Market Matters Afternoon Report Wednesday 14th September 2016

Good Afternoon everyone

What Mattered Today

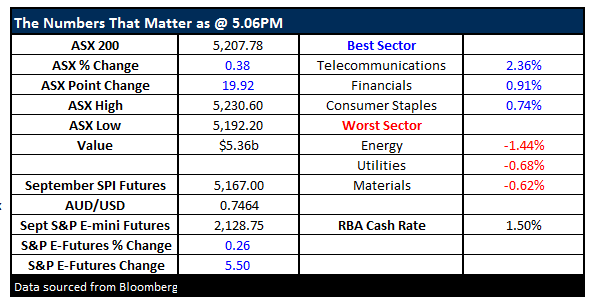

A small bounce from Aussie stocks today defying the sell-off in the US overnight…The S&P 500 fell -1.48% however, we finished up on the session – largely a result of buying amongst the banks and a recovery in Telstra (TLS) from sub $5. We had a range of +/- 38 points, a high of 5230 a low of 5192 and a close of 5228, up +20 points or +0.38%

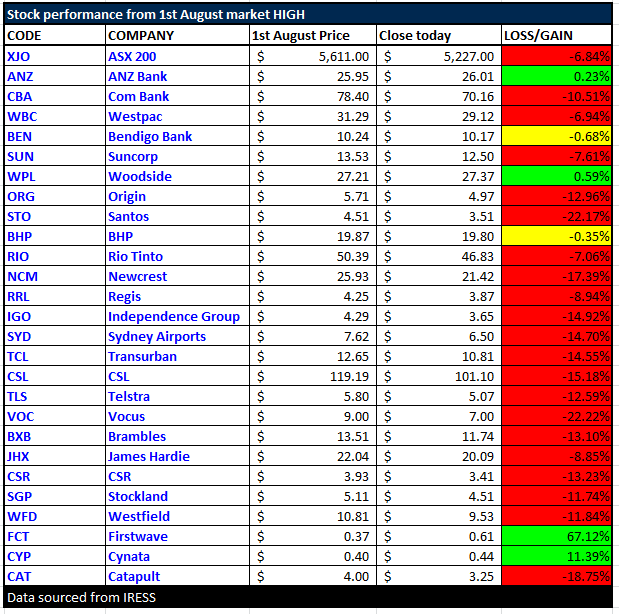

The ASX 200 had the most recent peak on the 1st August with a high of that day of 5611. Since then the market has fallen to a low of 5192 this morning – a drop of -419pts or 7.46%. We’ve had reporting season play out during that time, with about 58% of companies reporting inline, 22% beat to the upside and about 20% missed market expectations. We’ve now also seen changing expectations around US rates at that’s caused ructions in the bond market which has flowed through to global equity markets. Looking at some of the stocks on our radar tells an interesting story….

A BIG variance in the performance of banks, with ANZ the clear standout, while Commonwealth Bank (CBA) has been the weakest link. The same theme in the Oils with Woodside (WPL) massively outperforming Origin Energy (ORG) and even more so if we look at Santos (STO) which has fallen 22% during that period.

Well held defensive names have suffered in this sell-off – which has not been the case during recent market declines. Think Sydney Airports (SYD) which is down -14.7% and Transurban (TCL) which has fallen 14.55%. Compare that with BHP, which is a ‘risk on growth stock’ and it’s pretty much flat over the period of this decline. Golds are actually starting to look interesting again with Newcrest (NCM) down 17% from its Aug 1 high – near a decent entry point it would seem

The telco space has been a shocker – and we’ve got Vocus (VOC) in the portfolio which is down -22% from the August 1 high and down about 12% since we entered. Telstra (TLS), which is your traditional ‘safe haven’ has underperformed BHP by about 12%. In the property space, market darlings in Stockland (SGP) and Westfied (WFD) are down around 11% a piece – and the uptrends in these names are clearly broken.

It seems obvious that the trends in the market are changing and defensive stocks that are priced on yield are no longer the go to areas. In an environment of higher interest rates, companies that can grow their earnings will be more highly valued.

Vocus (VOC) deserves more attention here given the big fall in share price and given we’re down around -12% on our holding. We’re approaching key support and today we saw the stock dip below $7.00 then close smack on it. Some reasonable buying was seen below $7.00 and from what we saw today, that could be a reasonable low in the stock.

VOC was a high PE stock with good growth - it’s now a moderate PE stock with good growth and it seems a lot of the weak longs are out. Clearly, there’s been a few issues with this stock and it’s fallen. James Spenceley who started Vocus sold down shares – about $24m worth leaving him with about $7m worth of stock. M2 management have now largely taken over the running of the business and this change has gotten a few nervous.

Growth slowed in the 2H16 v 1H16 and probably prompted some of the PE re-rate – however, it’s still a stock that is expected to growth earnings by 34% in 2017/18, it’s operating in a growth sector, with plenty of levers to pull to lift margins – which are low versus peers. It seems very overdone on the downside.

