Is this a short term top in commodities?

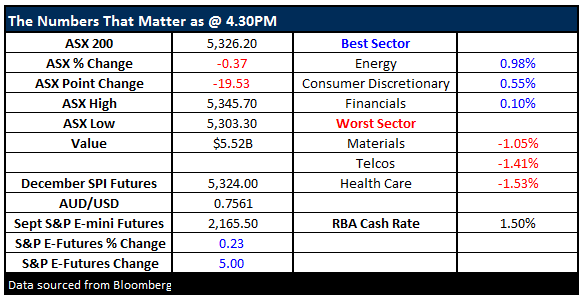

What Mattered Today

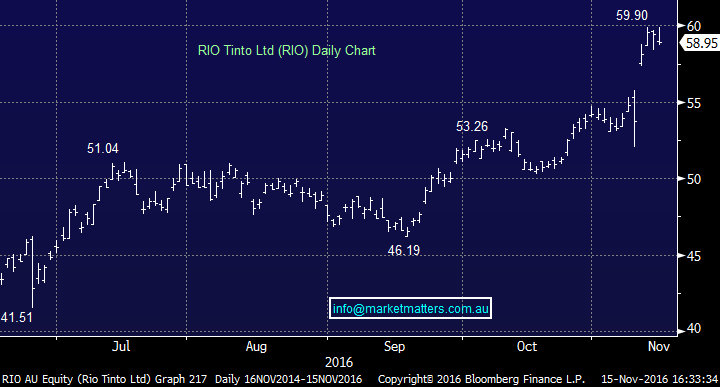

Resources pulled back today and there are increasing signs that we’re seeing a short-term top forming in the sector. Clearly, the resources / growth trade is back in vogue and we’ve seen the likes of RIO trade up from $50 to $60 in the last few weeks – a very good run and now we see a lot of commentary talking up the prospects for our miners BUT from our perspective the trade is now overheated and we should see it cool off in the short term. Obviously commodity prices have recovered, brokers are upgrading earnings and bears have turned to bulls – basically, all the press has turned decidedly positive however from a shorter term tactical view, we think you should be selling rather than buying here.

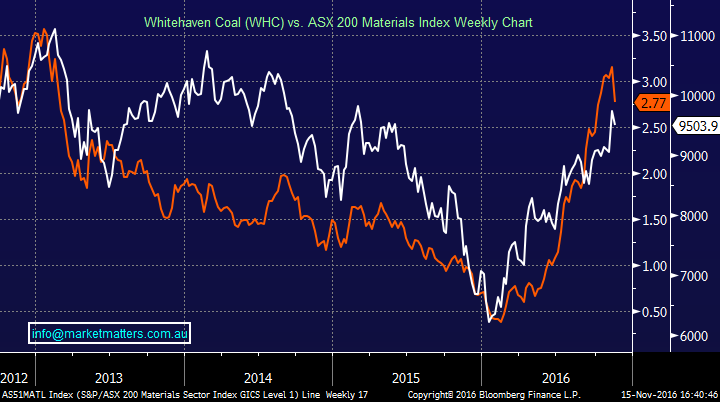

Whitehaven Coal (WHC) has been a pretty good leading indicator for the broader commodity space with it leading the sector out of the doldrums – rallying from a sub 40c low in Feb to a $2.77 close today (after hitting a high of $3.35). Clearly, WHC is a very leveraged commodity exposure and should be a good ‘canary in the coal mine’ for the broader sector. In the last month we saw Met Coal (steel) up +33%, and thermal coal (power) up +25% yet we see WHC now down marginally for the period. Stocks being sold when the commodities are rising is a sign that traders positioned ahead of the underlying move & importantly, they’re now selling before it rolls over...WHC was down 10% today.

Whitehaven (WHC) Daily Chart

Insiders have been on the sell side – with Tony Haggarty, who was old CEO selling 3m shares last week while a number of other substantials have offloaded into strength. We’ve actually seen the same theme across a number of mining stocks in the last little while with the CEO of Sandfire (SFR) offloading 1m shares yesterday ($6m)...I know it’s cynical but we’re also seeing a lot of the bulge bracket brokers fall on their sword and upgrade - Macquarie the latest today on Sandfire and Oz Minerals. Another sign a top is near.

We wrote this morning about our views on the $US – and if that continues to rally then commodities should cool from here and we’ll get a better entry into the sector over the coming weeks / months.

RIO Tinto (RIO) Daily Chart

In our own portfolio, we’ve been reasonably active in the last two days, buying three stocks.

Elsewhere on the market today, Banks continued to see some reasonable buying despite a pretty good run up over the past few weeks while the energy stocks seemed to like a story printed on Bloomberg this morning from Javiar Blas – who’s a very well-regarded reporter in the Oil space saying that OPEC nations embarked on a final diplomatic effort to secure a deal on oil cuts, with Qatar, Algeria and Venezuela leading the push to overcome the divide between the group’s biggest producers, according to a delegate familiar with the talks.

