Market Matters Afternoon Report Wednesday 5th October 2016

Good Afternoon everyone

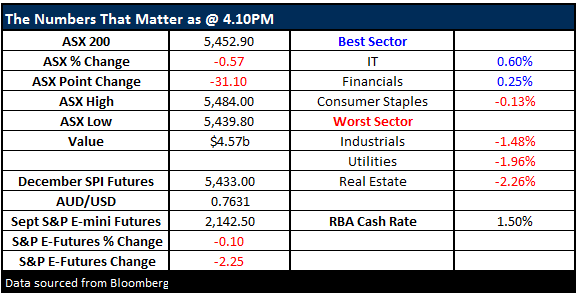

What Mattered Today

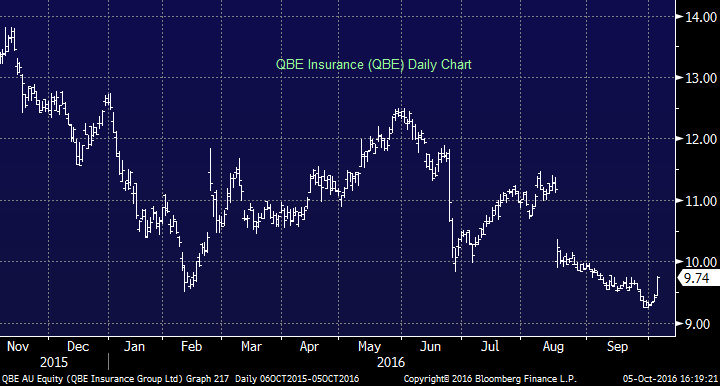

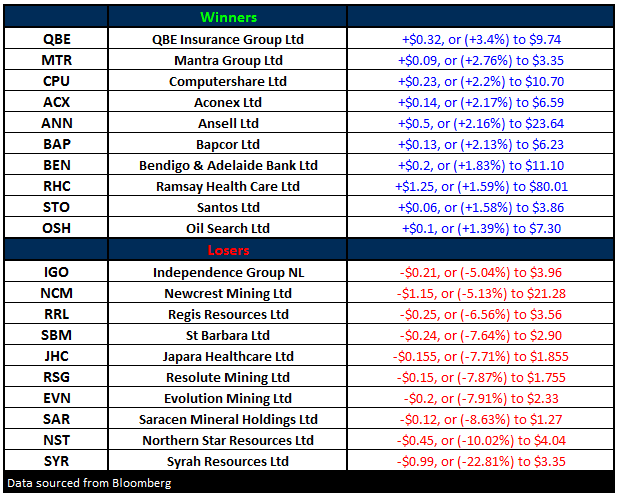

All about global interest rates today and those stocks that are exposed to them had mixed fortunes. QBE topped the leader board and you’ve got to think this is the canary in the global interest rate coal mine….QBE is a dog of a business, yet it’s massively leveraged to higher global interest rates. It rallied +3.4% to close at $9.74 today as money flowed in, probably funded by selling of interest rate sensitive infrastructure stocks like Sydney Airports (SYD) -1.92% and Transurban (TCL) -3.23%.

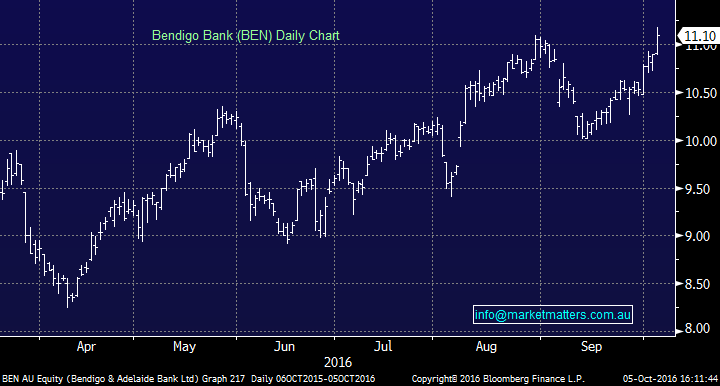

Banks were firmer collectively, Bendigo (BEN) the best of them adding +1.83% while Bank of QLD (BOQ) report tomorrow – more on that below. BHP ended down 5c while RIO was softer by 50c.

