Market down 95pts – but not out! (WES, JHG, FMG)

WHAT MATTERED TODAY

A day of mixed fortunes for Australia today with Hemsworth and co promoting Aussie tourism with the much anticipated Super bowl ad aired at halftime during the Philadelphia Eagles victory over the New England Patriots…not sure how the wider response has been but I quite liked it – CLICK HERE to view if any interest. A less positive day for investors though with the market whacked by -95pts suffering from the US led hangover of rising interest rates fuelled by signs of rising wages re-focussing attention back onto the outlook for inflation. In short, rates are going higher but the market is obviously concerned whether or not the Federal Reserve is behind the curve. If inflation spikes then the markets obvious conclusion will be that the Fed has acted too slowly to raise rates, and their hand may be forced to go harder and faster than they / the market would like, but as they say one hot day doesn’t make a summer!

It is interesting to think about the state of play in US equities – January was exceptionally strong, the best January since 1997 and investors piled into US stocks, cash levels are now low, margin loan origination and quantum has become high and optimism was rife. That rally in Jan was clearly unsustainable and we’re seeing a sharp sell off as a result. Despite the reasoning provided above – higher rates – inflation expectations and the like, I think it’s simply a case that US equities were overextended and needed to pause / pullback. reiterating our views from this morning which todays trade does not alter;

1. We are looking for the US S&P500 to correct another say 4% during February.

2. We believe this is the “Warning Shot” for stocks that we have discussed a number of times over recent months for a short-term buying opportunity.

3. We still see fresh highs from US stocks, potentially into the dangerous April / May timeframe where we are likely to become aggressive sellers.

