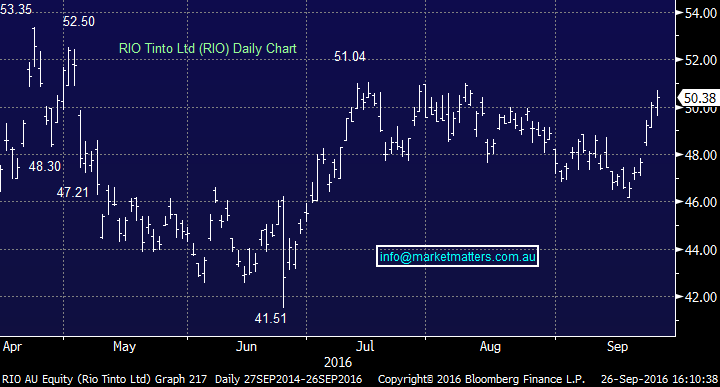

Market Matters Afternoon Report Monday 26th September 2016

Good Afternoon everyone

What Mattered Today

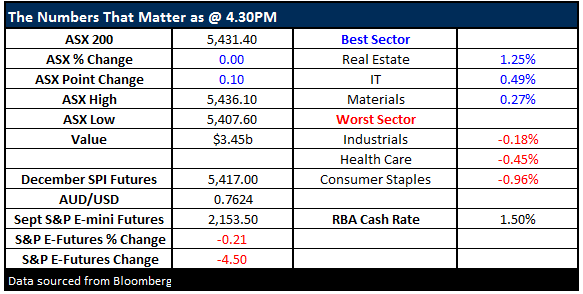

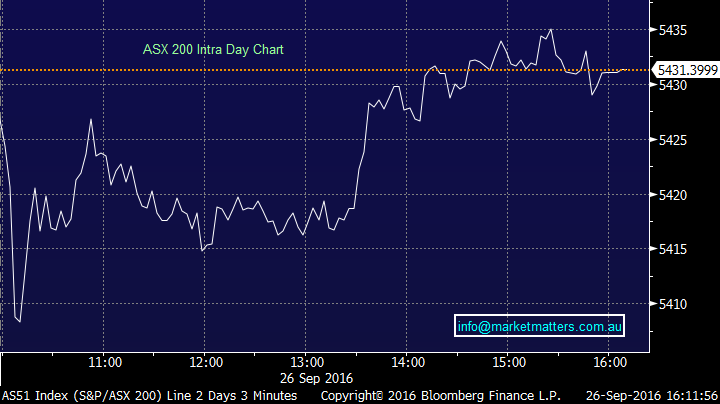

A weak open with the index trading just above the 5400 support level we’d flagged in today’s Morning Report before some buying ticked into the screens around 10.15am - the market rallied from then on. Our view is the ASX200 will spend a few days consolidating its recent gains around / above the pivotal 5400 area prior to continuing with its current advance.

We had a range of +/- 29 points, a high of 5436, a low of 5407 and a close of 5431, which was a flat result overall. Volume was about 30% below the 20-day average which is unsurprising really given public school holidays kicked off today.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

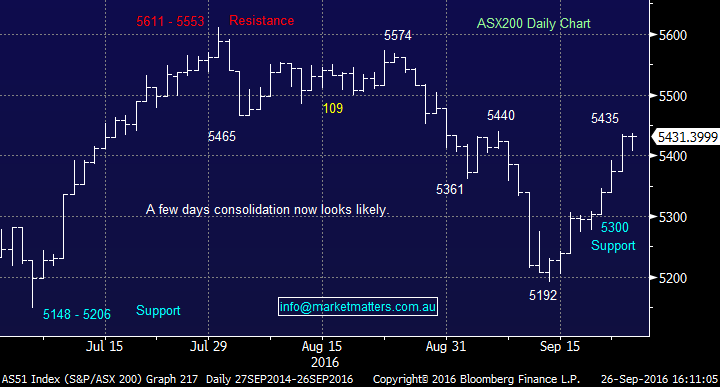

Although the index was flat, there was a fair amount of movement below the surface. We were active in Rio Tinto (RIO) today taking a bullish options trade while we also took a position in Mantra (MTR). RIO closed up +0.62% to $50.38 while Mantra (MTR) added +1.24% to close at $3.27.

Rio Tinto (RIO) Daily Chart

Mantra (MTR) Daily Chart

Banks were fairly flat today however a number of interesting points worth making here that are supportive of our current overweight positioning in the sector;

1. $7.5b of dividends paid out to investors this week with some of it likely to find its way back into the mkt at a time when volume is below the norm – which means we see stocks go up more than they normally would.

2. Statistically, October is an excellent month for our banking sector. For example, the worst performance over the last 5-years from CBA, our largest bank / stock was +3.4%.

3. In terms of CBA, we saw the Head of Investor Relations today and there were some very interesting takeaways particularly around capital which has been one of the big impediments to bank share prices in recent times. It seems the global view is moving towards; there is no Basel IV, will be minor changes to Basel III, there will be no further overall increase in capital requirements. The latest comments from APRA (30th August) “the steady accumulation of capital remains a sensible course for most ADIs”.

