Macquarie hits the sell button – Market Matters hits the BUY (LNK, RWC, ING, IAG, NAN, WEB)

WHAT MATTERED TODAY

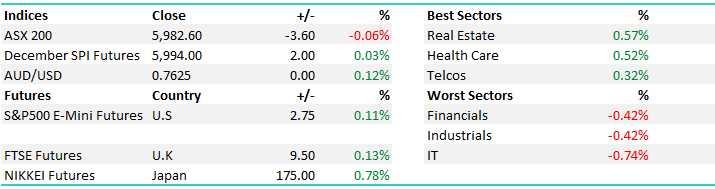

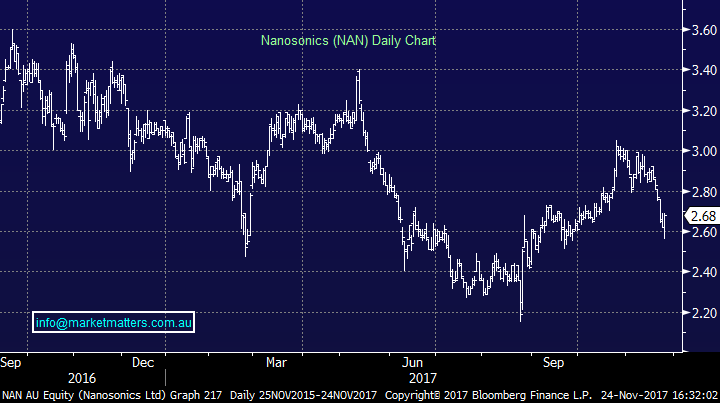

Some more activity across the MM Portfolios today on a day that saw the market sell off hard early before a strong recovery played out late in trade. Macquarie were BIG sellers of a few select names which we’ll cover below with a change in personnel showing that different views are what makes a market. Our problematic position in the MM Growth Portfolio (Nanosonics) actually showed some strength after early weakness and generated a BUY signal with a close above $2.65 versus our trigger level to sell if we saw a close below $2.60. More on this below in the MM CALLS section. Overall, most buying was in the Healthcare stocks today – an area we’re overall negative on however the strength today was clear for all to see while the IT stocks were sold. A range on the mkt today of +/- 28 points, a high of 5986, a low of 5958 and a close of 5982, down -3pts or -0.06%.

