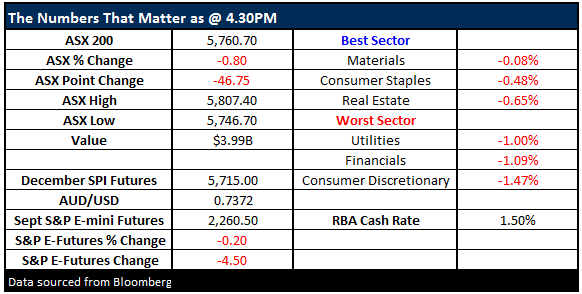

Market pulls back with all sectors in the red

What Mattered Today

Some weakness crept into stocks today but again, volumes were light and the conviction continues to be reasonably low. Unlike yesterday, material stocks were the outperformers dropping marginally as a group while the financial sector felt most pain.

We had a range today of +/- 61 points, a high of 5807, a low of 5746 and a close of 5760, off -46pts or -0.80%.

ASX 200 Intra-Day Chart

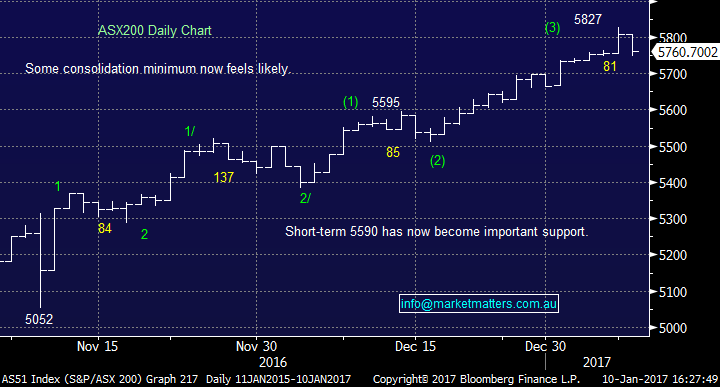

ASX 200 daily chart

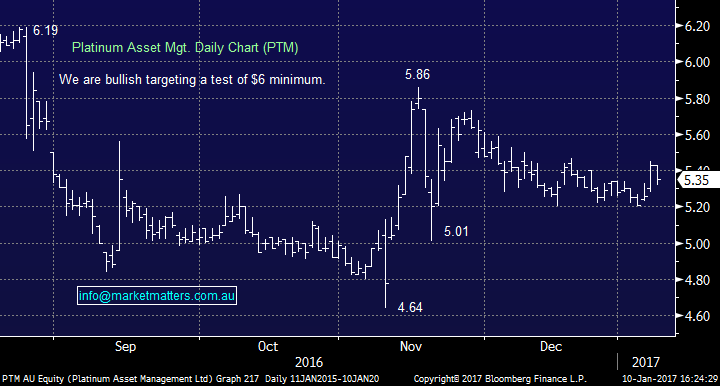

We used today’s weakness to add one stock to the portfolio – that being Platinum Asset Management (PTM) which we view as cheap in a relative sense v peers and the technicals stack up with a good risk / reward entry at $5.34.

A few points about PTM worth reiterating;

1. It’s been a woeful 12 months for the fund manager, down around 25% from its 12 month high above $7 in early January.

2. The drop is a result of weak performance, largely from its international fund which houses the bulk of its FUM

3. As a result they’ve dropped from about $28bn in Funds under management to $23b

4. There’s been a few other issues with key personnel leaving and a move from retail investors to lower cost passive strategies such as ETFs

5. In terms of outflows, these continued in December, but were about $97m which was a big improvement from the months prior and above where most analysts thought they would be – the bleeding is slowing it would seem!!

So why buy a stock when clearly the themes around it seem negative?

