Market Matters Afternoon Report Tuesday 16th August 2016

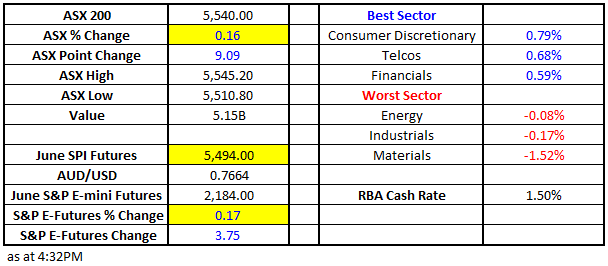

Market Data

What Mattered Today

Another fairly tight day from an index perspective however once again we saw some BIG individual stock moves play out. We had an extremely tight range of +/- 19 points, a high of 5549, a low of 5530 and a close of 5532, down -8 points or -0.14%.

ASX 200 Intra-Day Chart

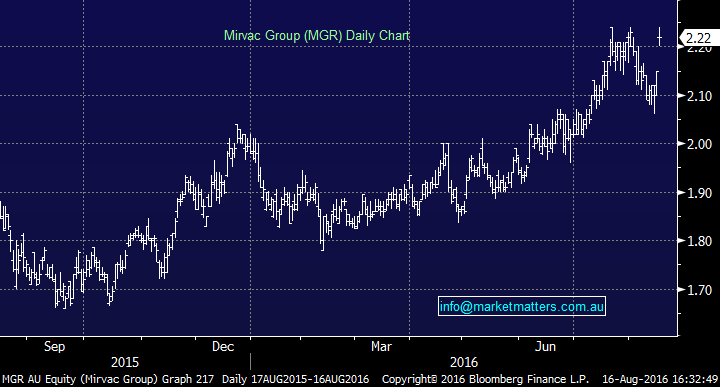

On the positive side, Mirvac (MGR) released good profit numbers and guidance, and the dividend was inline – the stock finished up +3.26%, however, we continue to see these property stocks as too highly priced at current levels.

Mirvac (MGR) Daily Chart

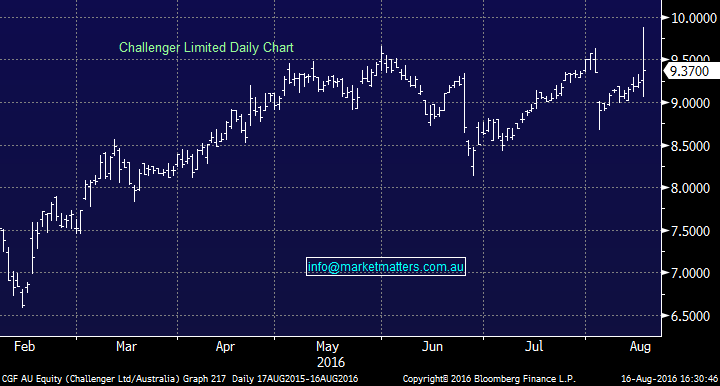

Challenger Group Financial (CGF) also impressed with strong annuity sales numbers pushing good growth in earnings. Annuity sales increased by 55% in Q4 which is huge. Guidance was also sound and capital levels were good which is very important for future growth (CGF must hold capital against written liabilities – increased annuity sales = more need for capital). Naturally it creates an impediment for growth but CGF more than adequate for now.

Challenger Group Financial (CGF) Daily Chart

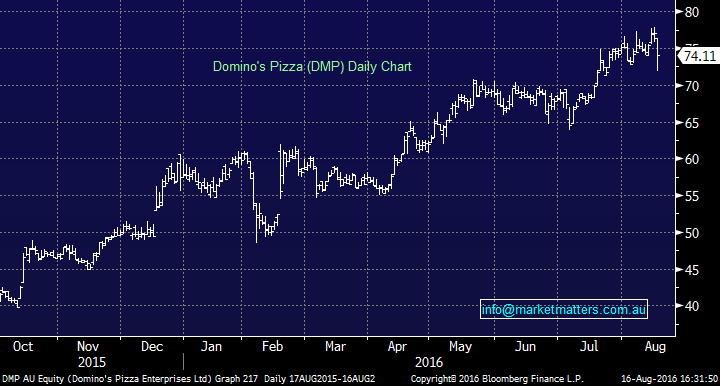

Domino’s (DMP) missed consensus on earnings ($82m v $89m expected), beat on the dividend and provided a reasonable outlook, however, you can’t afford to stumble at all when you’re priced on 80 times....We would have thought a higher dividend is also not necessarily a positive for a growth stock particularly one that is suggesting store roll outs abroad have cost more than they had previously guided to. We know it’s a brave call and one that may prove to be premature however this result is not good enough to support the current share price in our view. The stock fell -3.74% today to close at $74.11.

