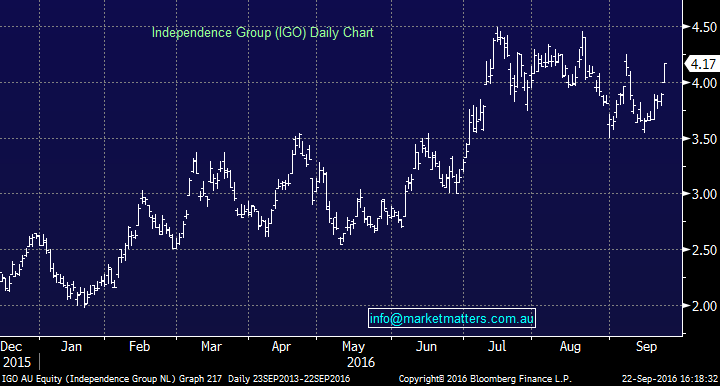

Market Matters Afternoon Report Thursday 22nd September 2016

Good Afternoon everyone

What Mattered Today

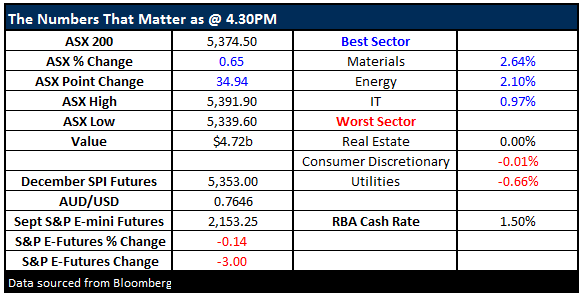

A good day for local stocks with the resources copping most support. We had a range of +/- 44 points, a high of 5391 a low of 5347 and a close of 5391, up +34 points or +0.65%

ASX 200 Intra-Day Chart

ASX 200 daily chart

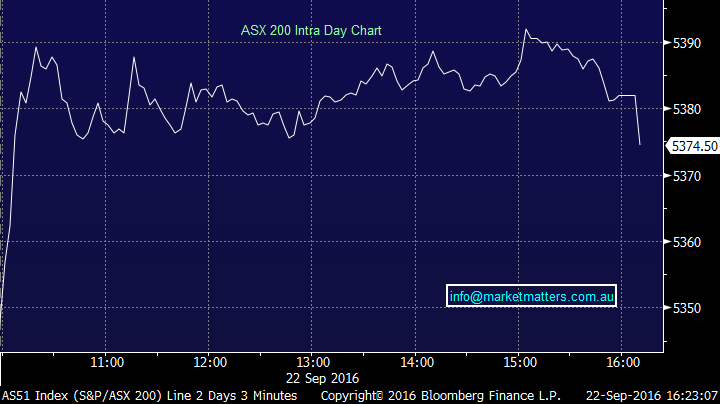

What we liked the look of today.....??? A couple of the stocks we follow closely had a very good session today after a few hard weeks, it’s nice to see. Obviously, we’ve seen some more optimism coming into the market post the BOJ and FOMC meetings with both showing commitment to further stimulus. Janet Yellen of the Fed would clearly be happy with the market’s reaction to her justification for leaving rates on hold, with the probability of December hike now sitting at 61% - which is up from 55% before the meeting, the $US actually rallied, the US stock market rallied as did bonds putting pressure on yields. She pretty much got everything on her wish list. The key – as we’ve written about recently is around where Fed members see rates in December 16. Each dot represents a voting member of the Fed. Clearly, the consensus sits at 0.75% which means we’ll be getting a December hike.

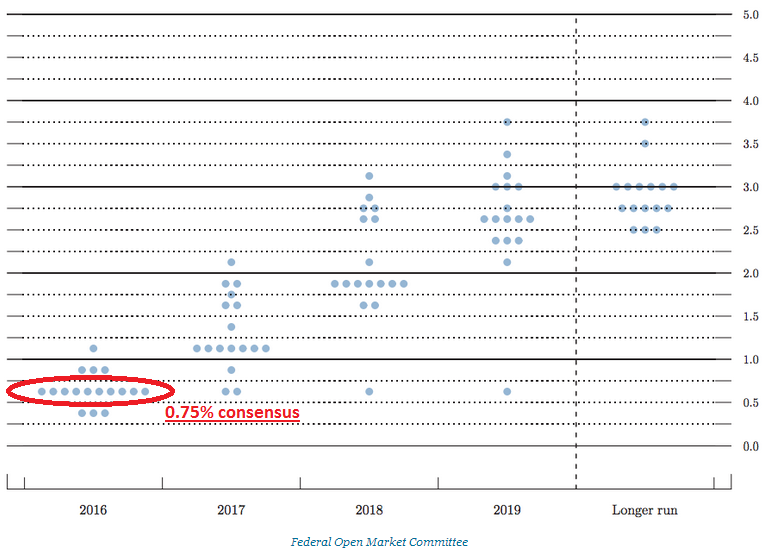

Independence Group (IGO) +7.2% – We own it and it started to perform today adding +7.2% to close at $4.17 supported by a strong gold price. This is a very volatile stock and has struggled with back to back rallies. One to watch tomorrow, however, it’s a good company in the right space.

