Market Matters Afternoon Report Tuesday 4th October 2016

Good Afternoon everyone

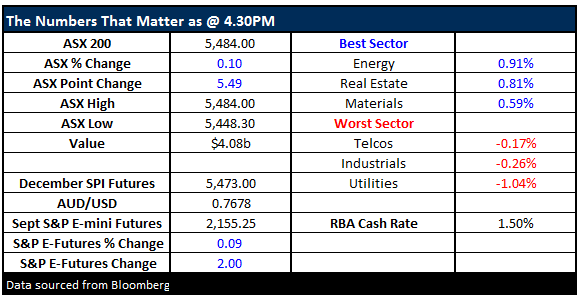

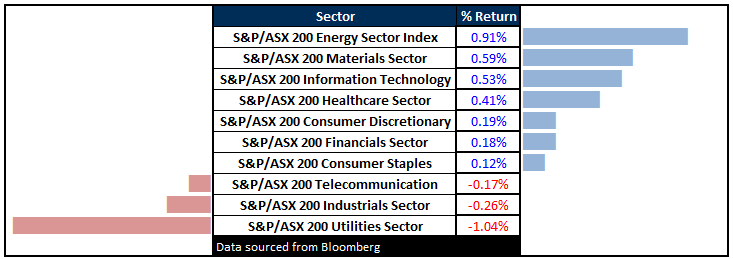

What Mattered Today

Energy stocks led the charge today with the sector putting on +0.91% offsetting some weakness in the higher yield ‘quasi bond’ like stocks. Materials coys were also good with BHP closing on its highs – up +0.66% to $22.90 while Rio Tinto (RIO) was also strong adding +1.12% to $52.48. No change to official interest rates today with Govenor Philip Lowe keeping the benchmark on hold at 1.50% in his first meeting at the helm.

Importantly, the Statement was very similar in tone to recent ones (under Glenn Stevens) and the market is now factoring in less chance of further cuts than it was a few months ago (hence the weakness in high yield plays). Housing the main area of interest and they still think that an uptick in supply will start to put a cap on prices and any talk of a ‘bubble’ is unfounded. In other words, the market will look after itself.

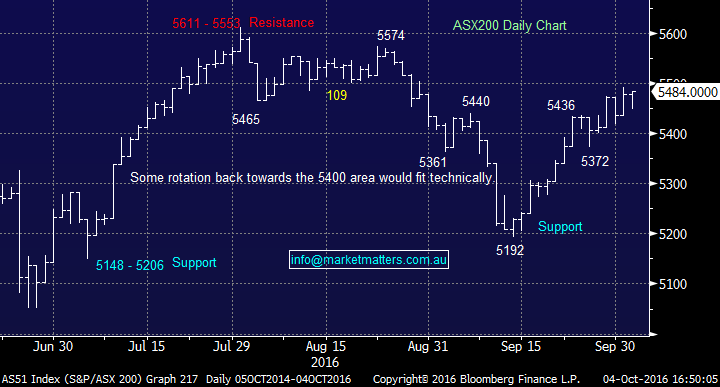

On the ASX, we had a range of +/- 36 points, a high of 5484, a low of 5448 and a close of 5484, up +5pts or +0.10%. Volume was about 25% below recent averages given school holidays continuing this week.

