Market Matters Afternoon Report Wednesday 31st August 2016

Good Afternoon everyone

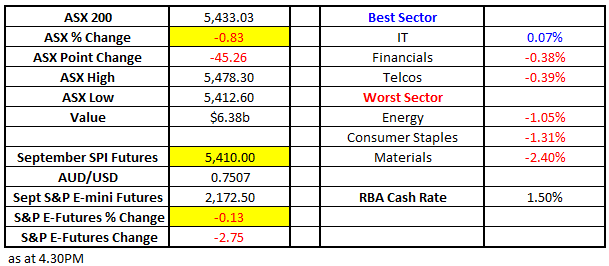

Market Data

What Mattered Today

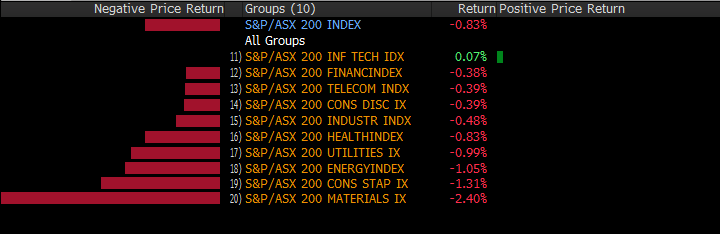

Another soft session for the Australian market with most pressure being applied to the resource space – which was the weakest link by a big margin. We had a range of +/- 64 points, a high of 5576, a low of 5412 and a close of 5433, down -45 points or -0.83%.

Big drop on the open before a weak recovery from the intra-session lows…

ASX 200 Intra-Day Chart

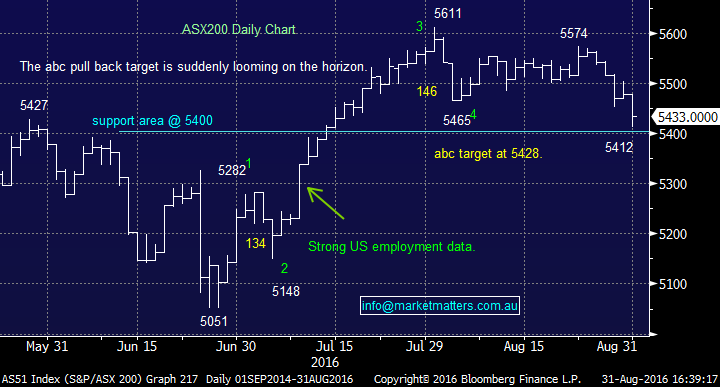

Looking at the daily chart of the ASX 200, we see the ABC target of 5428 come into play today – with the index dropping below it, before recovering and closing above. We flagged this region for a pullback in the weekend report – support should be found here and tentative signs supporting that played out today.

ASX 200 Daily Chart

Again, some interesting stock specific news flow dominated the wires and we saw some big intra-session swings in some of the stocks we’ve been discussing in recent reports. News that Estia Health (EHE) founder Peter Arvanitis had resigned and sold his entire stake in the business (17m shares totalling 9.43% of the company) probably helps to explain a portion of the significant share price weakness – with the stock down around 30% this week alone (and 50% for the year).

The company reported and missed expectations by a long way – which was on Monday and they announced plans to pursue a more organic growth strategy (rather than through acquisition) but it seems now the decision of Arvanitis to sell out and leave – with the announcement to the ASX being signed off on Sunday (but only released today) may have amplified the sell off. The 17m shares were sold at $3.15 v the daily low today of $3.33 – and the closing price of $3.44. Clearly, the selling dried up somewhat and the stock has bounced from todays low. One to watch in coming days to see if some of the pressure comes off the share price. We’ve had no interest in this sector as recent notes have suggested.

Estia Health (EHE) Daily Chart

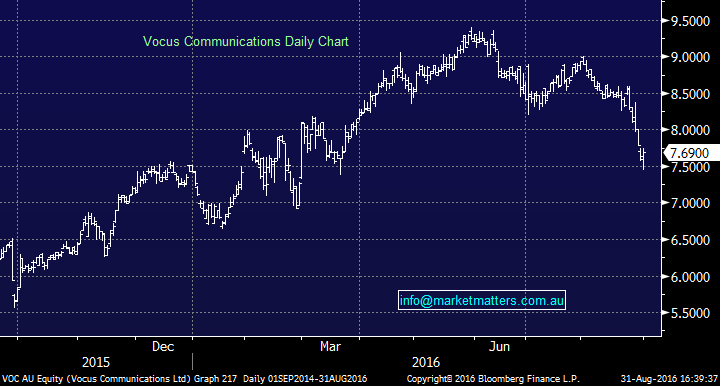

Vocus (VOC) is another company that’s been under pressure over the last week or so - and we do own it. Yesterday we took the decision to average in after selling out of CSR to fund the move. It seems VOC has been under some pressure from a large seller and today we saw first signs that the seller may now be done. The stock finished +3.3% up from the daily low ($7.44) and up +0.65% on the session to $7.69. Early signs only, however, a low looks a strong possibility given today's price action. Interesting to now think that VOC and TLS are on the same PE for 2018 yet VOC earnings growth is expected to be around +37% for 2017 v Telstra on low single digits…!!! Worth also noting that VOC finished the session higher today v CSR which closed down -4.43%. A good example of why it can often be worthwhile taking a loss if capital can be re-deployed better elsewhere.

Vocus (VOC) Daily Chart

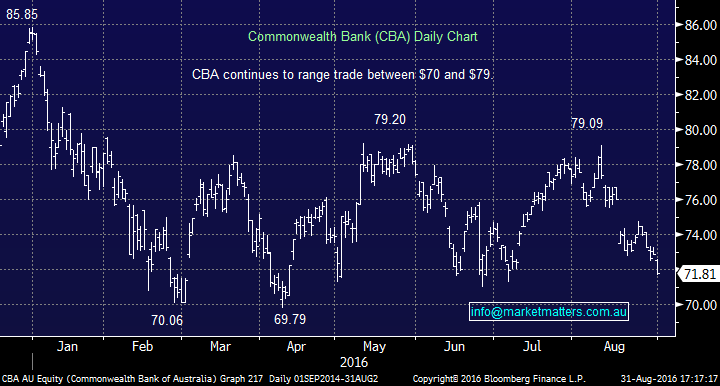

The banks were relative performers on the day with ANZ and NAB actually finishing in the black. We continue to think banks will be likely ‘outperformers’ in the near term given the positive trends in the US – and importantly, their relative value here if money comes out of Resources as the higher $US puts some pressure on commodity prices in the very near term. CBA was the exception today, though, after Morgan Stanley downgraded to underweight from equal weight suggesting that falling return on equity makes the bank vulnerable to an ongoing derating…they cut their price target to $68 from $72.50. The rationale seems to be that tougher operating conditions for the banks mean that CBA shouldn’t trade at such a high premium to the sector. We hold CBA and this report does nothing to sway our opinion of the stock for now.

Commonwealth Bank Daily Chart (CBA)

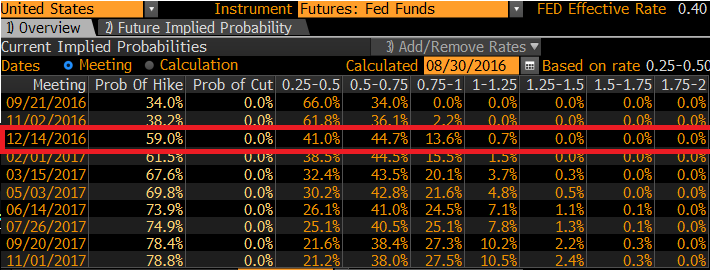

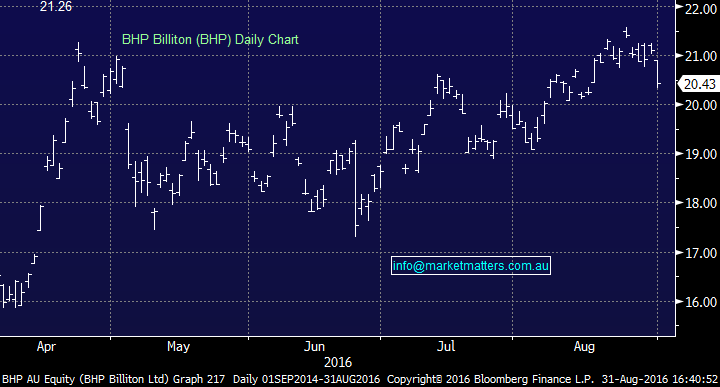

Both BHP and RIO were under the kosh today as the higher $US starts to bite. Clearly, the Fed’s more hawkish commentary at Jackson Hole and early this week got expectations for a rate hike firming up. We flagged this theme last week (ahead of the meeting) suggesting that market pricing was off – that is, there was not enough probability of another hike in 2016 being priced in and if expectations changed, then so would the direction of the US currency. Right now, expectations for a December hike stand at 59%, however, the bigger mover has been expectations for a hike of September – which is now priced as a 38% probability.