It’s cheap, trading on 15 times versus the most relevant peer being Magellan on 20 times, they have a very low cost base – one of the lowest in the industry, the market hates them at the moment and ‘less bad news’ will prompt buying. We like going against the grain, and this is certainly one that fits the bill. We think the outflows may be improving and the strong market performance should get retail money back into their funds – but as always, its likely to happen after the horse has bolted! They also pay a 5.6% fully franked yield with their dividend due on early March. We allocated 5% to it as a starting point. This still leaves our cash balance at 31%.

Platinum Asset Management Daily Chart

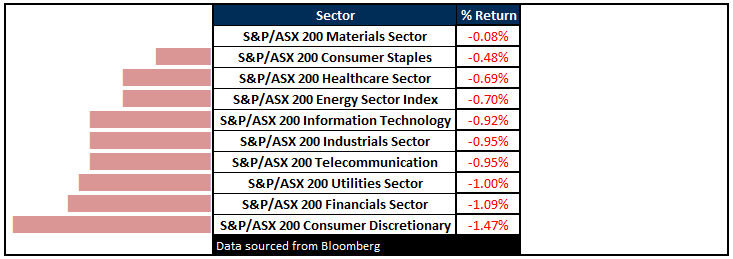

Sectors – Materials relative performers after a weak session yesterday.

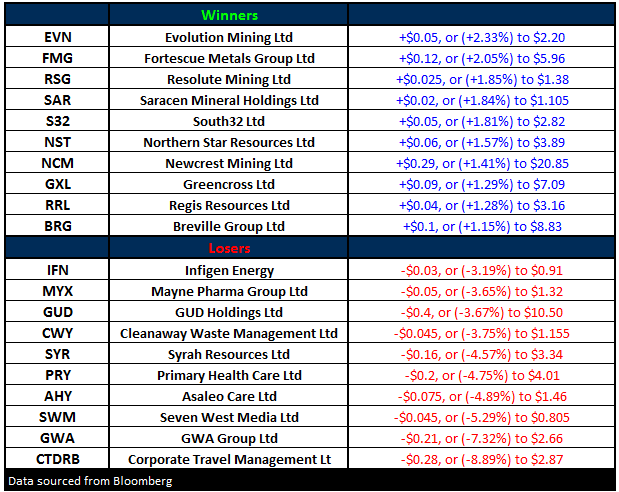

ASX 200 Movers – Golds strong however some signs that short term strength may be losing momentum – NCM susceptible to a pullback from current levels in our view.

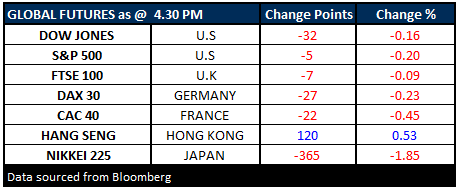

What Matters Overseas

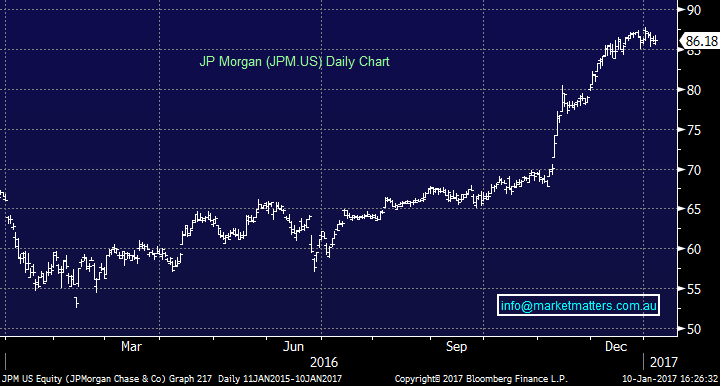

Q4 reporting kicks off this week in the US with JP Morgan and Bank of America reporting on the 13th. Both stocks have been strong in recent times (as has the financial sectors generally).

JP Morgan Daily Chart

Overall, the S&P 500 is trading of 17.1 times forward earnings, a premium to its historical average of 15.1 times. Earnings per share are expected to tick up by 3% which is positive – and reasonably optimistic we would think given the headwinds of a higher currency, higher wages and higher funding costs!

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here