Market up again – resources the key

What Mattered Today

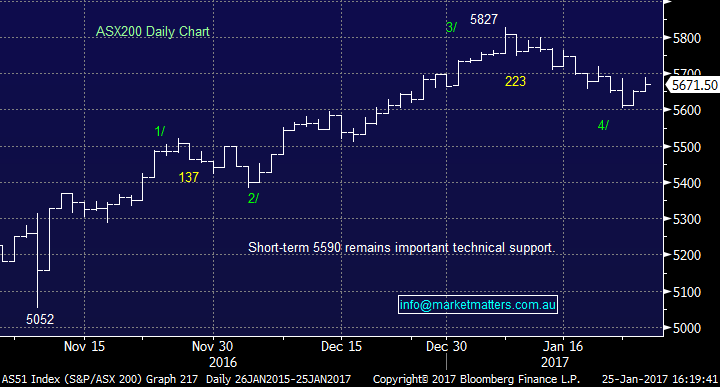

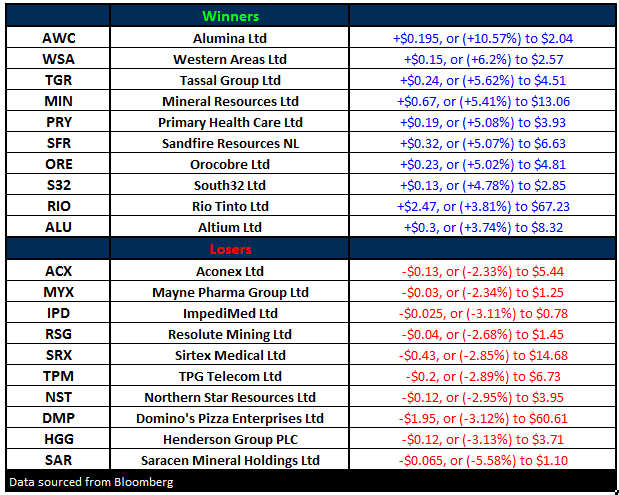

A second day on the up for the market although not as convincing as yesterday – resources the main driver with RIO, BHP, S32 & Alumina accounting for +16.5 index points while the BIG 4 banks added 8. The breadth of the move yesterday/today has been fairly tight hence our call in this morning’s note not to chase the market on positive days. There’s enough uncertainty – potential for left field events to retain the view of BUY weakness, SELL strength – the mkt is being driven by a few stocks rather than across the board buying.

RIO announced the sale of some Coal assets at good prices late yesterday while BHP’s production numbers where on song – more on both below. Alumina (+10.57%) was up following good results from Aloca in the US overnight while Western Areas, the ASX’s pure Nickel play rallied by +6% after a tough couple of weeks – DB and Citi the two latest brokers to upgrade the stock although they’ve simply gone from nett negative to neutral.

Henderson Group (HGG) was down -3.13% today to close at $3.71 following a weaker than expected earnings result from Janus, the company they are merging with. These two coys are now tied at the hip and any move oversees for Janus will see it reflected in Oz through HGG. Earnings Per Share (EPS) expected to be 24c and they came in at 20c, which is a decent miss. We’ve seen a similar pattern for active fund managers in Australia – it’s been hard to generate performance and we’ve seen reasonable outflows into more passive funds, like ETFs. That’s understandable BUT the fact that active managers have struggled over the last 12months, as Janus reported last night (same theme here with Platinum PTM), probably means that they’re in for a better ‘next’ 12 months, particularly if markets are volatile as we expect they will be. Buying active fund managers on the back foot makes sense to us, particularly given the Super changes that are playing our early this year.

We have a 5% holding in HGG and will add to it into further weakness. Another +3% max.

Henderson Group (HGG) Daily Chart

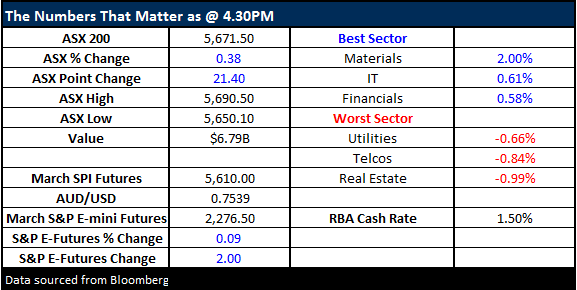

We had a range today of +/- 30 points, a high of 5690, a low of 5660 and a close of 5671, up +21pts or +0.38%. Value was BIG today given option exercises from yesterday; $6.79bn.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

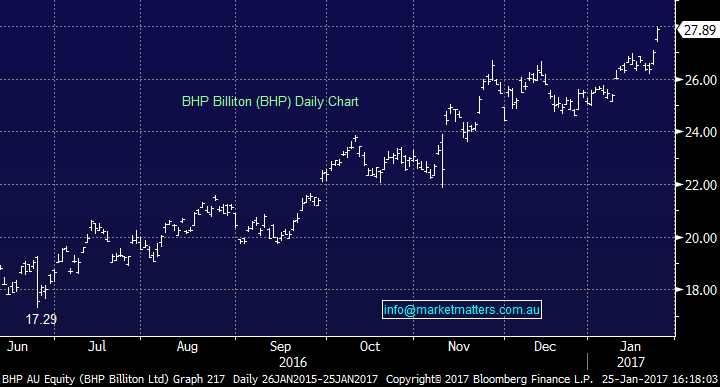

BHP; A good set of production numbers reported today, with their main earners doing well. Iron Ore was around ~12-13% ahead of expectations, which is good given iron ore generates more than 50% of BHP’s earnings these days.

Elsewhere, US onshore oil and gas was better than expected as they pumped more to take advantage of higher Crude prices. This is probably a pre-cursor for what’s to come with higher commodity prices incentivising miners to produce more which then puts a cap on commodity prices. Its why we think Oil will range trade between $US60-$US40 this year and Iron Ore has pretty much peaked.

They didn’t change prior guidance other than a small tweak to Copper and they said they were not yet in a position to provide an update to the ongoing potential financial impacts of the Samarco dam failure. All up a good set of numbers and BHP rallied +3.26% on the back of it to close at $27.89

BHP Daily Chart

RIO; Also rallied hard today putting on another +3.81% to close at $67.23 after announcing the sale of its Coal and Allied unit to Yancoal for $2.45B. $1.95B upfront and the rest over time – the price is good and higher what RIO had was carrying it at. The time to SELL coal assets seems to be now after a massive run up in Coal price – well done RIO and obviously that’s being reflected in the strong gains for the share price.

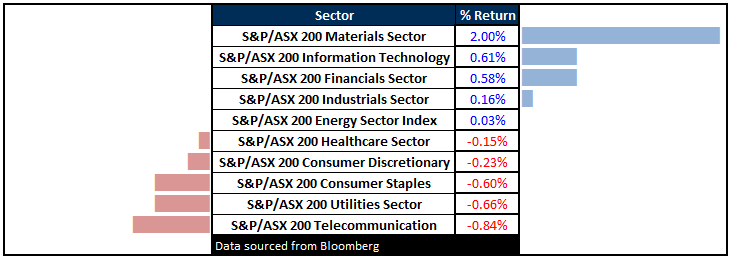

Sectors

ASX 200 Movers

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here