Domino’s Pizza (DMP) Daily Chart

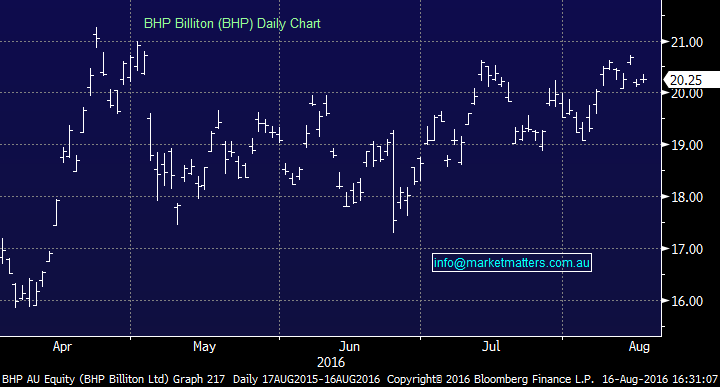

….While the result that most have been waiting for – BHP – has just dropped and the conference call with management is about to start (@6pm this evening). On first read through, there’s some good & bad in the result.

The Good

Top line revenue was inline printing $30.912bn v $30,929bn expected

Underlying earnings were $12.340bn v the market which sat at $11.648bn – so a bit better

Underlying net profit was $1.215bn v the market which was at $1.1bn

FY17 Free Cash Flow estimate by BHP came in at $7bn – they had discussed $5bn when last commented on in May this year

The not so good

Net debt was higher than expected – by about $1bn coming in at $26bn v $25bn expected by the market

The Dividend was a miss – with the full year at 30cps v the 32cps expected by the market

Iron Ore was weak (and was the only division to miss) – coming in at $US$3.7bn vs. $4bn expected.

All up

A very weak read through however the market has had about 12months to digest the likely result ahead of time. You’ll read a lot about the biggest loss in history, the weak result, poor profitability from a big asset base, which are concerns that have some merit however FY16 will likely be seen as the earnings NADIR. Not a pretty result and the higher debt is probably the biggest negative for us offset partially by a better free cash flow number and lower than expected capex.

More details to come post conference call. The stock was fairly quite in trade today.

