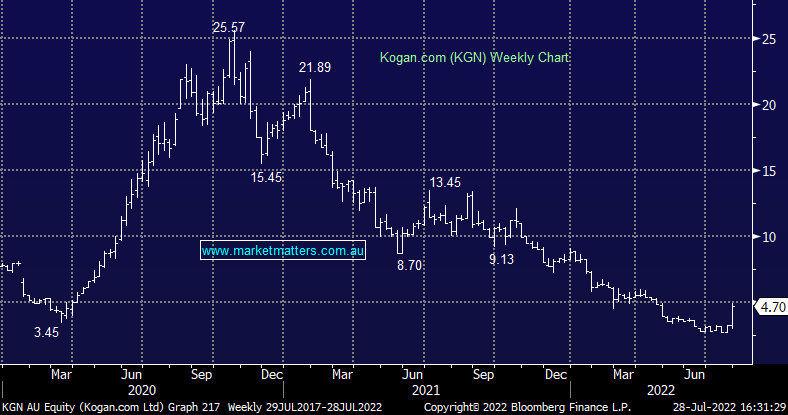

Kogan.com (KGN) roars on the back of a solid update, inventory levels reduced

KGN +50.16%: shares in eCommerce business Kogan.com surged to 3-month highs today on the back of better-than-expected performance in the business. Sales for FY22 are expected to come in marginally above the prior year, beating out expectations of a fall from the COVID-supported growth of FY21. While sales are up, EBTIDA is expected to fall to $19.1m, which is still a small beat to consensus. Impressively they have managed to reduce inventory levels from $228m down to $161m, which includes $22m already in transit. Warehousing costs had been an issue for Kogan with inventories blowing out requiring expensive overflow capacity. Importantly it appears stock has been moved without the need for significant discounting.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.