Market Matters Afternoon Report Wednesday 21st September 2016

Good Afternoon everyone

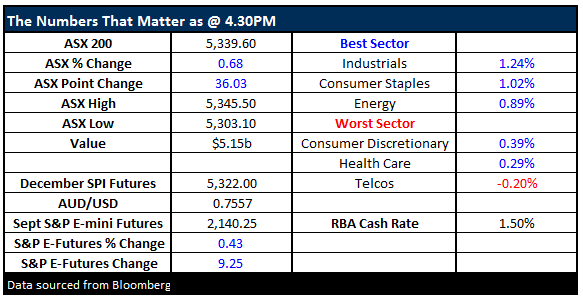

What Mattered Today

A good session for the broader market today following the Bank of Japan’s (BOJ) decision to ‘tweak’ it’s current stimulus package. All up, the package has a number of twists and turns but overall the market seemed reasonably happy with the plan put forward by the central bank.

Interest rates on deposits stayed stable at -0.10% which was expected, and they got rid of the 7-12 year JBG buying duration. They’ll introduce QQE with yield curve control and they kept their ETF purchases at JPY 5.7tn. Importantly, they said they’ll continue to expand monetary base until inflation is stable above 2% - which is an optimistic call but one that suggests they’ll be active in the markets for a while yet. All up, today's move is supportive of stocks and we saw that flow through here and in Asia.

Japanese Nikkei Daily Chart

Banks were up again today given they benefit from a steepening of the yield curve. We’ve spoken about this theme in a number of reports recently, and in simple terms, when the gap between the yields on short-term bonds and long-term bonds increase, it makes the yield curve steeper.

Banks borrow short and lend long, which means they benefit as the gap between short and long term rates widen. If I can borrow at 1.2% and lend at 2% I make 0.80%. If the short end moves up to 1.25% but the long end goes to 2.10%, the margin becomes 0.85% - an improvement in margin which is supportive of earnings. ANZ and NAB were the best performers today adding +1.68% and +1.33% respectively.

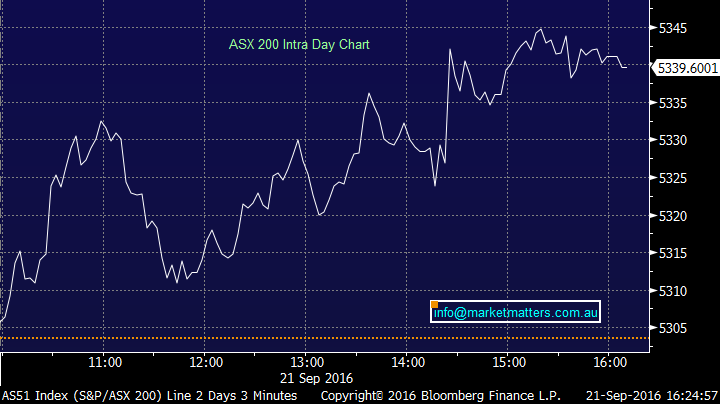

On the market today we opened fairly flat before pushing up for much of the session. We had a range of +/- 42 points, a high of 5345 a low of 5303 and a close of 5339, up +36 points or +0.68%

ASX 200 Intra-Day Chart

ASX 200 daily chart

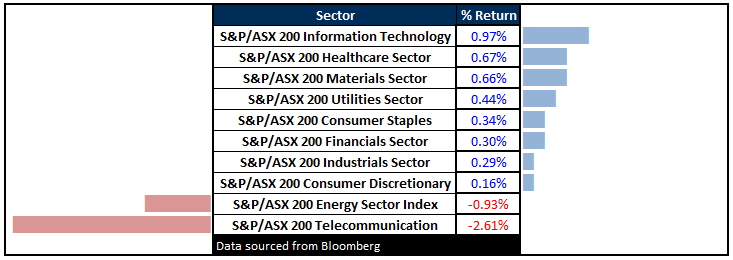

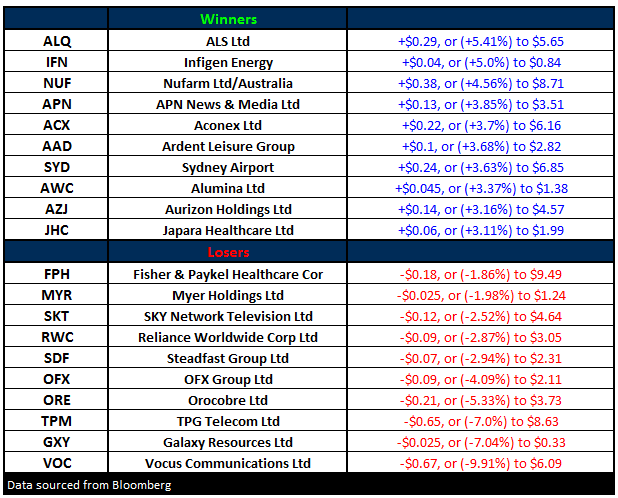

Another day and more pain in the telco space – this time it was Vocus (VOC) that headlined following the resignation of their CFO while TPG Telecom (TPM) – which was whacked 21% yesterday fell another -7% today. Both were on BIG volume today with VOC doing more than 21m shares v an average day around 5m shares.

