James Hardie (JHX) – Short-term pain for long term growth

JHX fell to fresh 2-year lows on Tuesday after announcing the purchase of US building products business AZEK for $US8.7 billion on Monday morning our time. The deal, which both boards have unanimously approved, comprises $US26.45 in cash and 1.034 JHX shares for each share of AZEK, for a total per-share value of $US56.88, based on JHX’s $46.80 close on Friday before the deal was announced, this represented a 26% premium to AZEK’s 30-day VWAP, and 37% premium to its last close. The takeover has since deteriorated for AZEK shareholders following the almost 20% decline by JHX, but they’re still cheering compared to JHX investors!

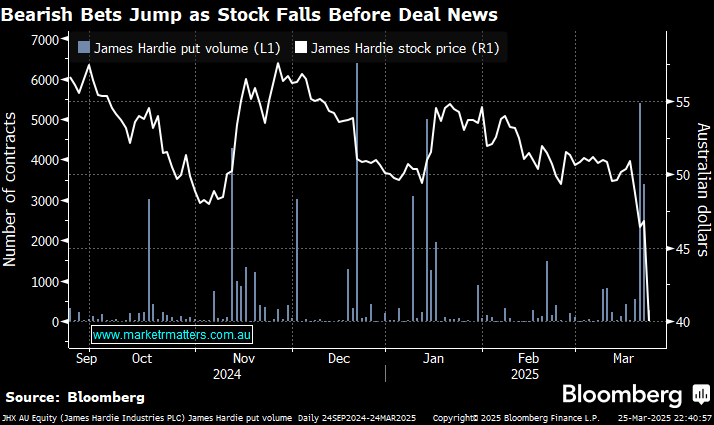

- Interestingly, JHX was smacked around 10% at the end of last week; it appears to be a case of loose lips somewhere in this deal. Additionally, a massive block of 3,000 JHX Puts was traded on Friday afternoon, as some individuals “in the know” anticipated the news, with some “fortuitous” traders benefiting from this takeover.

Both AZEK and JHX have their headquarters in Chicago, with some synergies evident from the get-go. Further synergies will be crucial to making this deal work from a financial perspective. The 22x James Hardie is paying for Azek comes down to 17.4x once the cost synergies are accounted for and falls again to about 12.5x if the $225 million of predicted revenue synergies can also be extracted. Azek is growing faster than James Hardie, having delivered a compound annual revenue growth rate of 15% over the past seven years, compared to 11% at James Hardie. Still, CEO Erter is paying up for that growth, and James Hardie will only grow return on invested capital over the medium term if the synergies arrive. As would be expected, Erter is focused on the long term, while investors are focusing on the risks and price paid by JHX.

JHX has a lofty synergy target driven by revenue synergies: Management is targeting $US350m of synergies, with $US225m of this as revenue or “commercial” synergies, and the remaining $US125m, which we would consider true cost synergies. MM is generally reluctant to factor in revenue synergies; however, there are undoubtedly some clear overlaps between the two businesses. We also see an opportunity to expand the JHX Contractor Alliance Program, adding value to the AZEK platform. If half of the revenue synergies targeted by Erter come to fruition, the share price of JHX has arguably been treated harshly.

- We believe AZEK is a quality business, which, interestingly, despite concerns surrounding the price JHX paid for AZEK, the initial deal price was only ~4% above where it was trading at the end of 2024.

What MM liked: AZEK is an attractive asset for JHX, with a strong historical growth profile and prospective opportunities for JHX to broaden its market penetration in areas where it is weak. We ultimately see sound logic in combining the two growth portfolios.

What MM did not like: Paying ~6x price/book for an asset that will likely materially dilute JHX’s return profile i.e. a good acquisition at a bad price. The timing is also a concern, with tariff uncertainties rising, increasing recession fears, and/or higher mortgage rate concerns persisting for longer, through this could also be a positive, as they haven’t bought AZEK during a rampant construction bull market. Also, capital initiatives are now off the table over the coming years.

At MM, we struggle to justify the premium paid for AZEK; however, the ~21% month-to-date share price decline has the stock trading at attractive levels, even allowing for EPS dilution. Hence, we expect a volatile near-term performance, but on a medium-term basis, value cannot be ignored.

- MM is considering “topping up” our JHX position based on long-term valuation.