IOOF (IFL) – FY18 result okay while they remain upbeat on the future

Stock

IOOF (IFL) $8.94 as 07/08/2018Event

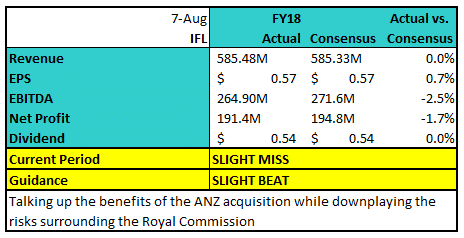

This morning IFL reported their full year results with the stock initially trading down, then marginally higher while at time of writing it’s largely flat. A few interesting elements to the current result however what’s more important here is their commentary about the future and the acquisition benefits derived from their purchase of ANZ’s wealth business – and whether or not we believe them! On today’s result, they missed slightly on EBITDA and profit relative to consensus however there are some wide ranges in terms of analyst numbers on this one. The final dividend was in line with consensus at 27cps however that equates to a 98% full year payout ratio which is clearly unsustainable. Anyway, we’ll call it an inline result for FY18! Of more interest was their commentary on the future and the trends we’re seeing across platform earnings following industry wide pressure to cut fees. For FY18, they delivered a platform revenue margin of 54bps which was down -10% from this time last year (60bps) while we also saw some pressure on their advice revenue margins which were 38bps, down from 41bps. The other parts of the business are actually doing well with Funds Management and the Trustee Business chugging along nicely, however the biggest leverage in the business going forward is advice, an area that is clearly under the microscope. Interestingly, they didn’t provision for any increased regulatory costs associated with the Royal Commission.

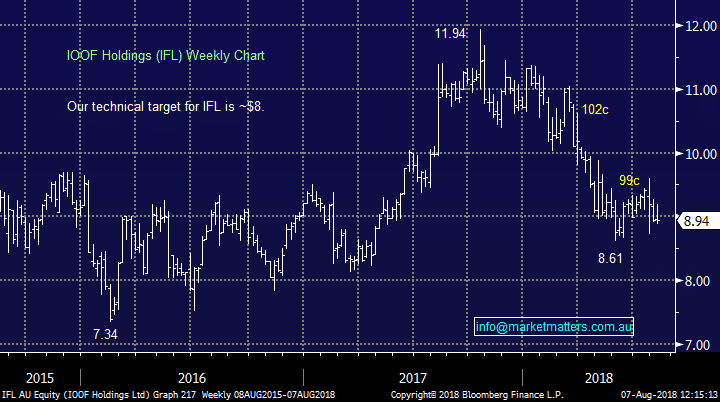

IOOF (IFL) Chart

Of more interest was their commentary on the future and the trends we’re seeing across platform earnings following industry wide pressure to cut fees. For FY18, they delivered a platform revenue margin of 54bps which was down -10% from this time last year (60bps) while we also saw some pressure on their advice revenue margins which were 38bps, down from 41bps. The other parts of the business are actually doing well with Funds Management and the Trustee Business chugging along nicely, however the biggest leverage in the business going forward is advice, an area that is clearly under the microscope. Interestingly, they didn’t provision for any increased regulatory costs associated with the Royal Commission.

IOOF (IFL) Chart