Life Insurance providers under the spotlight (FIG, CVW)

WHAT MATTERED TODAY

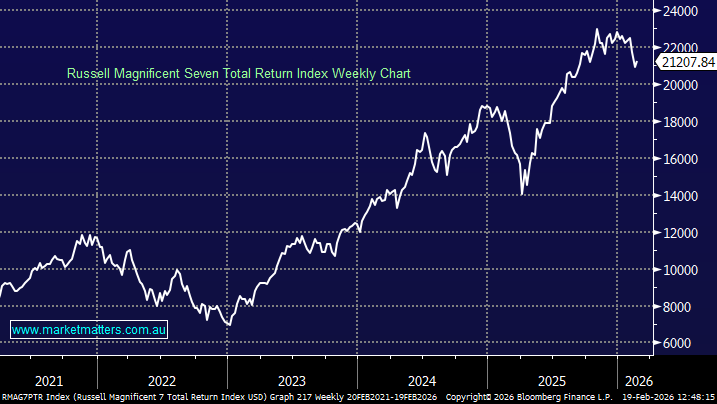

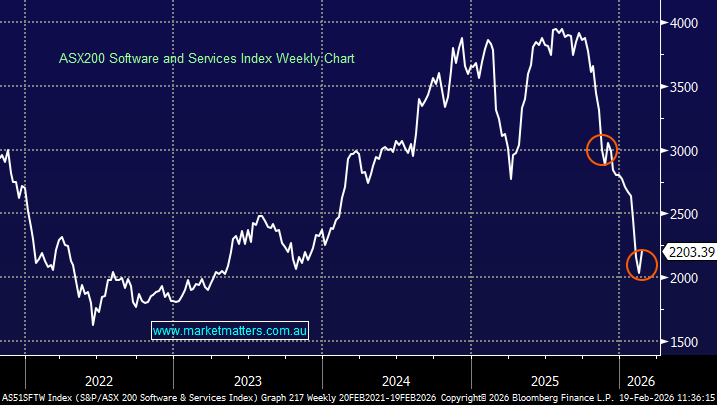

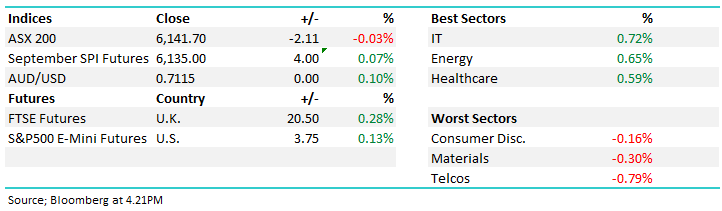

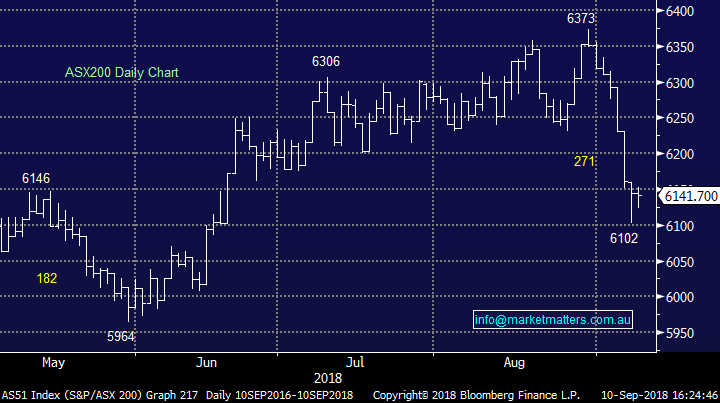

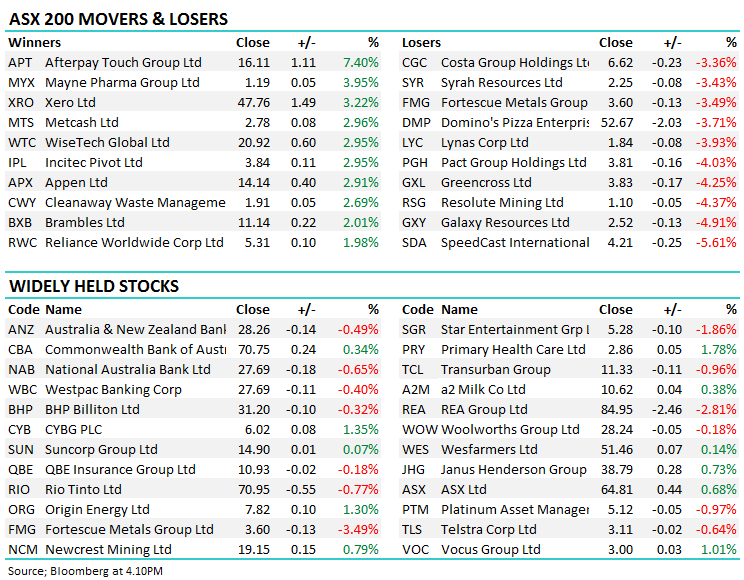

The market started on the back foot this morning, however as US Futures moved higher throughout our time zone and Asian markets traded up from their earlier lows the ASX clawed back some lost ground, to finish more or less flat on the session. Materials were again weak, taking -3 index points from the market offset from buying in the recently weak Healthcare names that collectively added +3 index points to the ASX 200. The tech names, AfterPay (APT), Xero (XRO) Wisetech (WTC) and the like rebounded today after a pretty savage end to last week – APT the best of the bunch adding +7.4% to close at $16.11

Overall, the index closed down -2 points or -0.03% today to 6141. Dow Futures are currently trading up +33pts

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Credit Suisse was out with a note on Rio Tinto (RIO) today, saying that RIO remains cheaper than BHP and offers prospects for further cash returns, though lacks large-scale growth options. They went onto say that Rio has an “exceptionally strong balance sheet,” though the company faces questions on what comes next with limited near-term volume growth, declining asset sales rising costs. We own RIO in the Growth Portfolio after buying into recent weakness.