The behind-the-scenes diplomacy comes after bilateral meetings over the weekend failed to resolve the rifts, leaving just two weeks to finalize an agreement before the Nov. 30 ministerial meeting in Vienna, according to the delegate, who asked not to be identified because the discussions are private.

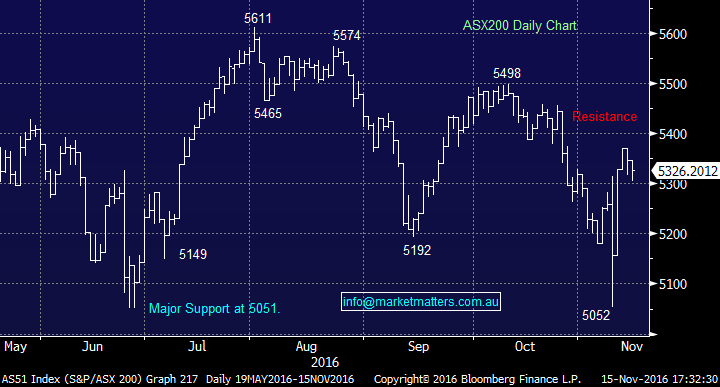

Overall we had a range today of +/- 39 points, a high of 5342, a low of 5303 and a close of 5326, off -19pts or -0.36%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

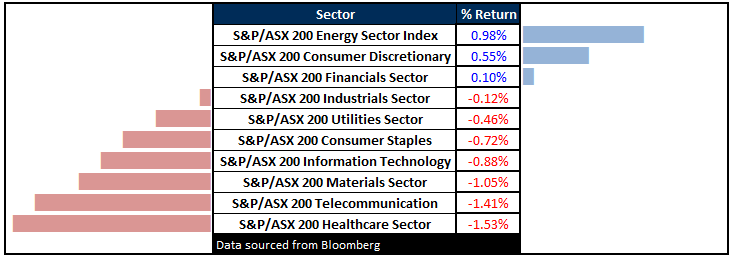

Sectors

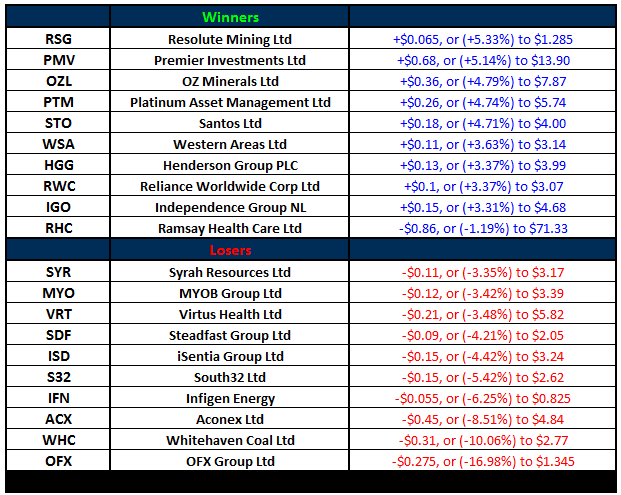

ASX 200 Movers

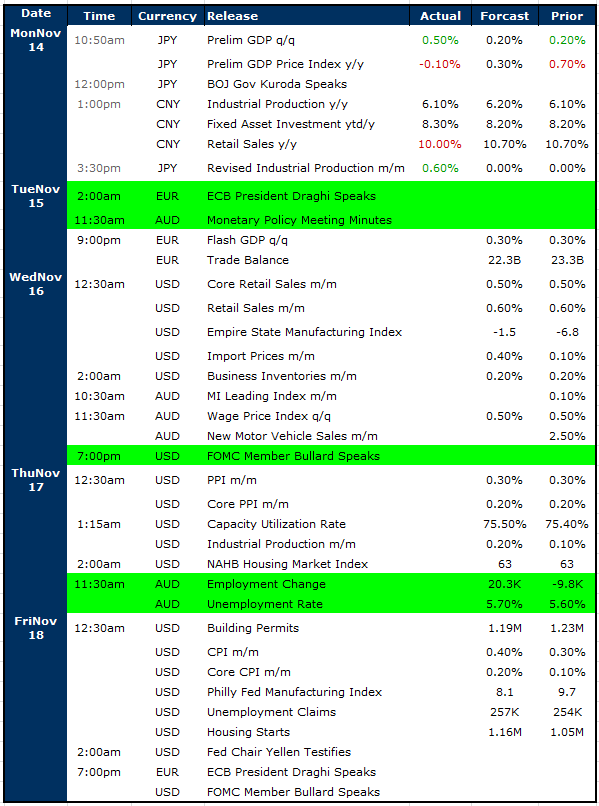

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

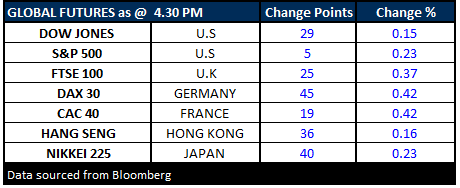

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here