Market down but recovers from lows…(KMD)

WHAT MATTERED TODAY

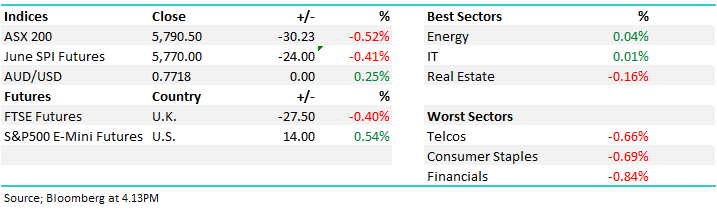

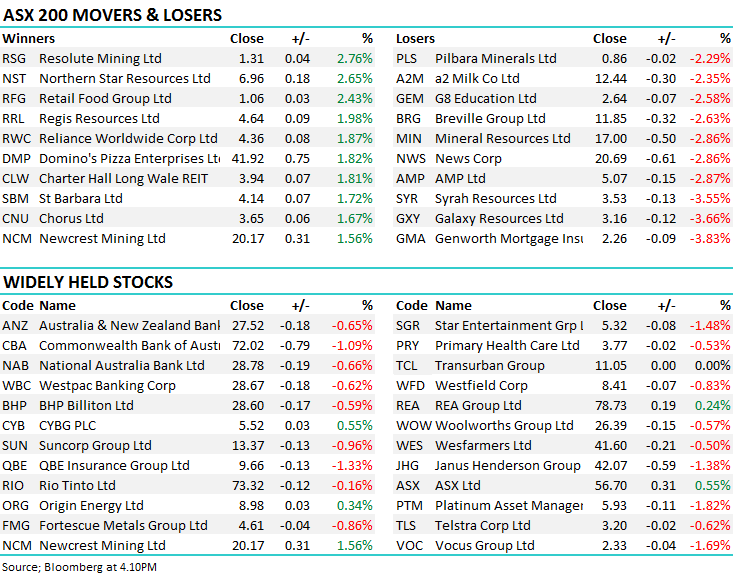

A positive move for US Futures during our time zone helped to support our market today with the S&P up 0.81% (+21pts) at time of writing. The ASX obviously opened lower – hit hard after the US market was sold heavily on Friday however buyers stepped in early, the mkt bounced from the lows (-41pts on the ASX 200) and we grinded sideways to mildly higher throughout the day…not a bad effort really. Looking at relative performances, the S&P 500 has now corrected 7.7% since the mid-March high while the ASX 200 is down -3.43% for thr same period. The same happened in early Feb when US stocks dropped ~10% we were down about half that amount, so the outperformance locally is becoming a theme.

One supportive factor this week will be the big flow of dividends finding their way into bank accounts – about ~$10b being paid out with a portion no doubt finding its way back in to the market – for some context the mkt traded ~$6bn total today so clearly, dividend payments should provide some support for stocks in the next week or so – as long at the US behaves.

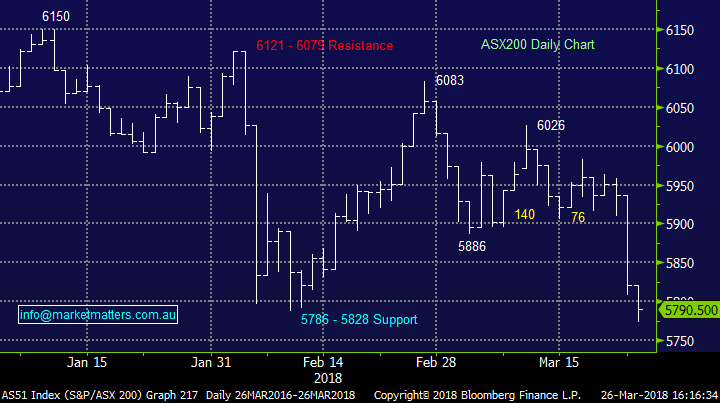

We wrote in the weekend report on Sunday that we’re now 50-50 the market at the moment – as much as we hate fence sitting sometimes it’s hard to throw a leg one way or another – at least until the wind blows hard in one direction. Today’s trade helped the bulls – no doubt about it and if the market can trade back up above 5830 in the first instance that’s a more bullish technical picture.