Rio Tinto (RIO) Chart

RATINGS CHANGES:

· Contact Energy Raised to Outperform at Forsyth Barr; PT NZ$5.72

· Primary Health Upgraded to Buy at Citi; PT A$3.20

· Ansell Upgraded to Buy at Citi; PT A$28.50

· Northern Star Resumed at Macquarie With Outperform; PT A$9.50

· Boral Upgraded to Hold at Morningstar

· Incitec Upgraded to Neutral at Credit Suisse; PT A$4.02

· James Hardie GDRs Upgraded to Overweight at JPMorgan; PT A$23

Life Insurance; The life insurance companies came under Royal Commission scrutiny today in what was always going to be a fairly confronting dive into a sector that seems to rely on high pressure sales, cold calling and manipulative practices. We touched on Freedom Insurance (FIG) this morning however the spotlight was on their much larger rival today, Clearview Wealth (CVW) who do life insurance, financial planning and the like. While the share price didn’t move much today, it’s been under pressure in recent times, down from a ~$1.80 high in January to $1.02 today. This is a stock that trades by appointment despite its ~$680m market cap, largely because Crescent Capital Partners owns 257m shares or ~38.5% of the business.

It’s very hard to get excited about this stock on ~19x forward earnings and with such significant regulatory headwinds, however Blue Ocean Equities have slapped a buy and $1.50 price target on the stock today.

Clearview Wealth (CVW) Chart

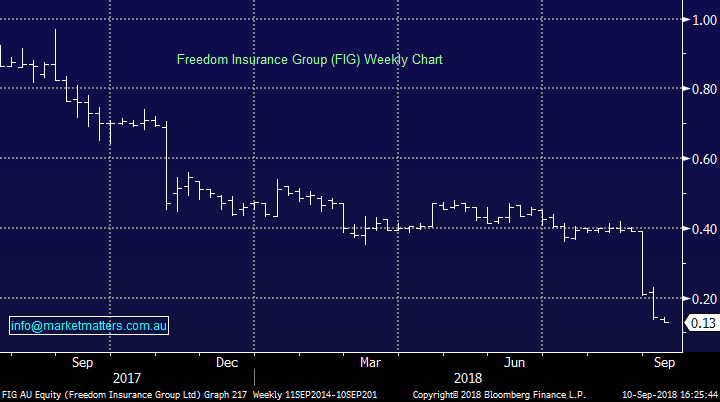

Freedom Insurance (FIG) is likely to be on the stand shortly with a similar grilling on the cards. This business is cheap, dirt cheap after falling from around 50c in January to now trade at 13c – ouch! They did miss expectations when they reported recently, but by a palatable margin however news that ASIC is conducting a review into the direct life insurance space has seen the shares really taken to the cleaners. The review by ASIC is targeting the direct sale of products to consumers i.e. no advice provided which is Freedom’s bread and butter. FIG creates the product, markets and distributes that product and administers policies direct to customers they have sourced through their own channels – cold calling potentially part of that if CVW is any sort of guide today!!

The ASIC review is directly targeting this space, which is sort of ironic given they’ve just pulled the pants down on the advice side of the ledger and now they’re targeting businesses that provide the consumer with products (without advice). Anyway, the industry is under scrutiny and probably rightly so given what I’ve heard today from the RC.

Steve Johnson’s Forager Funds Management is 2nd on the register holding ~11% of FIG. They recently wrote about FIG’s accounting policies which I found interesting…The upfront commission and the present value of this entire stream of future payments are both booked immediately as revenue. So in the early years of its existence, the company reports revenues well in excess of actual cashflows. As it matures they should roughly match. And if it stops writing new policies the cashflow will continue flowing for years despite not reporting any accounting revenue. So, while it has a huge impact on the accounting profits, we aren’t overly concerned whether Freedom’s level of new sales changes by 10% or 20%, as long as it keeps building the annuity stream. If Freedom can generate about $60m of annual sales for each of the next three years, the value of the resulting stream of payments justifies the current market capitalisation of $110m. If the business doesn’t grow there is little downside. If growth returns then Freedom should prove a great investment. Currently the Fund’s investment represents 4% of the portfolio. (source Forager Funds Management) – todays market cap is $31m

Freedom Insurance (FIG) Chart

FIG is down a long way since Forager wrote their piece and it now trades on a P/E of just 3x, has very little debt and some cash on the balance sheet. While the company is too small for us, and liquidity is an issue + an ASIC investigation has cast a large shadow over their model, it’s hard to argue that it's not dirt cheap! A speculative stock for the watchlist.

FIG P/E Chart

Round 6 of the Royal Commission started today – here’s the schedule

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.