BHP Billiton (BHP) Daily Chart

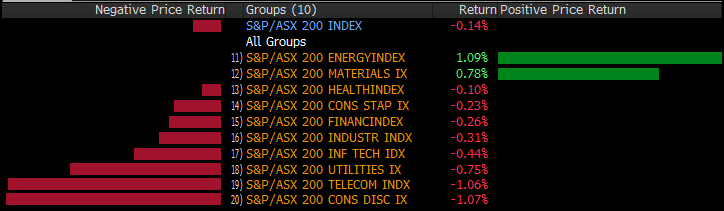

Sectors

Source; Bloomberg

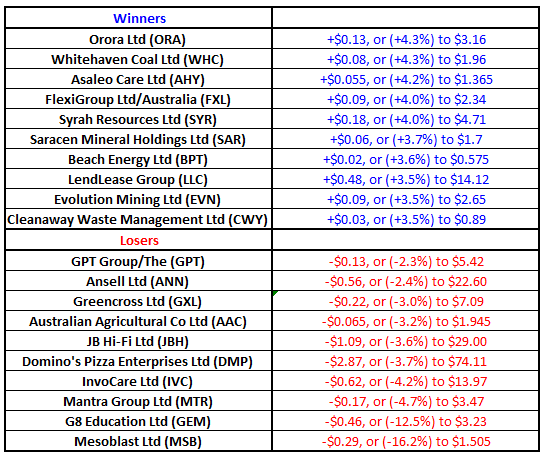

ASX 200 Movers

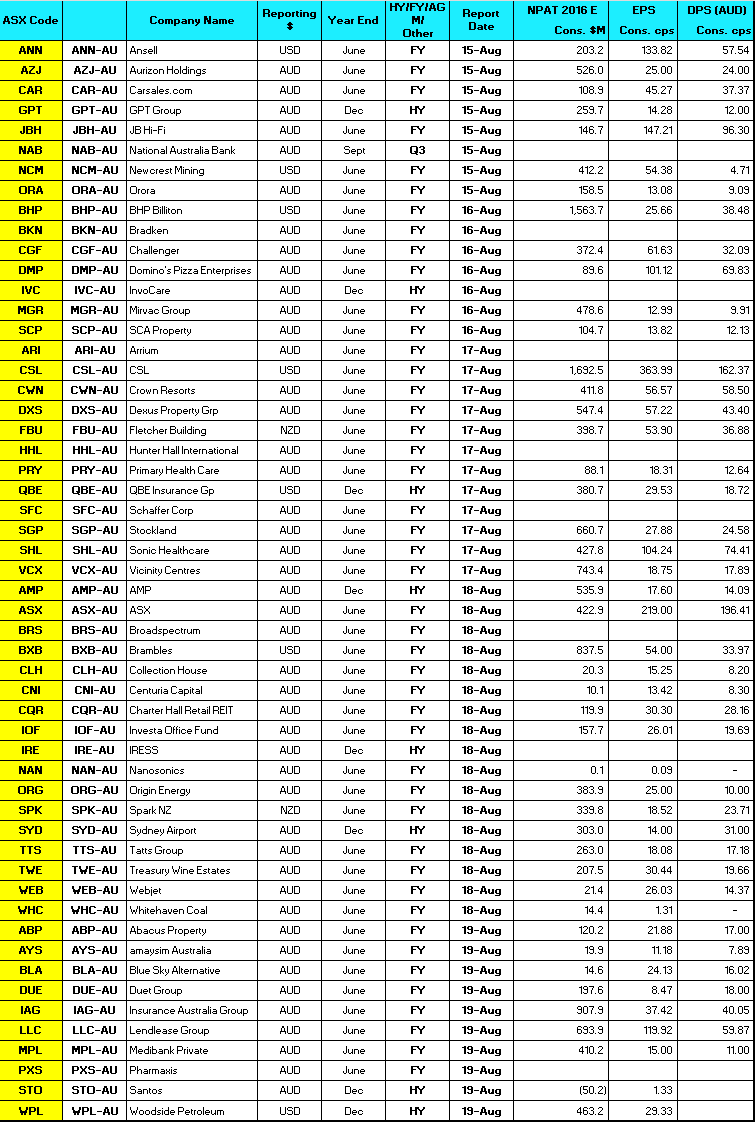

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

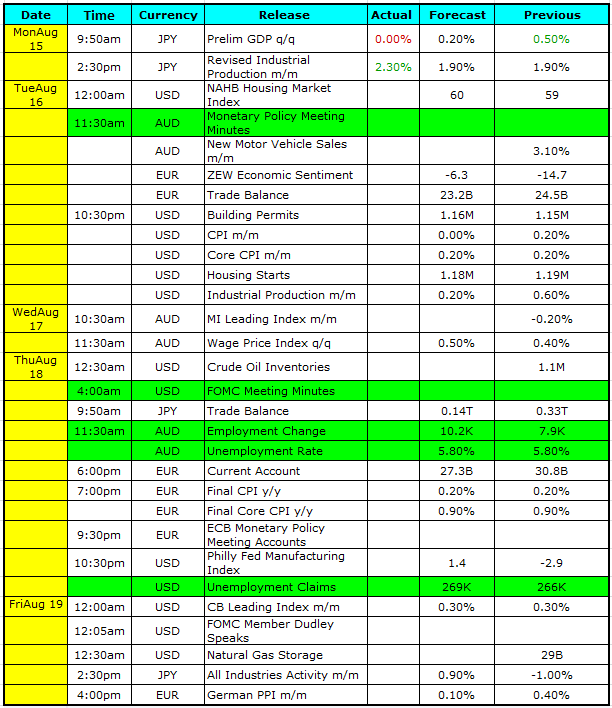

Select Economic Data – Today & Tomorrow; Stuff that really Matters in Green

What Matters Overseas

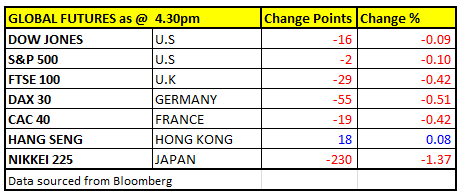

FUTURES pointing to a lower start overseas…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here