Market recovers from early weakness

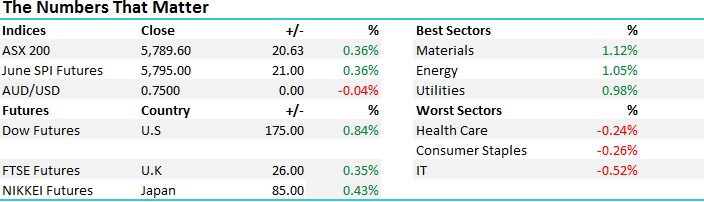

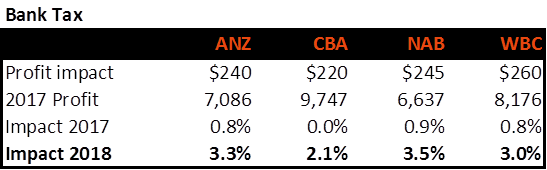

The market was weak early on with a decent sell off in the futures putting some pressure on the large caps – the banks in particular were soft from the get go and looked like they may have started another leg down – however it was all one way traffic from 10.30am onwards with the market pushing up around +40pts from the session lows – buyers stepped into the banks, Westpac in particular which was sold on open after they offloaded $600m worth of BTT stock to insto’s at a big discount to market – they saw a low of $30.05 this morning only to close at $30.60 – a rally of +1.8% . ANZ finished best on ground adding +1.27% after Chair David Gonski wrote to shareholders, in part about the financial performance of the bank which has improved a lot, but more importantly around the impact of the new bank tax and how the third largest bank in Australia will handle it. We recently included a table from Shaw and Partners that estimated the impact of the tax and today ANZ confirmed their estimation of a $240m cost impost post tax. They also said they expect it to happen and they’ll have to work with Govt to deal with it. Here’s the table for those that missed it.

Source; Shaw and Partners

ANZ Daily Chart

The weak open this morning gave way to strength soon after with the market booking a range of +/- 41 points, a high of 5790 , a low of 5749 and a close of 5789, up +20pts or +0.36%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

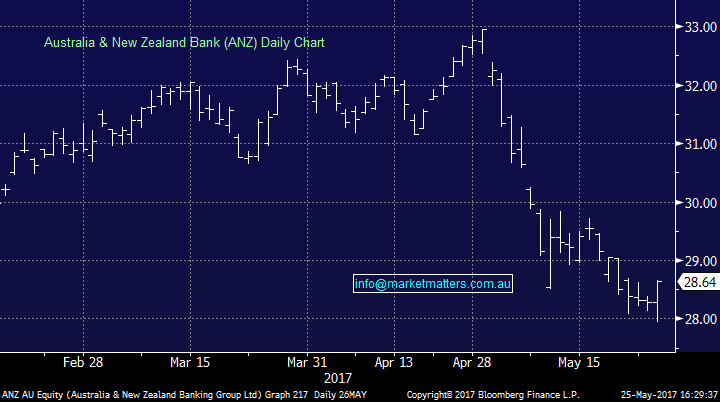

A lot of company news out today, starting with Westpac sell down of BTT stock overnight. They offloaded 60 million shares – which is 19% of the BT shares on issue at $10.75 versus last trade of $12.18. It reduces WBC holding in BTT to 10% and they intend to sell the further 10% after May 2018 – and will do so at a 12% discount to the prevailing mkt price – so from that perspective, it may mean that investor demand on market is –softish over that period. We thought BT might have come back weaker than it did today when we penned our note this morning + there was the added complication of the HGG consolidation and shares trading deferred settlement (more on that below), so we left our idea of switching for now.

BTT was trading on 18.1 times ex-the upcoming 19c dividend which new investors get – and on the trade price of $10.75 it put it on 15.5x. Interestingly, the sale gives WBC CET1 capital of 10.3% - the best in the sector.

BT (BTT) Daily Chart

AMP held an investor day today and updated the market on a few things – they were light on details / numbers but articulated their strategy reasonable well. In a nutshell, they are going to skew towards higher growth less capital-intensive businesses, release and recycle capital in low growth business – which all sounds good in theory! They are going to expand in China and a few other international markets targeting $50m profits pa in 5 years – which would add 5% to profits. On a PE of 14.4x vs long term average of c15x, it’s a little cheap – but it’s just very hard to get excited on a business model likes theirs. It’s old world and facing a lot of headwinds….No real interest here other than to pick up dividends if we can scalp a free one!!

AMP Daily Chart

BIG Volume through ANN today following their sale of their condom business to a Chinese mob for $600m + the share price got a kick after they announced plans for a share buy-back. Two positive developments for ANN today and we’d now expect the stock to test it’s 12 month highs.

Ansell (ANN) Daily Chart

…and finally, Henderson Group (HGG), a stock we own completed a share consolidation today on a 1 for 10 basis, and now trade at $41.20 – however we now hold 10% of the volume of shares we held yesterday. No direct impact and the stock was good today from a low base early, however it will trade under code HGGDA given they are deferred settlement. HGG trades on ~14.5x compared to BTT which transacted at ~15.5x to institutions this morning. We think that’s about the right multiple for a fund manager at this point in time.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here