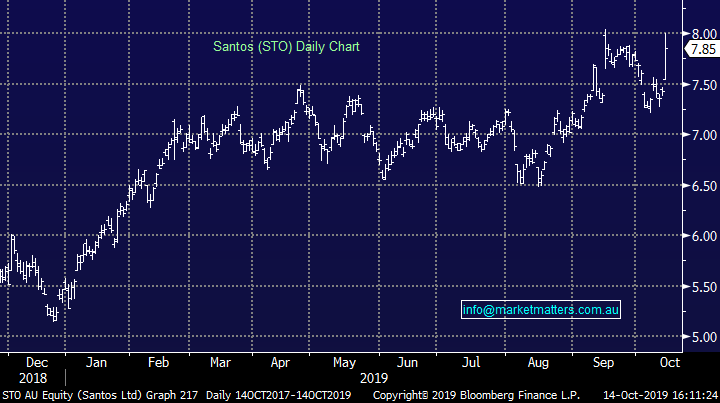

Santos (STO) +5.65%; Strong today after buying a number of Australian assets - the $US1.4b deal with ConocoPhillips will see Santos take an interest in 4 LNG projects – Darwin LNG, Bayu-Undan, Barossa and Poseidon, effective from 1st January this year as the company continues their push for further expansion which included the $2.15b Quadrant deal last year. These new acquisitions will be fully funded by cash and debt facilities already available to Santos which has done a good job of deleveraging the balance sheet in the past few years. It adds a number of low cost assets onto the balance sheet and despite Santos already being one of the lowest cost produces, the new assets will reduce their breakeven oil price by another $US4/barrel as well as increasing production by around 25%.

The Darwin LNG plant currently services the Bayu-Undan project producing around 3.7 mtpa however it is expected to run dry in 3 years. The Barossa project is expected to plug the gap while plans are in place to increase capacity at the Darwin plant by more than double. The deal is EPS accretive from day one which has been taken well by the market.

Santos (STO) chart

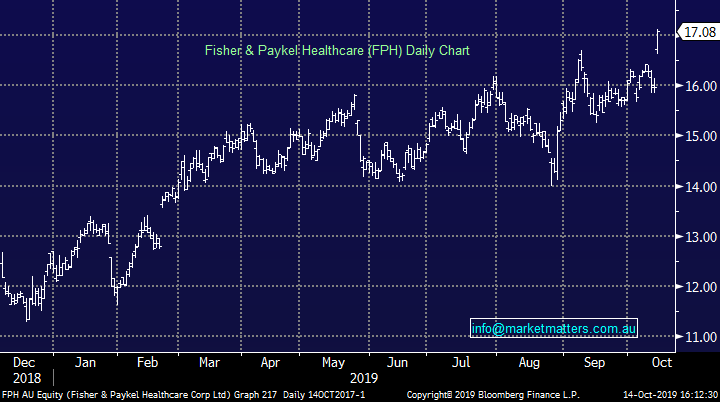

Fisher & Paykel (FPH) +7.02%; New Zealand’s version of ResMed shot higher today thanks to increases in guidance on the back of US approvals. Fisher & Paykel increased net income by 4% in FY20 on an operating revenue of $NZ1.19b which beat the most bullish analysts estimate. The source of the added income was the company’s sleep apnoea face mask Vitera which received clearance to commence sales into the US earlier than was previously anticipated. The upgrade was also assisted by a weaker NZD vs the USD with assumptions lowered from 64c to 63c against the greenback. Today’s move sets another all-time high for FPH which has essentially rallied near uninterrupted since 2012 lows around $1.45.

Fisher & Paykel (FPH) Chart

BROKER MOVES;

· Pushpay Raised to Buy at UBS; PT NZD3.65

· Sandfire Cut to Neutral at JPMorgan; PT A$7

· Newcrest Cut to Overweight at JPMorgan; PT A$32

· Pilbara Minerals Cut to Underweight at JPMorgan

· A2 Milk Co Raised to Hold at Bell Potter; PT A$12.35

· St Barbara Raised to Outperform at Credit Suisse; PT A$3.50

· Regis Resources Raised to Neutral at Credit Suisse; PT A$4.95

· Perseus Raised to Outperform at Credit Suisse

· Rio Tinto ADRs Raised to Buy at Jefferies; PT $57

OUR CALLS

We sold Tabcorp (TAH) and bought Oz Minerals (OZL) today.

Major Movers Today – Costa (CGC) caught the eye as did the UK exposed stocks with Janus (JHG) and CYBG (CYB) both being well bid. Appen (APX) found some buyers today after recent weakness while the Gold stocks were obviously the weakest link.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.