Independence Group (IGO) Daily Chart

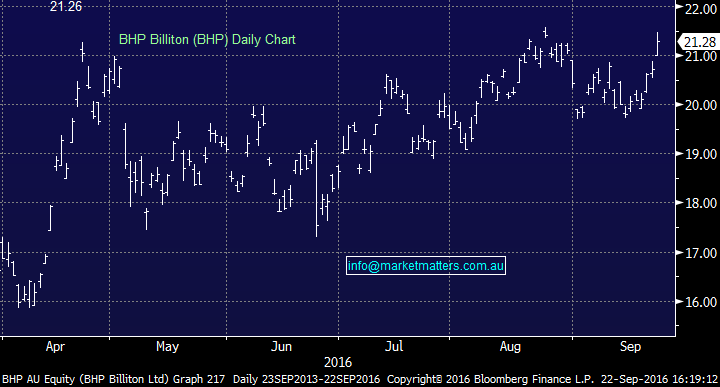

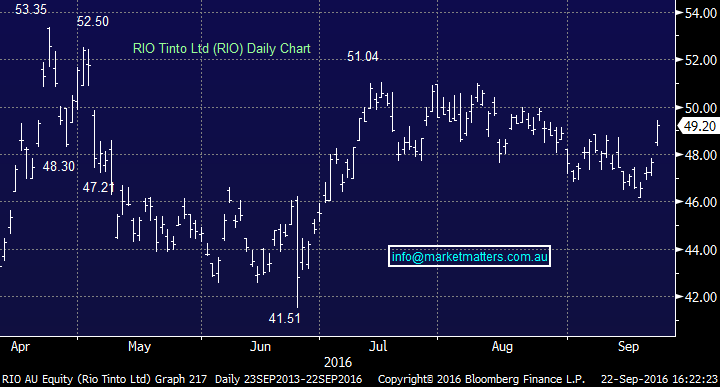

BHP (BHP) +2.7% – Both BHP and RIO (+3.25%) had very good days today in what looked like some pent up buying. A lot in the mkt were talking about the Fed decision, which could bring forward expectations for a December interest rate hike and in theory that could push the $US higher and commodities lower. It’s a pretty logical assumption to make and would have kept some on the sidelines till after the decision.

BHP (BHP) Daily Chart

Rio Tinto (RIO) Daily Chart

Aconex (ACX) +7.47% - It provides a cloud-based solution to manage information and processes across projects in construction, infrastructure, energy, and resources. They’re global, have big name customers and a great product that is highly valued by those that use it. Since listing in 2014, Aconex has gone from around $1.70 to a high of $8.75. It now trades at $6.60 and looks interesting...

Aconex (ACX) Daily Chart

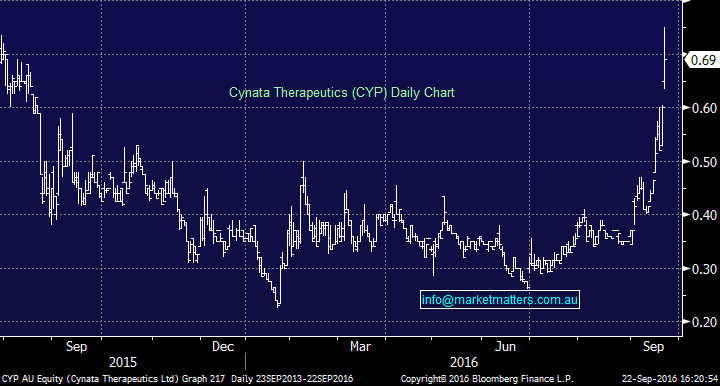

Cynata (CYP) +15% - we wrote about this smaller spec a few weeks ago – CLICK HERE to read – and it’s done well. Biotechs tend to be somewhat binary particularly when they’re entering a trial – which is the case with CYP.

Cynata (CYP) Daily Chart

….& finally, this week we had Sydney Airports (SYD) release another bumper set of traffic numbers which got us thinking about Travel stocks. Inbound tourism is accelerating and it’s an investment theme worth having some exposure to.

The Airport is processing more international tourists than ever before with growth over the past 12 months of around 9.5%. A number of factors combine to support this flow, however, the main two clearly revolve around the rise of the Chinese middle class and the fall in the Australian Dollar.

In terms of the Chinese middle class, the changes to global consumption including overseas travel will be huge as the middle class grows. Right now, only about 4% of the almost 1.4billion people in China hold a passport, compared to 35% of Americans — but that 4% spends almost $200 billion overseas annually, more than any other nation, according to Goldman Sachs. China's urban middle class dominates tourism spending, and Goldman Sachs reckon that 12% of the population will hold a passport within a decade.

