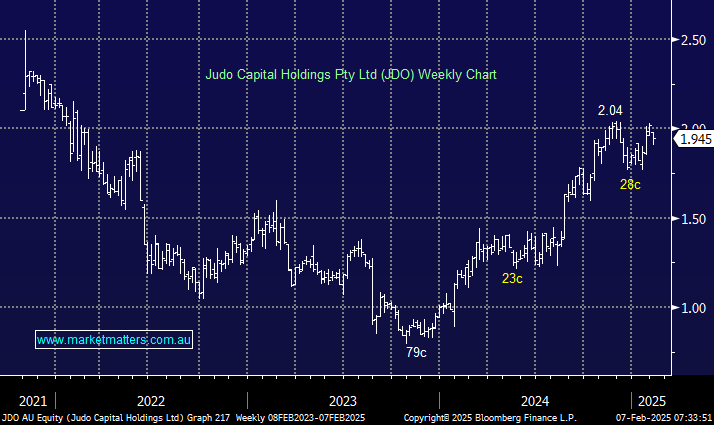

Judo Bank (JDO) – An alternative to the ‘Big Four’

We already know that the banks and a number of other well known financials are flying high hence this morning we’ve looked at a far less discussed, new entrant to the ASX. JDO is a $2.1bn Victoria based finance business that provides banking and lending services tailored for small and medium-sized enterprises (SMEs). In stark contrast to the “Big Four”, JDO emphasises personalised banking through dedicated relationship managers and offers flexible lending solutions rather than a one-size-fits-all approach, when rates start to fall through 2025 consumer confidence and business activity should lift which will drop down to greater activity for SME’s and by definition JDO.

Unlike the “Big Four” JDO is not a well owned momentum/high yielding bank and as investors continue to look for value in this increasing rich sector/market JDO compares relatively well. Last FY the company achieved just shy of 10% revenue growth while gross loans and advances grew by 20% to AU$10.7 billion, illustrating the positive direction the banks heading in with profit forecast to grow almost 3x over the coming two years, we believe the share price is set to follow its peers higher.

- We like JDO targeting a test of the $2.25-2.50 area.