4. Supporting this call was Mark Carney, the Governor of the Bank of England saying “In short, there will be no Basel IV.”

5. Andreas Dombret said the Bundesbank, where he’s in charge of financial supervision, had considered the industry’s arguments and concluded that “there is a need to recalibrate” the Basel proposals.

…and there’s a number of other heads that are making similar calls around bank capital requirements and associated regulation. To give some context here, one can look at ANZ Bank (ANZ) following their last market update. Their capital was in much better shape that had been feared by the market and realisation of that fact prompted shares to rally +26%. Further capital raisings are being factored in by the market. If that does not happen – and we don’t think it will - bank share prices should rally from here.

Another interesting discussion in the AFR today with Shane Finemore – an Aussie trader from Wagga Wagga now based in London running a very successful $2.43bn hedge fund. A lot of readers may not have heard of him – he tends to like a low profile however he was ex-UBS before setting up his own shop backed by a number of well-known Aussie Families. He’s done very well and the interview covers some of the topics we’ve written about / and positioned our own portfolio towards.

"If you're investing in today's world where assets are trading at high prices, you have to find things that are unpopular to have any chance of getting value."

Finemore says the banks "have to be winners over time from higher rates, subject to economies not going into recession or having a big increase in credit costs"..

"We are also looking for assets that can give us an acceptable return when rates start to go up. The best banks in the bigger economies are well positioned for that." (Source AFR.com)

He also has a position in Origin Energy (ORG)!!

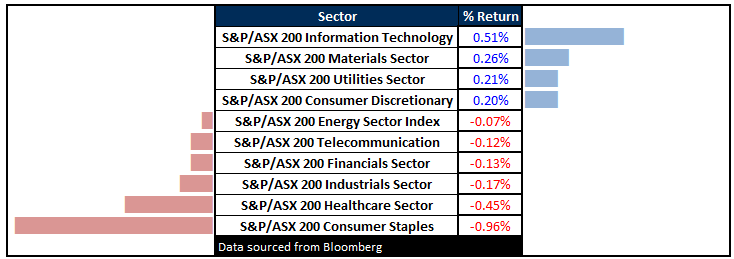

Sectors

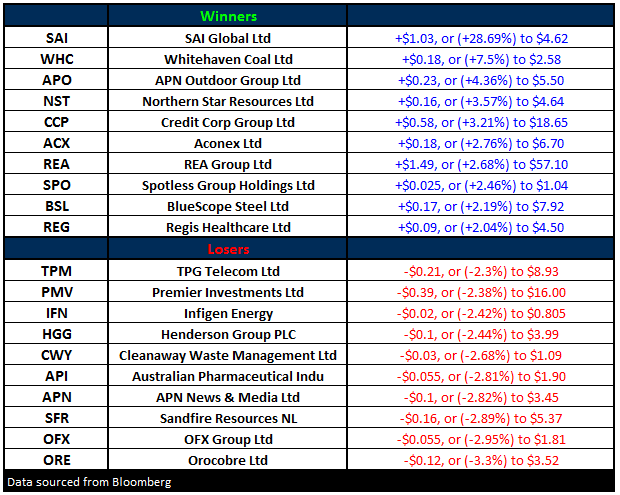

ASX 200 Movers

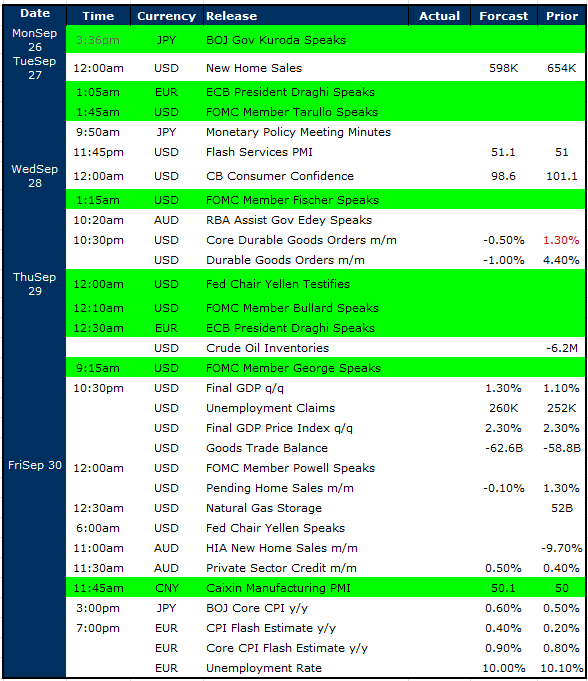

Select Economic Data - Stuff that really Matters in Green

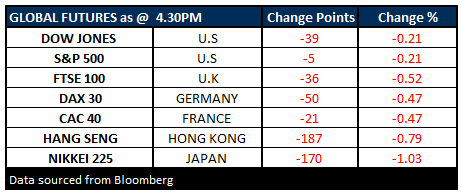

What Matters Overseas

FUTURES weaker….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here