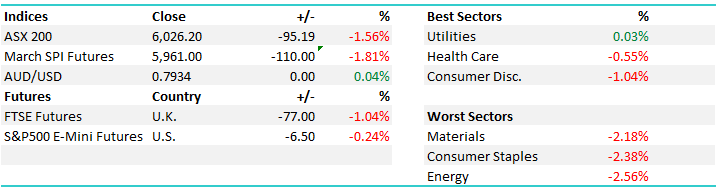

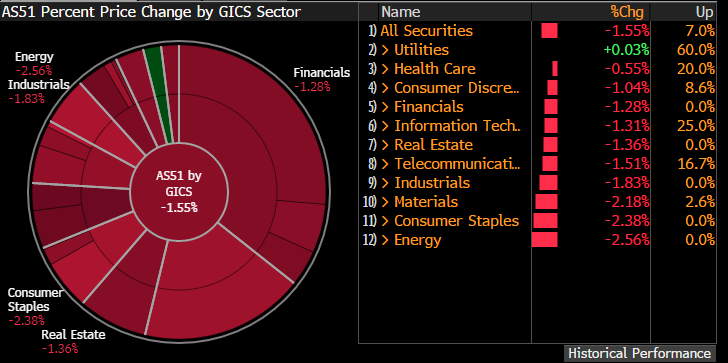

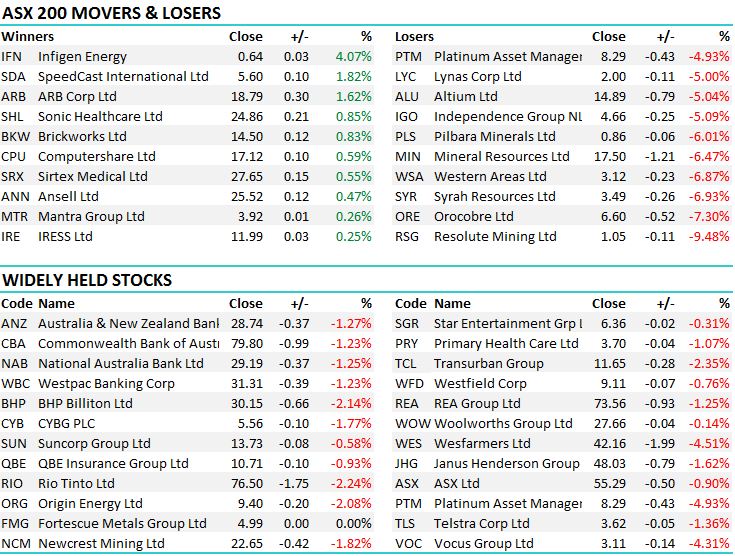

The Australian market actually did ok today given the torrent going against it. A drop of -1.56% versus the -2.5% drop in the States on Friday – plus US Futures were weak on our open, down another -0.5% before clawing back some of it, while trade in Asia was also soft – hard for our market to do any better than it did given the negative international and regional influences. The Energy sector was hardest hit in America on Friday and the local sector followed suit today while a downgrade from Wesfarmers put the kibosh on the consumer staples – WES taking a whopping 8.5 index points off the 200 today.

Looking at the 2 MM Portfolio’s is interesting today – performance in periods of market weakness are always telling. The Growth Portfolio was down, pretty much in line with the mkt but cushioned partially from our cash weighting (a daily movement of -1.4%) while the Income Portfolio lost 0.53% - about a third of the mkt decline. That portfolio holds 55% equities and the rest in more defensive income securities & cash, however the equities have a value bias, no expensive growth stocks and that approach is shown to work better in periods of weakness / volatility.

More broadly today, the S&P/ASX 200 index lost 95 points, or -1.56 per cent, to 6026, the broader All Ordinaries index also fell -101 points, to -1.63 per cent, to 6128, while the Australian dollar reached US79.31c.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Wesfarmers (WES) $42.16 / -4.51%; Hit hard today following a review of their underperforming divisions – basically Bunnings United Kingdom and Ireland (BUKI) and Target – which has prompted them to take write downs, mostly non-cash but it’s still not a good look. They say poor trading (and execution) in both entities are to blame and the mkt suddenly gets the Masters induced shudders. Although it’s a poor update for these divisions, the BUKI division is running pilot programs only and is not big driver for growth now while Target has been weak for ages. This announcement will obviously take some heat out of the recent share price momentum, but what’s more important is what will Coles do in the face of a resurgent Woolworths, given Coles’ poor LFL comps from 4Q16 to 1Q18, and increased competition in the Supermarkets segment? Interestingly, this was new CEO Rob Scott’s 1st major news announcement, and clearly not a strong start – will his tenure now be a case of being continually on the backfoot repeatedly over the coming years as the market questions the validity of persisting with the BUKI expansion every result? We have no interest in Wesfarmers at current levels, targetting $38 for a potential income opportunity.

Wesfarmers Daily Chart

2. Janus (JHG) & Fortescue (FMG); Both on our radar at the moment with FMG showing resilience today in the face of a weak market which highlights underlying appetite for the stock. We bought in the income portfolio below $5 and remain comfortable here , while Janus is fast approaching our $47 target after a poor session today that saw the stock off by 1.62% to close at $48.03.

Fortescue Metals Daily Chart

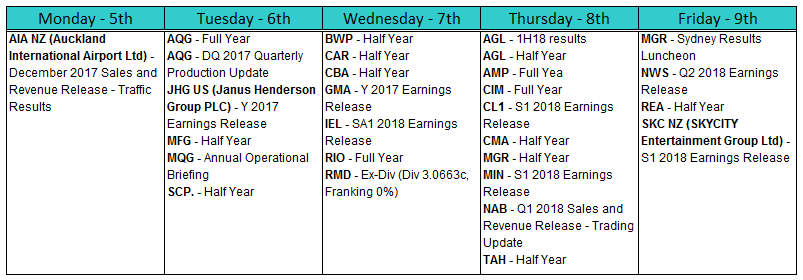

REPORTING THIS WEEK

No real companies of magnitude today however things kick up from tomorrow onwards – I’ll be on SKY BUSINESS Monday to Wednesday at 8.30 providing previews for the day ahead.

OUR CALLS

We added to our position in CBA today by 2% in the Growth Portfolio

CBA Daily Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/02/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here