Market finally breaks out – 6000 in its sights

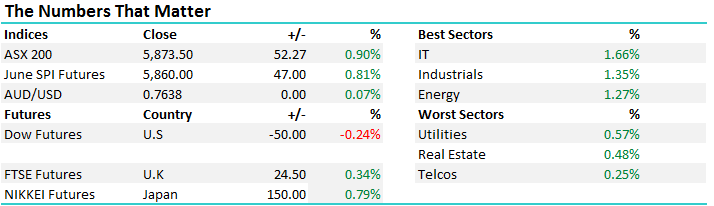

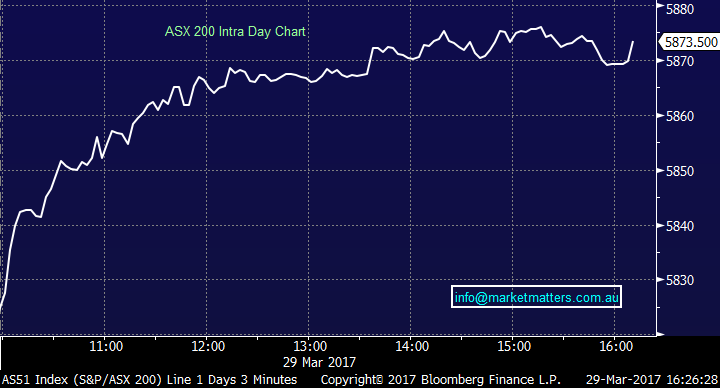

A continuance of recent trends today with the market surging higher again and importantly pushing up through the previous high of 5833, following yesterday’s highest close since mid 2015. All sectors were in the green today and as we titled this morning’s report, stand back and enjoy the market rally, with our first target of 5900 just 26 points away.

We had a higher open today and it was more or less a carbon copy of yesterday with the market rallying throughout the session – another clear sign that fundies are underweight equities and are being forced to chase. Although we mightn’t be witnessing massive buying at this stage there is an obvious lack of selling which can lead to equally dramatic rallies. It doesn't matter how overvalued fund managers may believe stocks have become if they are underweight they cannot sell, and potentially may even be mandated to buy just when they should actually be considering the opposite - this is how tops are created.

The market had a range of +/- 55 points, a high of 5876, a low of 5821 and a close of 5874, up +52pts or +0.9%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

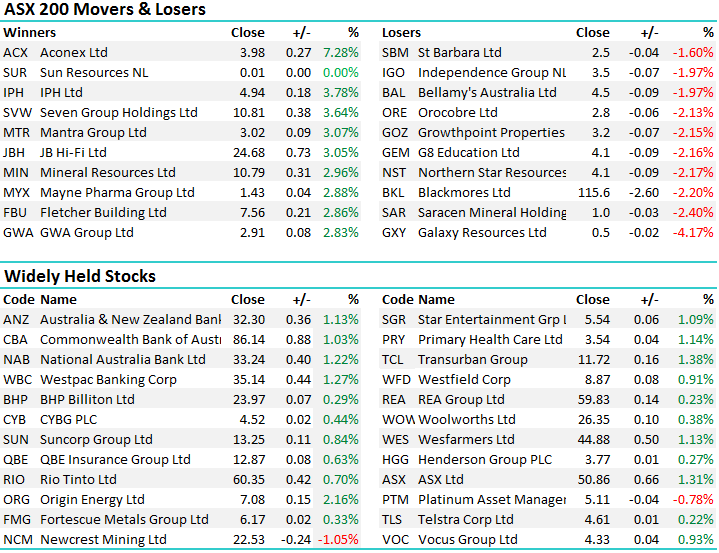

We’ve been very keen on a numbers of specific sectors over the past few months which have really started to kick. Healthcare was one of those today with Ramsay Healthcare (RHC) rallying by 2.47% to close at $69.64.

Ramsay Healthcare (RHC) Daily Chart

Financials have also been one of our target areas of late with nearly 30% of the MM portfolio sitting in three of the major banks and Suncorp, plus we also have QBE and a number of other diversified financials that benefit from higher equity markets and rising global interest rates. We continue to like these sectors however we will start to trim positons towards the end of April ahead of the seasonally weak period in May.

ANZ Bank Daily Chart – breaks to new 19 month highs today

The other area that we’ve targeted is beaten down stocks that were oversold leading into February reporting, with their reports being ‘less bad’ than the market had previously priced. Remember, markets get overly pessimistic particular stocks/ themes then it seems in a heartbeat, we get a bout of over optimism, which we think is now starting to play out. Star Entertainment (SGR) is a stock we targeted around $4.70 after the Crown debacle in China and hit to earnings from the Sydney renovations. Today the stock closed up 1.09% to $5.54.

Star Entertainment (SGR) Daily Chart

Our recent BUY of Primary Healthcare fits the same category – another stock that has been sold fairly hard, with a portion of the sell down being justified, but a portion not. As value gets harder to find, expect these sort of stocks to fine some love!

Primary Healthcare (PRY) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/03/2017. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here