Kogan (KGN) flags soft margins in the first quarter

Stock

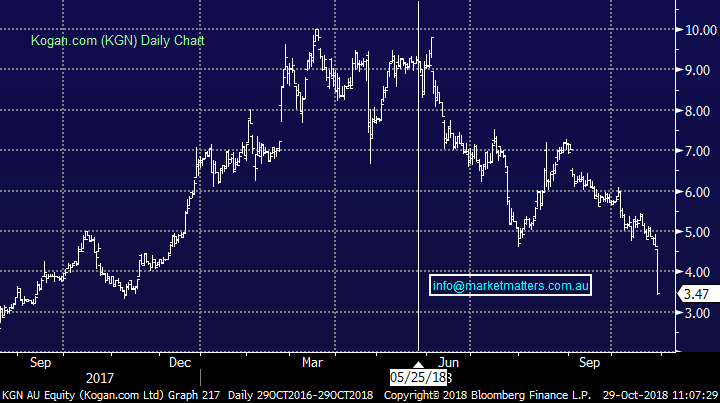

Kogan.com (KGN) $3.47 as at 29/10/2018

Event

Online retailer Kogan has slumped today on a less than impressive business update to the market. Despite showing user numbers growing 40% over the past 12 months, as well as double the users on Kogan’s mobile offering, the stock has slumped ~25% today as the market focusses on falling margins and a decline in revenue from non-exclusive brands. The exclusive brands revenue for the first quarter rose 15.7% compared to 1Q18, and partner brands revenue jumped 73% however the lift in sales was offset by rising costs and a 27% fall in sales from global brands.

Kogan has blamed a falling Aussie dollar hurting as well as compliance with GST laws hurting their competitiveness, calling out other retailers for avoiding the GST laws. The market caught the jitters on an increase in spending and investment despite the lack of growth. For the year, analysts’ consensus suggest 44.4% EBITDA growth on an 18.1% increase in revenue for a 67% lift in profit. Margins are clearly key to performance in FY19.

Kogan.com (KGN) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook