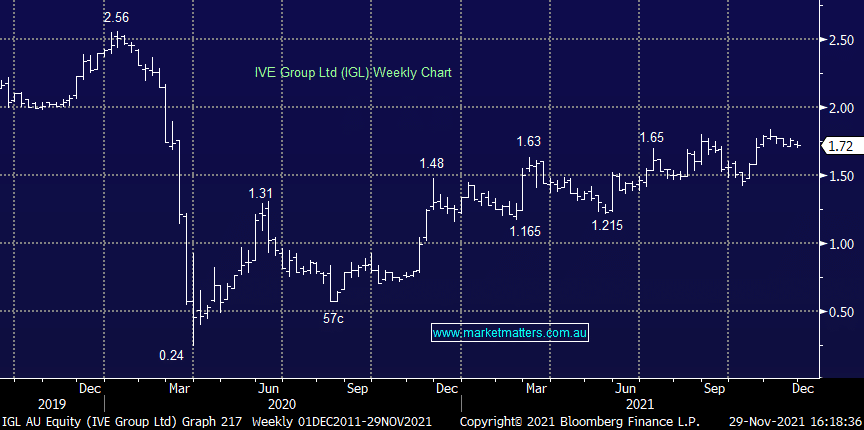

IVE Group (IGL) AGM supports rally in shares

IGL -2.27%: The integrated marketing business held their AGM last week and provided a trading update for the first 4 months of FY22. Overall, the update was strong relative to a weak trading period this time last year however the key takeaways are as follows:

- EBITDA up +32% on same time last year with NPAT up +75% although it was off a low base

- Revenues have increased 9% against expectations of a flat top line

- Net debt of ~$90m is higher than at the end of FY21 however capital management still in play we think

- IGL is trading on a sub 10x P/E with an expected yield ~8% fully franked i.e. it’s cheap