Vocus Communications (VOC) Daily Chart

Clearly, todays resignation by Rick Correl – who was on the Vocus side of the merger (with MTU) rattled the market and seemed to be the straw that broke the camels back.

It’s never good when we see an abrupt move like this that blindsides the market, particularly a market that’s reeling from yesterday’s TPM downgrade. We’ve also had news in recent times that James Spenceley – founder of VOC sold down 3.2m shares which tends to erode confidence. In June the company raised $652m at $7.55 a share to acquire the NextGen assets – and the raising was oversubscribed. Today you could have had all the shares you wanted below $6.00.

Interesting to see one analyst downgrade today following the resignation claiming that something must be going in the ranks of VOC management. It’s hard to make that judgement and to downgrade post such a big drop – surely the horse has bolted! The Q becomes, what to do with VOC given we own it?

We continue to hold it and today's drop looks like that capitulation style event – where all the weak longs fall on their sword. As we wrote earlier – the straw that breaks the camels back has prompted a -10% drop in the stock today – yet the resignation of the CFO alone would not normally do that. Clearly, the market smells a rat and is wanting out. If we didn’t own it, we’d buy it. Unfortunately, we don’t have that luxury at this point in time.

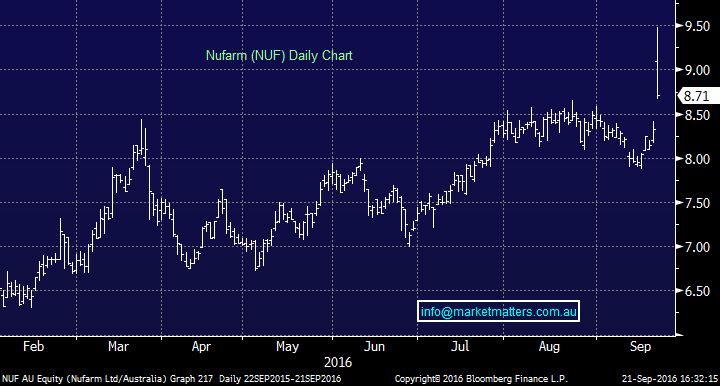

Elsewhere, Nufarm (NUF) reported today and the numbers were ahead of the street – $286m earnings v $255m expected. The stock has been in a rut for the past 12 months trading within a $6.40/$8.80 range. Today it broke that range. We like the sector although think NUF has some headwinds from weaker crop prices offset to a large degree by a good cost out program.

Nufarm (NUF) Daily Chart

Sectors

ASX 200 Movers

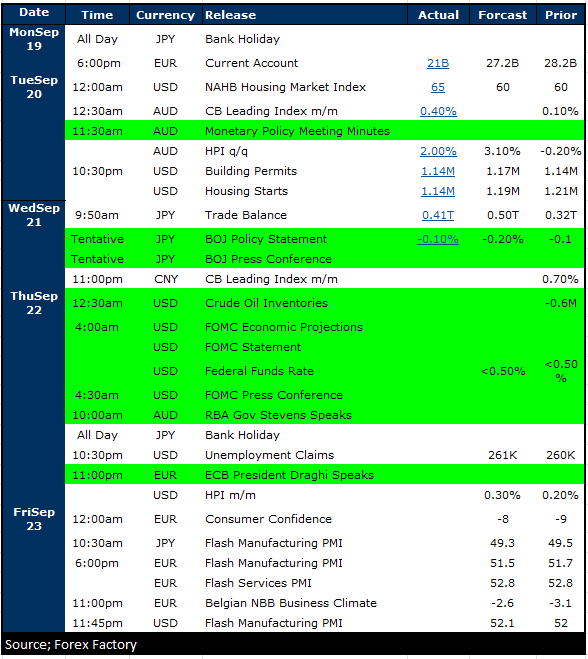

Select Economic Data - Stuff that really Matters in Green

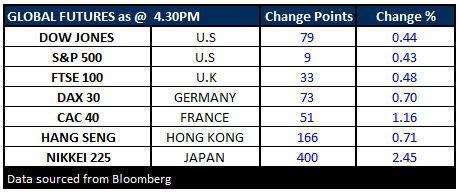

What Matters Overseas

FUTURES higher overseas leading into the 2nd day of the FOMC meeting.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here