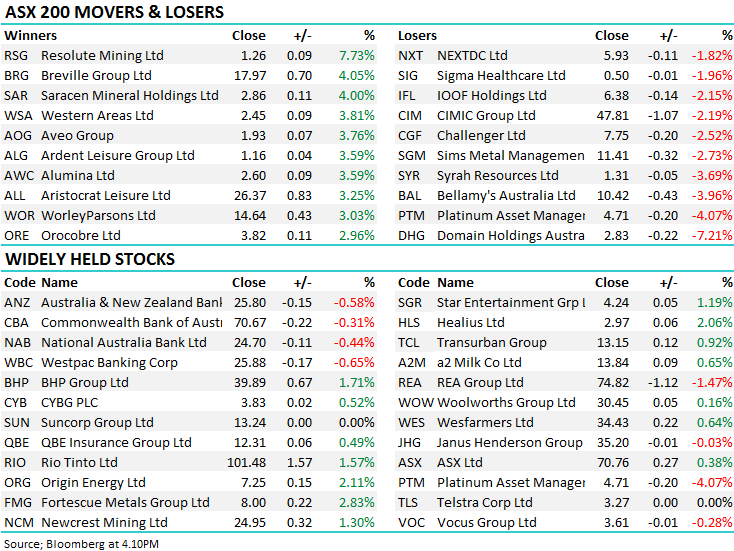

Iron Ore rally continues – ASX outperforms (SGM, EHL, RSG, PTM)

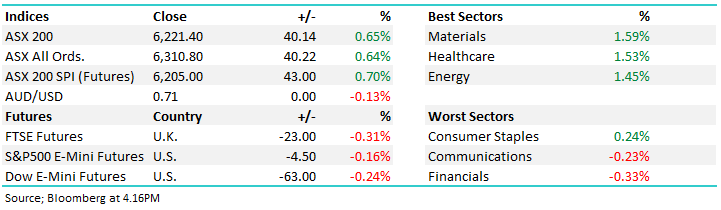

WHAT MATTERED TODAY

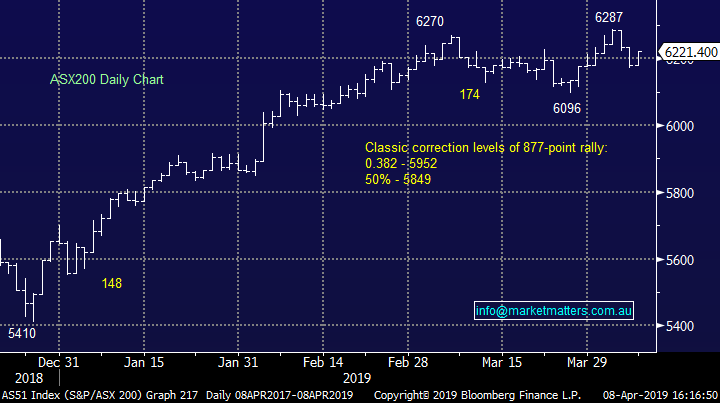

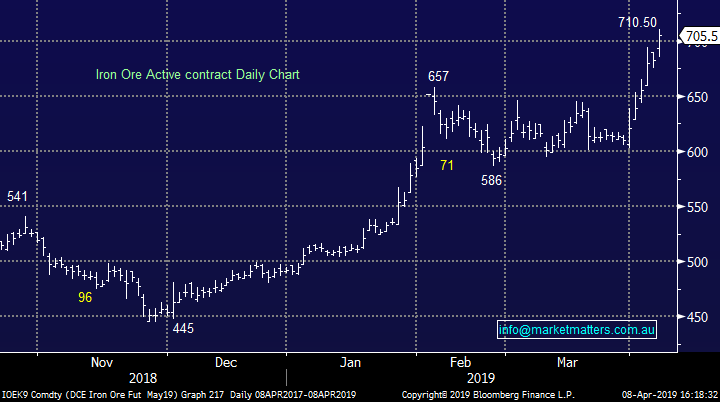

US Futures + Asian markets were all lower on the session today, however Australian stocks rallied – the ASX 200 up by 40pts – closing on its highs - thanks largely to strength in the Iron Ore price - Iron Ore Futures up strongly on the session which propelled Fortescue Metals (FMG) up through the $8 handle - Rio Tinto (RIO) now looks more comfortable above $100 per share & BHP is knocking on the door of $40. A pretty phenomenal move with many saying there is more left in the tank!