QBE Insurance (QBE) Daily Chart

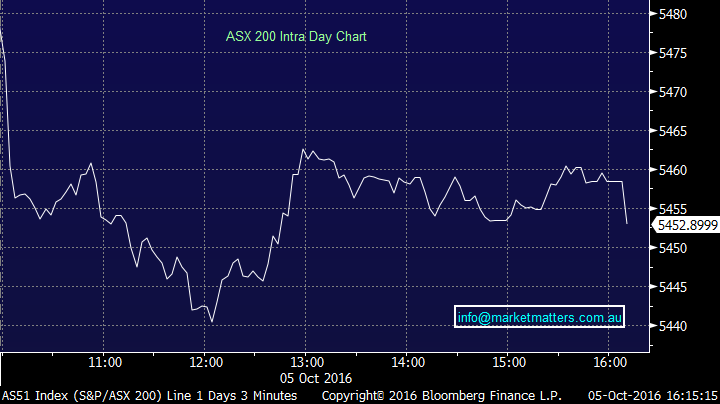

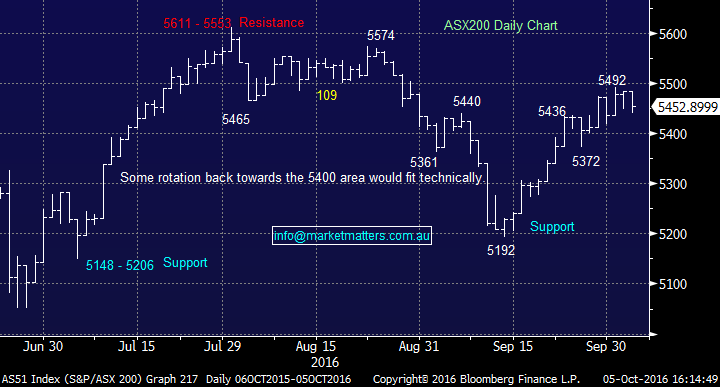

We had a range today of +/- 39 points, a high of 5478, a low of 5439 and a close of 5452, off -31pts or -0.57%. Volume was still weak courtesy of school holidays but it helps with the traffic coming into the city from Manly!!

ASX 200 Intra-Day Chart

ASX 200 daily chart

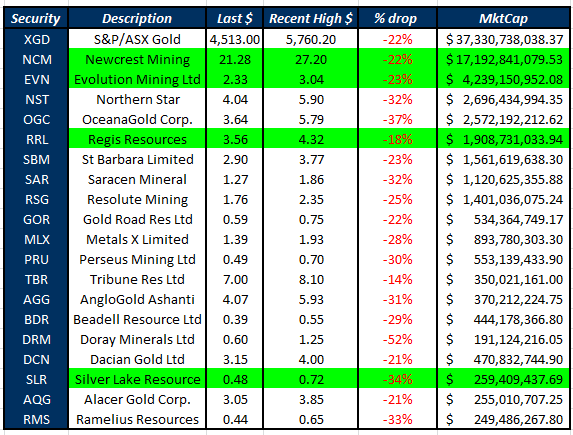

Golds were hit hard today as expected with the GOLD price falling off its perch overnight – dropping $40 to settle at $1272, before recovering around 0.5% in Asian trade today with FUTURES trading higher ($1276). We’re looking for an entry point into a gold stock as per today’s morning note however we’re being patient for now. Of the mid/larger cap stocks, Regis Resources (RRL) has performed strongest into the recent decline. Long’s seem strong in RRL – or at least they’re stronger than some of the other gold plays. Relative strength into the weakness is a positive…

We hold Independence Group (IGO) in the portfolio and given its got some GOLD exposure, it was down today in line with the rest of the sector but still up on our BUY price. They did announce a small acquisition this morning buying Winward Resources (WIN) for $20.5m which is small for IGO in financial terms however it is a vote of confidence in the Nova Nickel project – which IGO start producing from in December.