So after the initial sell off the market tried to pull itself out of its rut and did a reasonable job of it. By the close, the ASX 200 had lost -30pts or -0.52% to settle at 5790 – Golds (unsurprisingly) were the strongest on the boards with Resolute Mining +2.8%; Northern Star Resources +2.7%; Regis Resources +2%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

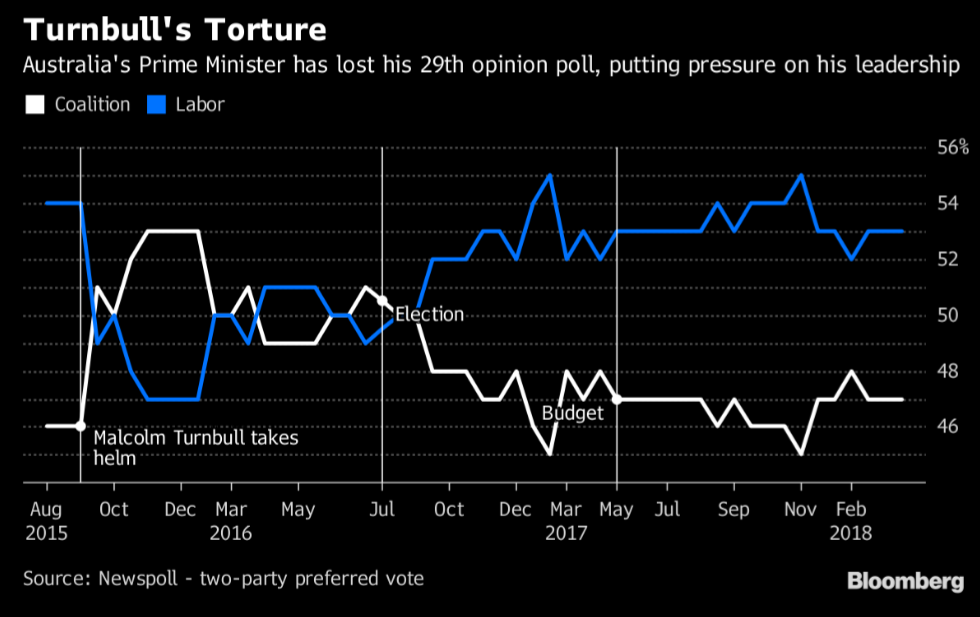

Malcolm Turnbull; A lot written today about 1. The Aussie Cricket Team (not sure what to say about that other than ‘idiots’) and 2. Turnbull losing his 29th opinion poll. Bloomberg put a good chart out looking at the two party preferred since he took the reins and it highlights why we should be concerned about Labour’s franking credit revolution. When Malcolm Turnbull successfully challenged Tony Abbott to become PM in 2015, he said…. “We have lost 30 Newspolls in a row,” he said. “It is clear that the people have made up their mind about Mr. Abbott’s leadership.”

Kathmandu (KMD) $2.27 /-8.84%;The stock was hit hard today after the shares from their recent capital raise were issued. These were issued at $2.16 with the company closing today at $2.27. This is an interesting stock and one firmly on our radar at the moment for a buy in the Income Portfolio at some point. We covered it in an afternoon report on the 20th March saying….

Kathmandu reported half year numbers this morning which were okay however they announced an acquisition and $60m capital raising at $2.16 per share + SPP at the same level. We haven’t looked closely at KMD for some time however the announcement today – buying a manufacturer / wholesale distributor of footwear (Oboz) + other outdoor accessories mainly targeted to the North American mkt makes a lot of sense in our view. Retail is clearly tough domestically, however those businesses that are focussed (like Nick Scali) have continued to do okay.

In the case of KMD, they trade on 12x and a 6% yield which is about the average they’ve traded at last year, however in 2016 they had an average PE of 15x, so we’ve seen a decline in earnings + a re-rate on the multiple. The acquisition announced today, while not huge is a step in the right direction. It will be EPS accretive by mid-single digits by FY19 and is a clear move in the right direction which could underpin a multiple re-rate and see the stock price rally back reasonably hard.

The stock will likely get hit when it comes out of the halt however this is a stock worth a look – some more work at least as an income play that has a very low correlation to the market…

Kathmandu (KMD) Chart

OUR CALLS

No trades in the MM portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here . Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/03/2018. 5.48PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here