ASX 200 Intra-Day Chart

ASX 200 daily chart

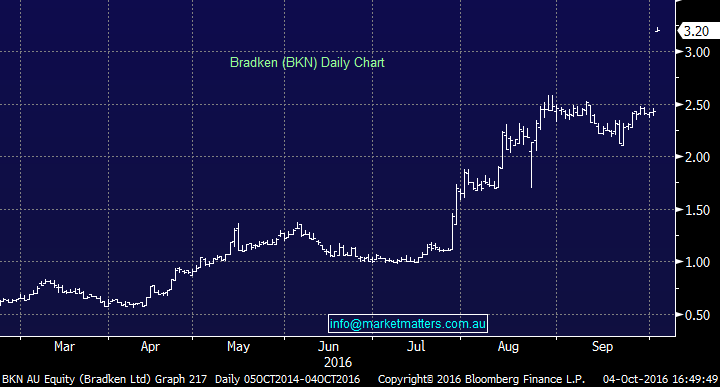

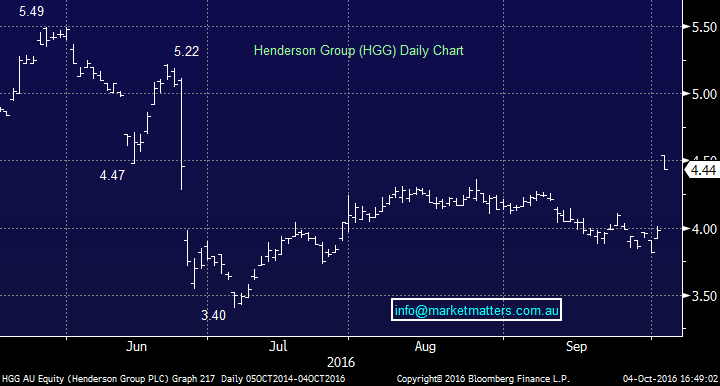

Bradken (BKN) and Hendersen Group (HGG) charged higher today – putting on +31% and 11.56% respectively. M & A clearly picking up in Oz and we continue to think more will come. Bradken copped at takeover bid at $3.25 from Japanese company Hitachi Construction Machinery Co while Hendersen Group (HGG), announced a merger with Janus Capital Group creating "Janus Henderson Global Investors plc" which will be dual traded in Australia and the US, and will delist in London once the deal is complete, which is likely to be some time around Q2 2017.

Bradken (BKN) Daily Chart

Hendersen Group (HGG) Daily Chart

Bank Inquiry

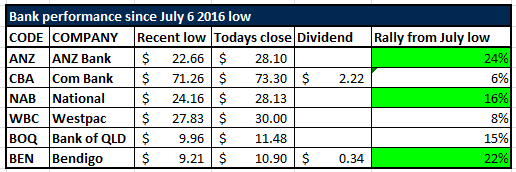

Today we saw Commonwealth Bank (CBA) front the parliamentary enquiry into the banks. ANZ will be grilled Wednesday then NAB and Westpac will front up on Friday. Each bank faces 3 hours of questioning. Ironically, David Coleman, the Liberal Member for ‘Banks’, which is in Sydney’s South West is chairing the committee.

CBA will have the most to say in regard to financially sensitive answers given they’ve already reported while the other three majors report later this month or early November – so may be hamstrung on some aspects. Clearly the issues raised are very important ones and we support all attempts being made to improve the standards for advice in Australia.

In terms of bank performance, we had a low in July and all have rallied to varying degrees. October is a key month for the banks and they generally perform well…we’re overweight banks despite the current negative headlines and will continue to stay long into seasonal strength over the next few weeks / month