This move shows a desire to increase their Nickel exposure which is sensible given existing infrastructure in the region. We don’t know a lot about WIN’s asset, but in broad terms, it looks like a reasonable play. Mark Creasy who is WIN’s major shareholder is well known as a very good prospector.

Independence Group (IGO) Daily Chart

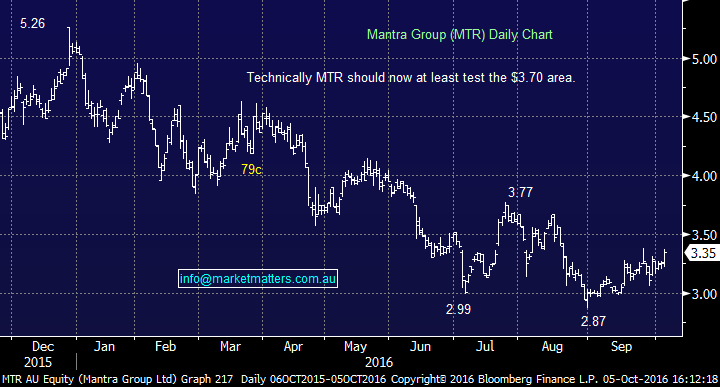

Mantra (MTR) ticked higher today and the selling pressure in that seems to be abating somewhat. We’ve bought into weakness recently, a stock that was off 45% from the high set in Dec 15 so it’s fairly normal that we see a few false starts before it gains traction. The stock put on +2.76% today to close at $3.35 on reasonable volume.

Mantra (MTR) Daily Chart

Bank of QLD (BOQ) reports full year numbers tomorrow and the stock has been reasonable leading into the result. It’ll be an interesting read through for our position in Bendigo Bank (BEN) given regionals typically face similar headwinds. The market sits at cash earnings of $368m for FY 16 and $392m for FY17. A full year dividend of 76cps and CET 1 capital of 8.8%.

It seems BOQ have increased rates in recent times (Tks BOQ!) to relieve some of their margin pressure but that’s reduced volume (loan growth). Net Interest Margin (NIM) will print 1.96% according to factset consensus. For those that look at core profit, consensus here is $601m.

Bendigo (BEN) has outpaced BOQ in recent months, trading up from a low of $8.00 in March – hitting a high today of $11.18 a run of nearly 40% plus the dividend. +2.2% on the session today is a good move. For our position, we need to hold for another 10 days to pick up the franking (45 day holding rule).

As we wrote this morning…. We stick with our relatively unpopular view that banks are the place to be at least for the short term.