In terms of the Australian dollar, at time of writing the AUD/USD is trading around 76c however with an interest rate increase in the US on the horizon, it’s easy to see the Aussie dollar dip sub 70c at some stage this year , which would prompt renewed interest in sectors that are leveraged to a lower currency – travel stocks clearly fit this bill.

Sydney Airports (SYD) has been the go-to travel stock in recent years and rightly so – it’s a great business with sensational long life assets and high levels of free cash flow, however, the backdrop of rising interest rates globally means we’re looking elsewhere for our travel exposures.

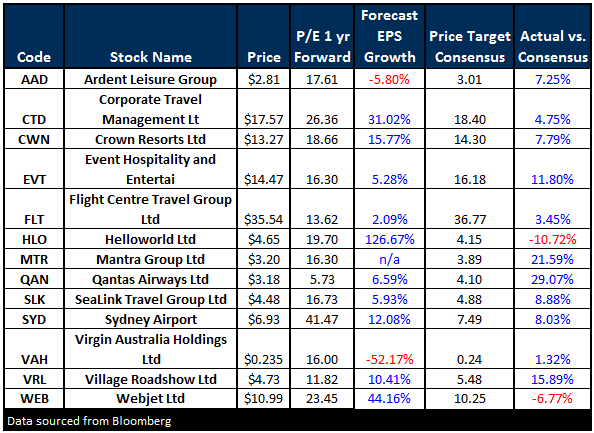

Here’s a list showing the main travel companies listed on the ASX, including their 1 year forward PE, earnings per share growth profile and consensus price target according to Bloomberg. A couple of these stocks look appealing and we’re contemplating adding one to the portfolio…

ASX listed Travel Stocks

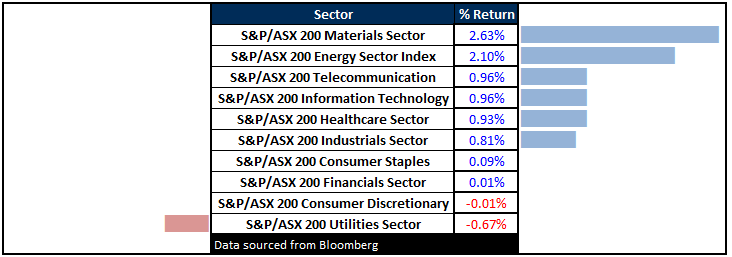

Sectors

ASX 200 Movers

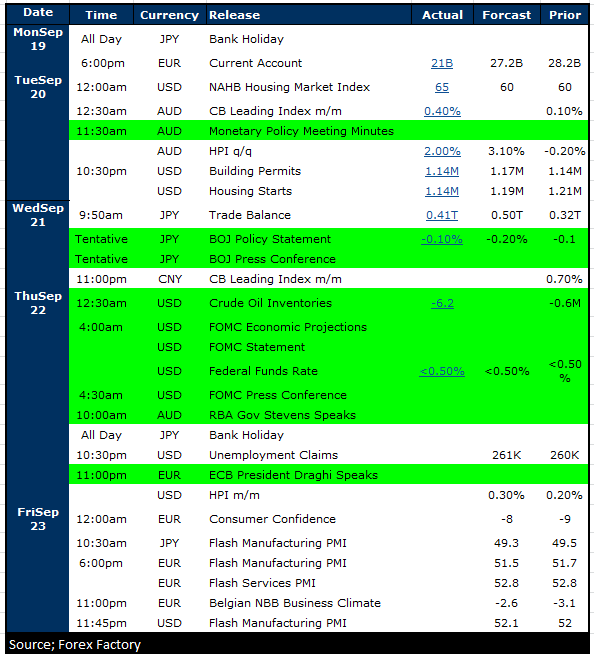

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

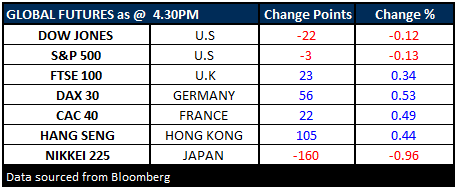

FUTURES are fairly muted this evening…

Overnight, the Fed left interest rates unchanged as expected by both ourselves and the market. However, the Fed appears to be revving the engines for the future with 14 of 17 board members targeting an increase in 2016 i.e. The December hike that we targeted yesterday. Importantly the Chair, Janet Yellen, suggested the lack of hike was not due to a lack of confidence in the economy, they are closely monitoring financial developments and asset valuations are not out of line with historical valuations.

Our major interpretation from this morning is from the rhetoric – recall the phrase "Don't fight the Fed", if the Fed are saying asset prices are ok strongly implies they do not want the stock market falling from current levels. The USS&P500 is only 1.4% below its all-time high and our 2400 target area remains intact.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here