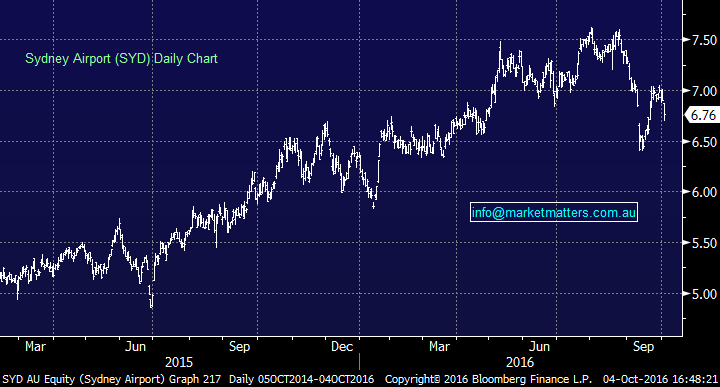

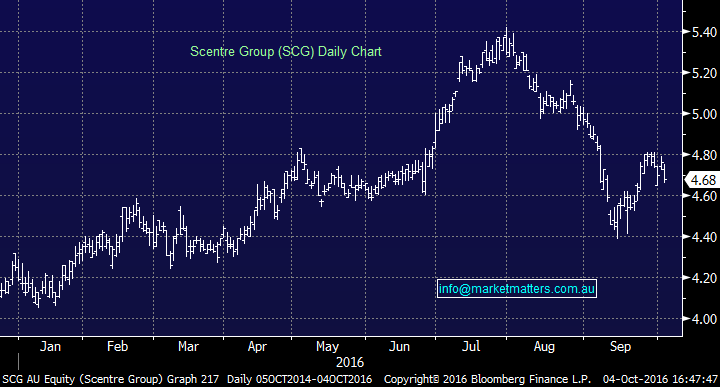

Elsewhere, we’ve been fairly vocal about the risk of expensive defensive stocks priced on yield and cautioned about holding them as rates rise. We’ve now seen many pullback sharply, before a relief rally (dead cat bounce in our view) provides another opportunity to SELL. Sydney Airports (SYD) a case in point here while some of the property stocks like Scentre Group (SCG) have also bounced short term – and can be sold here.

Sydney Airports (SYD) Daily Chart

Scentre Group (SCG) Daily Chart

Sectors

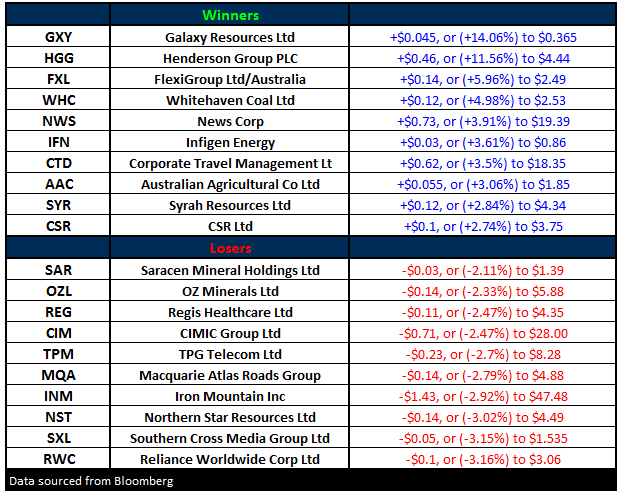

ASX 200 Movers

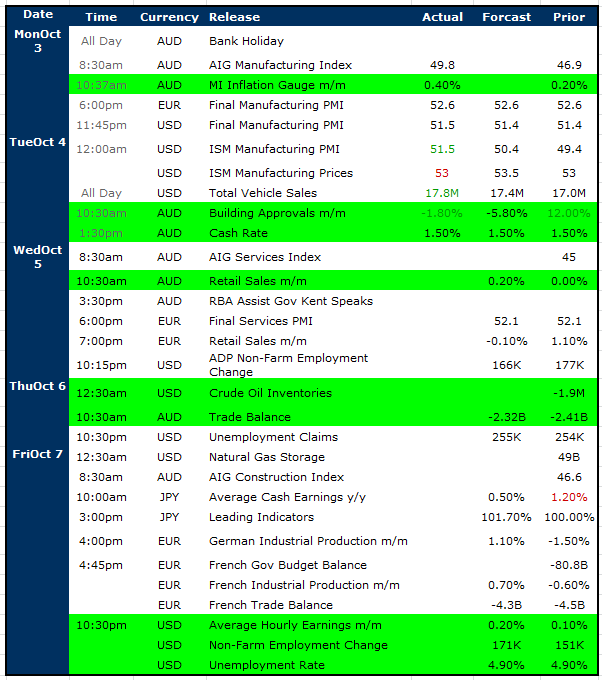

Select Economic Data - Stuff that really Matters in Green

**Chinese Bank holiday for the rest of the week**

What Matters Overseas

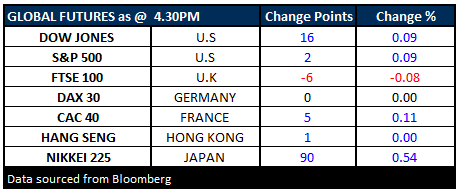

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here