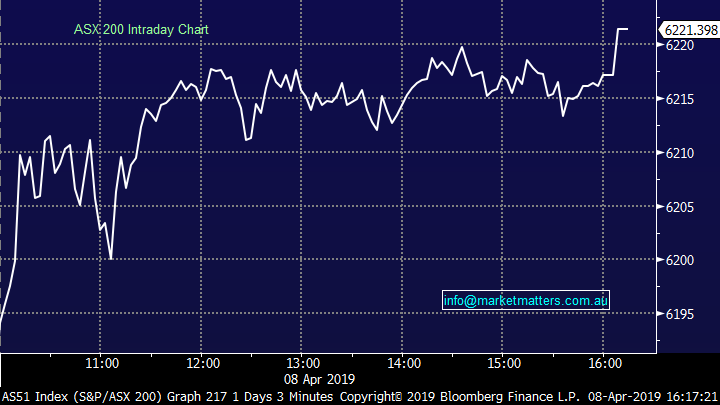

Overall today, the ASX 200 added +40 points or +0.65% to 6222. Dow Futures are trading down -63pts / -0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Iron Ore – Citi the latest out with a bullish note on Iron Ore saying it should be above $US100/t over the next 3 months before it track down to $US80/t on a two year time frame. – current benchmark is around $US94…While the mkt has now turned extremely bullish the bulk commodity, the story is around supply, and the speed at which Vale can come back on stream the main game.

Iron Ore Futures Chart

A big week for commodities and recent strength in Crude may be tested with the OPEC report due on Wednesday while Chinese trade figures for the first quarter are out later in the week. Trade negotiations are clearly center stage from a headline perspective, however we’ll get a better feel for how this is actually impacting imports of iron ore, copper, coal – obviously important for Australia but more so a reflection of the actual strength or otherwise of the Chinese economy.

Sims (SGM) -2.73%, a stock we bought last week had an investor day today providing a strategy update which the mkt sold into, in short, all looked okay however we presume a lack of positive comments around scrap metal prices which have been strong of late played into the markets caution – why didn’t they bang the drum on a positive theme?? Not sure. More to come on this

Sims Metal Management (SGM) Chart

Emeco (EHL) +1.63%, A stock we had a few questions on this morning after Eley Griffiths sold 500k shares last week to take themselves below substantial, however by the look, they still hold around 15m shares. The stock was weak early however there seems to be decent buying when it moves into new lows – today that was $1.82 before buyers pushed it back to a $1.90 high before settling at $1.87. This is the weakest link in the Growth Portfolio currently – after flagging it at $2, but chasing to $2.18 to get filled.

Emeco Chart (EHL) Chart

The small gold play in Resolute Mining (RSG), +7.73%, led the way on the local market today thanks to an impressive quarterly update. Resolute’ s quarterly production jumped 33% thanks to a ramp up in production out of its Syama mine. The company is continuing to reinvest into the mine, increasing automation across the production line, all funded by cash flow in the quarter. It noted it is on track to hit production and cost guidance for the full year.

Resolute Mining (RSG) Chart

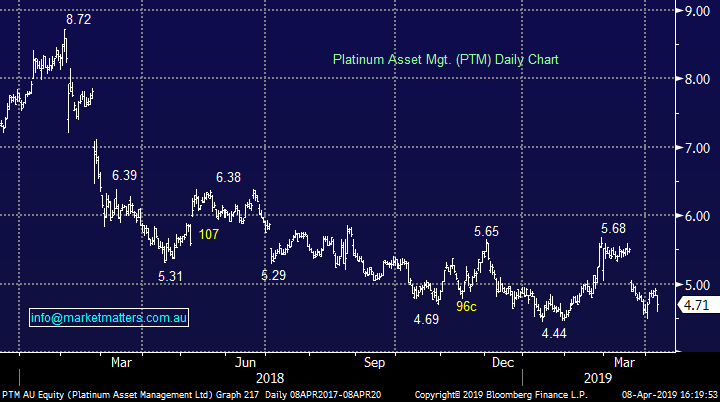

Platinum Asset Management (PTM), -4.07%, hit today despite that market trading higher thanks to a disappointing FUM update the company snuck through late on Friday. The manager saw net outflows of around $230m for March according to an announcement posted late on Friday, equal to around ~1% of total funds under management, resigning the manager to the third consecutive month of outflows as underperformance shakes investors. Despite the outflows, FUM grew 0.12% thanks to the investment performance over the month. The manager saw net outflows of around $230m for March according to an announcement posted late on Friday, equal to around ~1% of total funds under management. Despite the outflows, FUM grew 0.12% thanks to the investment performance over the month.

Platinum Asset Management (PTM) Chart

Broker Moves: Property related stocks were hit today after MQG downgraded Domain Holdings (DHG) on lower forecasted listing volumes… the broker shifted April volumes lower on the back of Easter & ANZAC day alongside school holidays, and failed to definitively call the month as the bottom of listing volumes. Hard to argue with the caution here, although Domain will also see some counter cyclical benefit of relisting volumes which help support earnings in a down market.

· Domain Holdings Cut to Underperform at Macquarie; PT A$2.70

· Monadelphous Upgraded to Neutral at Goldman; PT A$17.20

· Automotive Holdings Raised to Equal-weight at Morgan Stanley

· Brickworks Upgraded to Hold at Morningstar

· Mineral Resources Downgraded to Hold at Morningstar

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.