Source: Bloomberg

BHP Billiton (BHP) Daily Chart

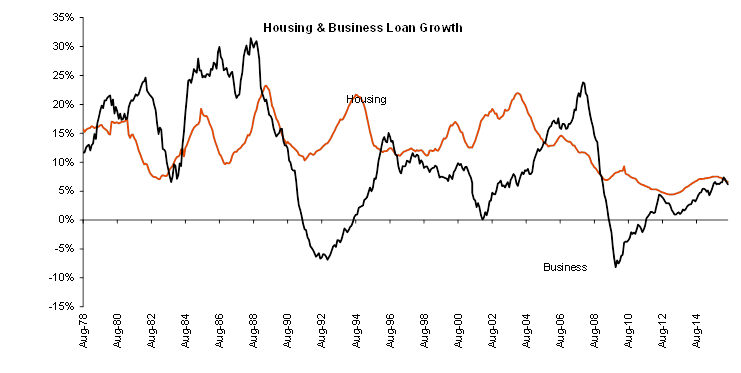

On the economic front today, loan growth stats were out with the Australian banking system loan growth for the year to July printing +6.0%; housing 6.6% and business 6.2%. Business credit growth has rebounded in July +0.3% from weak June(-0.2%) – while Housing remains strong. This is supportive of the banks.

Source; Shaw and Partners

Sectors

Source; Bloomberg

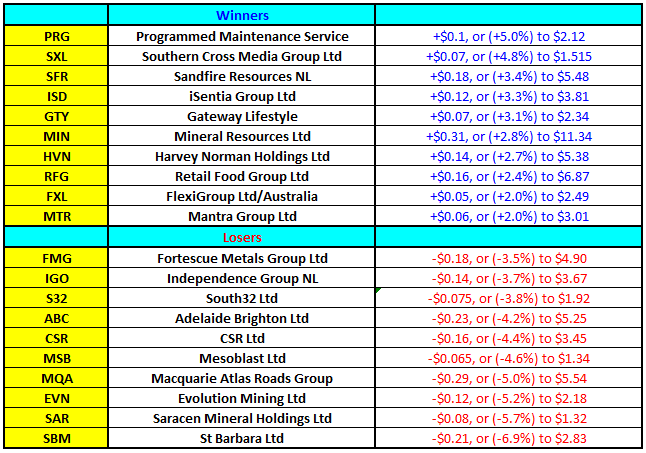

ASX 200 Movers

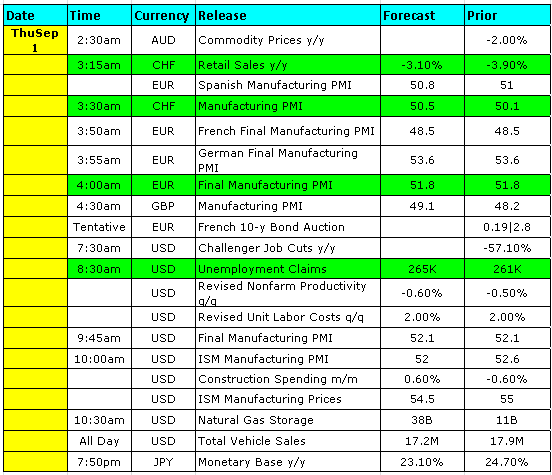

Select Economic Data – Stuff that really Matters in Green

What Matters Overseas

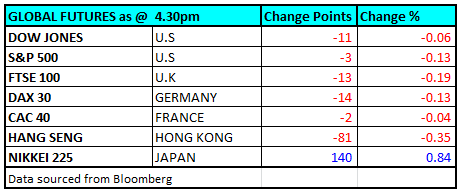

FUTURES LOWER…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here