Vocus (VOC) Daily Chart

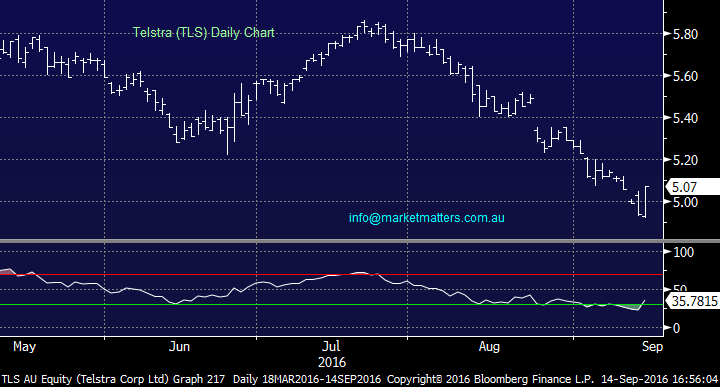

Telstra (TLS) was also interesting today – BUYING obvious sub $5.00 – we’re still negative TLS with a $4.75 downside target. We’ll be buyers if it trades in that region…

Commonwealth Bank (CBA) is also near support, with some reasonable buying sub $70…CBA continues to be a BUY sub $70.00

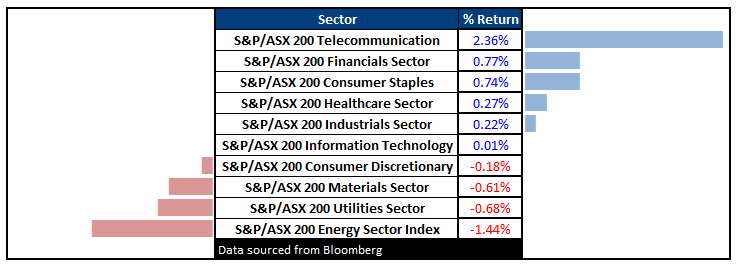

Sectors

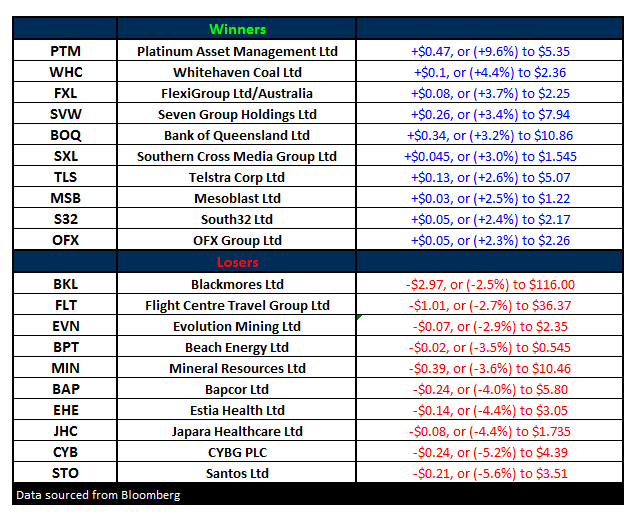

ASX 200 Movers

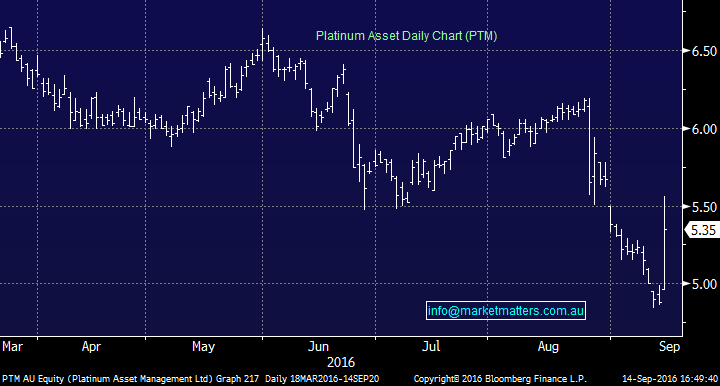

Platimum Asset Management (PTM) topped the leaderboard today after announcing a share buy-back. It’s hard to get excited over PTM, however, they did say they’ll buy back up to 10% of its total shares on-market over the next 12 months, commencing on 4 October. Shares will only be bought back if the stock 'trades at a significant discount to its underlying value' although 'no target price has been set'!! If they do 10%, it’s about 59m shares. This is a very tightly held stock with only about 40% free float – so a 10% buy-back is pretty substantial hence the stock popped today.

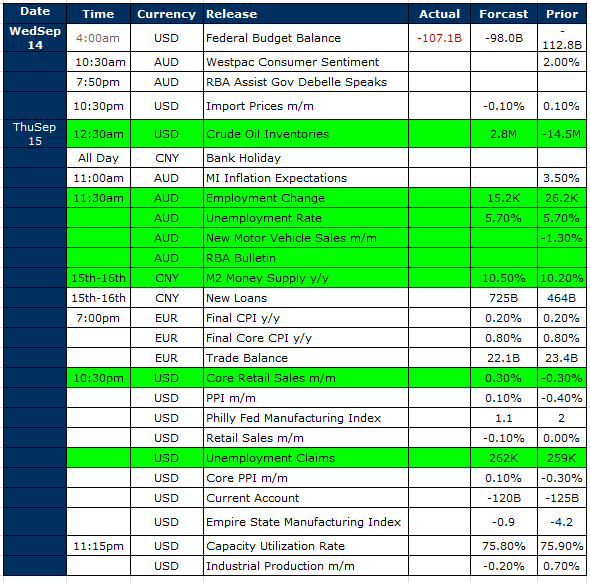

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

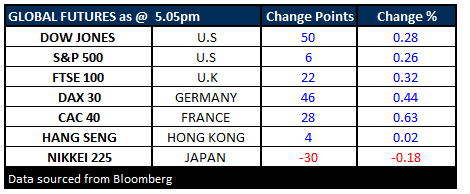

FUTURES reasonably upbeat this evening….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here