Lithium stocks take it on the chin…(ORE)

WHAT MATTERED TODAY

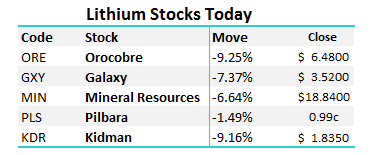

The ASX 200 came back and tested the 6000 level today with the market once again seeing the best of it in early trade. Lithium stocks were in focus today and the AM report proved to be very timely, CLICK HERE with our view that volatility in the sector would create opportunity at lower levels – simply the lower levels probably came quicker than we thought. From a portfolio perspective, we used the BIG sell off in the sector to buy into Orocobre (ORE) below ~$6.45 this afternoon. It was certainly a volatile stock / sector today with some big downside moves prevailing. In the case of ORE, it opened weaker, got bid up in the first 15 mins back up above $7 before tracking lower for much of the day – closing at $6.48 – an ~11.5% daily range which is pretty extreme. More on the sector below.

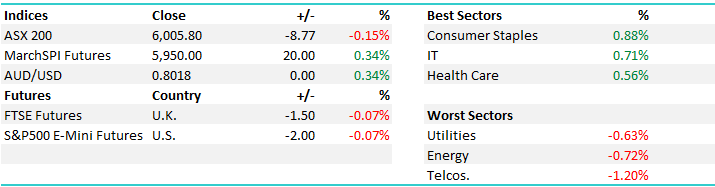

Overall, the Consumer Staples were strong, while on the flipside, the Telco’s had another poor day capping off a fairly soft weak. An overall range today of +/- 26 points, a high of 6028, a low of 6002 and a close of 6005, down -8pts or -0.15%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Lithium Stocks; A lot going on in the sector today with ORE coming online after finalising a capital raising that involved a placement to Toyota of $A234m worth of stock at $7.50 per share, while institutions tipped in $A35m at the same level while the renounced entitlements were sold at $7.25 through a book build process, which was 11c above the TERP. The stock closed at $6.48, we bought at $6.34 however with the acknowledgment that this is an incredibly volatile stock and it traded around the $6.45 limit price at the time of the alert.

The pricing pressure came on the back of news that major global Lithium miner – SQM – ended a long-running dispute with Chilean development agency Corfo over royalties in the Salar de Atacama. Basically the upshot of this news is thatSQM will be able to expand its Lithium production by an extra 349,553 tonnes until 2030, allowing the company to take advantage of increasing lithium demand for electric car batteries – which is the theme we spoke about this morning. Clearly, this new production will have a negative influence on the Lithium price and we saw this play out today with the decent move out of the sector – however it’s worth noting that the production discussed above was always in the wings.

What’s also worth noting though, is that the deal will have less of an impact on the funded Australian producers like Orocobre – but instead it will mean that those unfunded developments that are further from production will find it more difficult to get funding in the short term. Clearly, the move is a negative influence for the price of Lithium now as we suggested above, and that’s why we saw such an aggressive move out of the sector today + it’s the reason why we’ve only taken a 3% holding in the portfolio. Expect this to be a very volatile position.

Orocobre Daily Chart

OUR CALLS

We added ORE to the Growth Portfolio today below $6.45 into the afternoon weakness. This is a high risk position.

Have a great Weekend and keep an eye out for the report on Sunday.

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/01/2017. 5.41PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here