APA Group (APA) scores a win with the regulators

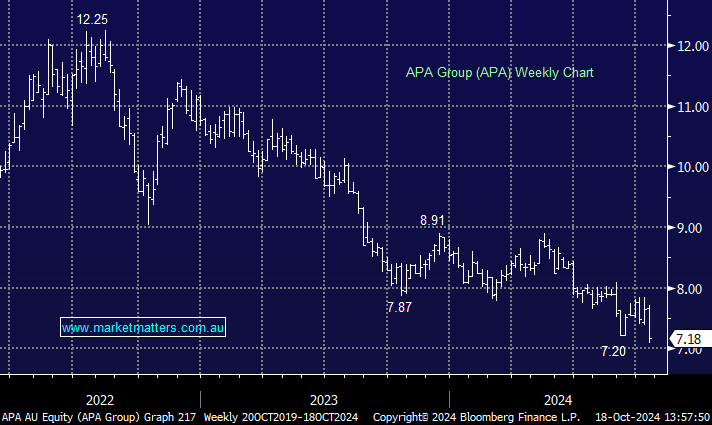

UBS downgraded APA to a sell last week having been fairly neutral (and right) for the past year. While APA has some challenges balancing weakening credit metrics with an increasingly ambitious growth plan, UBS decided the balance has tipped the wrong way and cut to a sell. More importantly, overnight UniSuper launched a $500 million block trade of APA, over 5% of the company. The shares were placed at $7.23, a 5.4% discount to yesterdays close.

The Australian Energy Regulator (AER) recently announced its draft decision not to recommend heavier South West QLD pipeline regulation. This is a positive outcome for APA, but UBS is concerned about broader funding and commercial challenges irrespective of the regulatory outcome. While APA took the UBS downgrade in its stride, a big tranche of stock placed via a seller led transaction at a 5% discount to market will see the stock fall this morning, and we suspect lots of fundies will now be ‘full’ of APA, creating a dearth of new buyers for a few weeks.

- We like APA into weakness, but with rates likely to remain elevated, it may take time to regain market confidence – MM holds APA in its Active Income Portfolio.