Bendigo Bank (BEN) Daily Chart

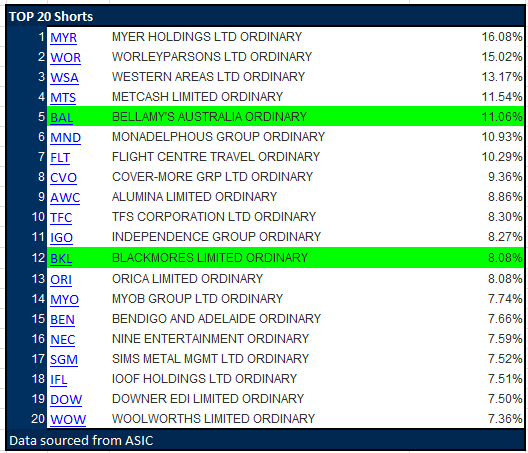

Top 20 Shorts

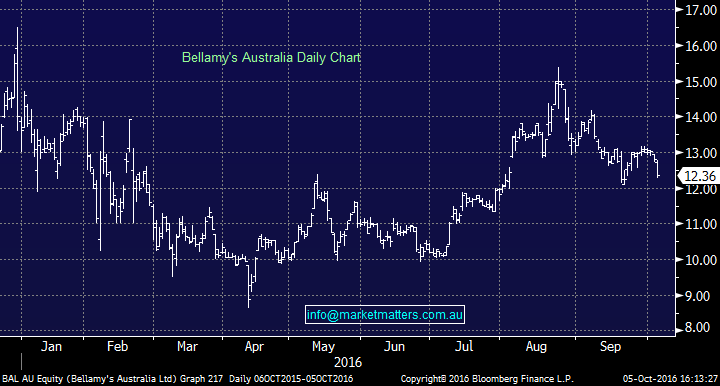

Blackmores (BKL) and Bellamy’s (BAL) continue to attract strong short interest. Seems a lot are still very sceptical of their current valuation given risks towards their Chinese growth strategies. A number of well-known brokers are still pushing Bellamy’s fairly hard, yet it seems to be falling on deaf ears…the stock is soft and further downside looks likely. Shorts are certainly backing that view…

Bellamy’s (BAL) Daily Chart – looks weak technically

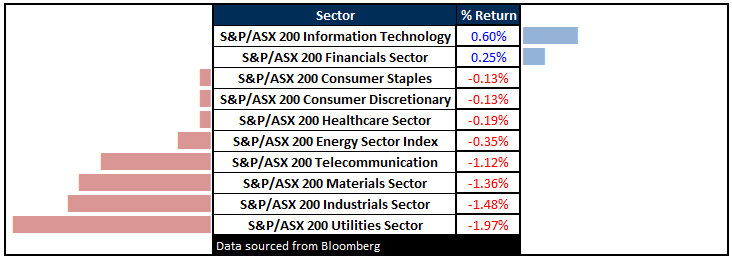

Sectors

ASX 200 Movers

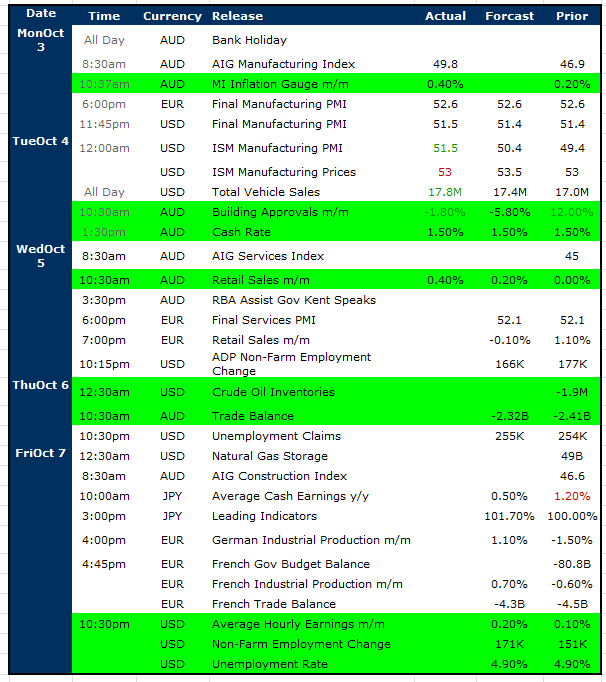

Select Economic Data - Stuff that really Matters in Green

**Chinese Bank holiday for the rest of the week**

What Matters Overseas

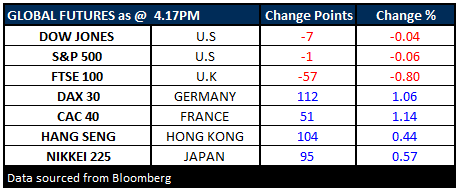

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here