ASX 200 Intra-Day Chart – decent BUYING from session lows

ASX 200 Daily Chart

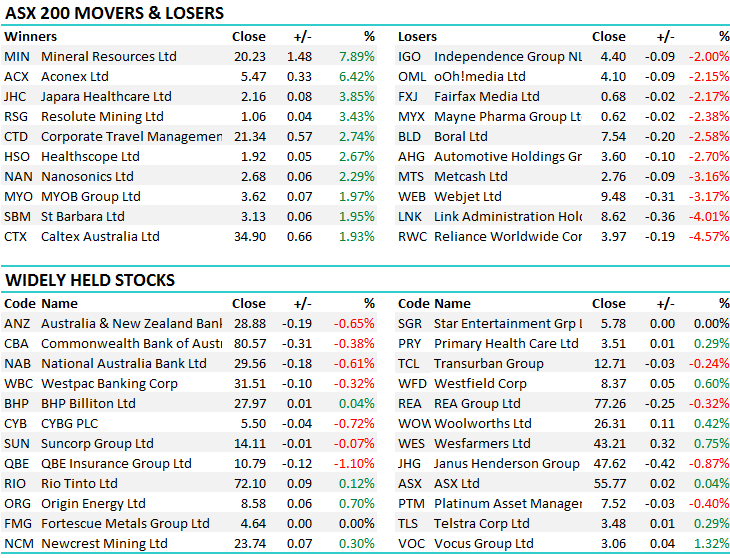

TOP MOVERS

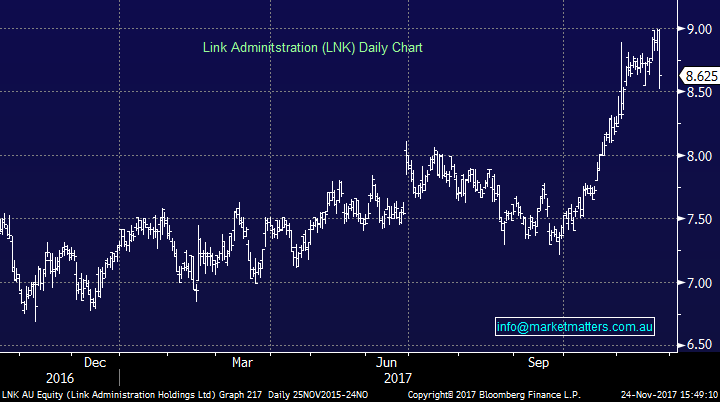

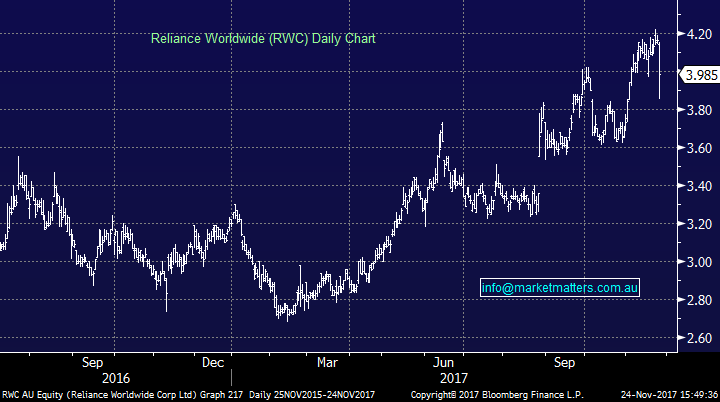

Macquarie had a change of personnel recently in the funds division and interestingly enough, their high conviction calls became less high conviction as reported in the AFR today with decent sell orders going through in the BIG names on their high conviction list. The details can’t be confirmed until T +2 however the AFR reporting that some decent volume going through after the MQG high conviction fund recently lost their portfolio managers, Patrick Hodgens and Blake Hendricks, and its wider team, have also walked. That funds highest conviction's top five overweight positions as at the end of last month were Boral, Link, Qantas Airways, Reliance Worldwide and Woodside Petroleum. Today they’ve sold;

Link Shares Daily Chart -7.1 million Link shares at $8.57, worth $60.9 million, at 1.51pm

Reliance World Daily Chart -10 million Reliance Worldwide shares at $3.88, worth $39 million, at 1.51pm

Inghams Daily Chart -13 million Inghams shares at $3.55 worth $46.2 million, at 1.51pm

IAG Daily Chart -3.9 million Insurance Australia Group shares at $7.29, worth $28.5 million, at 1.52pm

Sims Metals Daily Chart -2 million Sims Metals shares at $14.13, worth $28.4 million, at 1.50pm

It seemed to me, Nick Scali (NCK) also got caught up in the MQG selling perhaps, given the illiquidity in the stock and the BIG sell order in the mkt early – before it recovered later in the day. Still down -5.26% however the selling pressure was indicative of one line being aggressively sold. – typical of a larger holder with a mandate to SELL.

From the Sept QTR Macquarie High Conviction Fund update – Performance was driven by strong stock selection – yet performance was in line with the index..mmmmm

OUR CALLS

We bought Webjet (WEB) this morning after it dipped below $9.50, paying up slightly to get filled at $9.54.This is a reasonably light stock in terms of liquidity so hard to get set in decent volume however there were opportunities throughout the day. We covered this in the AM report today saying that Last time we looked at WEB we were bearish targeting a potential fall towards $9, the stock has now fallen 15% this month and ~$9 is within striking distance. The fall in the online travel booking site was triggered by a trading update with earnings guidance coming in short at $80m, compared to the $89m that analysts were expecting.

The fall is a classic example of what happens to a stock trading on a high valuation which suddenly disappoints the market. However, we do not see major concerns within the business at this stage and the current P/E of 20.8x Est 2018 earnings is rapidly becoming more attractive – the 1.78% fully franked dividend is clearly not exciting at this stage, it’s all about potential capital appreciation. One of the themes we’ve witnessed in more recent times is follow through selling on downgrades for a few days after. The WEB downgrade happened on Wednesday, following through selling yesterday and often stocks find a low on the third day.

We bought today at $9.54 – Daily Chart here

We also thought about NAN this morning after it broke through $2.60 on the downside. In the last few days we suggested that a break below $2.60 would concern us and we’d revisit the holding. In today’s alert we suggested that a likely close below $2.60 would have us out, while a recovery above would keep us in. After weakness early the stock recovered and actually closed up +2.29% - which is actually a bullish sign given buyers stepped up in force below a key technical area. Obviously we’ll continue to asses however the price action today was good.

Nanosonics Daily Chart

Have a great night – keep an eye out for the Weekend Report Sunday

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/11/2017 4.33PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here