Ingham’s Floats – Trump Sinks

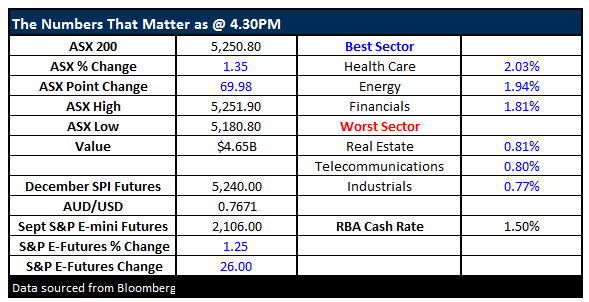

What Mattered Today

News early this morning that the FBI will not be pursuing Hillary Clinton over the email scandal saw the market up strongly from the outset and buying continued throughout the day. As we wrote this morning, the difference between markets now versus markets ahead of BREXIT is around complacency and positioning. Markets were not positioned for the ‘leave vote’ to actually get up, and when it did, traders / investors started positioning after the fact which caused big volatility / weakness. For the looming US election, BREXIT remains fresh in minds and therefore we’re seeing positioning ahead of the vote.

If Trump gets up, they’ll be a short sharp negative reaction, but at some point we’ll see traders cover those hedges which would lead to a sharp bounce back. If Clinton gets up the hedges would need to be closed sooner, and markets rally on relief but that rally is amplified as hedges (which were put on to cover for the lower probability outcome) are unwound. We saw volatility in the options market tick up sharply last week, but we’ve seen a big unwind of that volatility today. Markets are clearly reacting to news, and things might change tomorrow – so you’ve got to have some cash up the sleave but for now, things have calmed a bit.

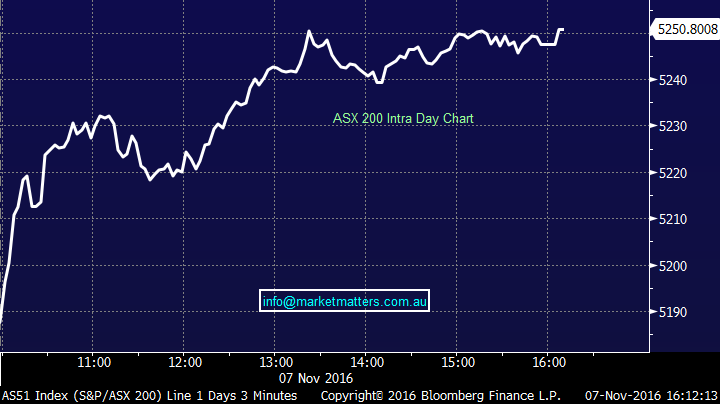

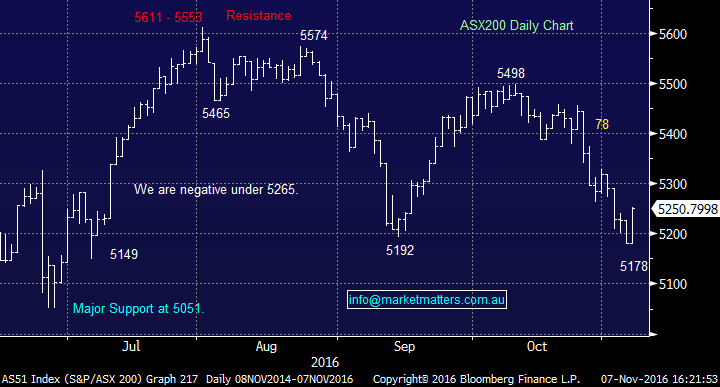

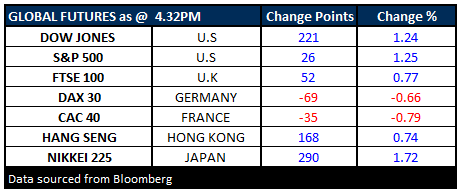

In terms of odds, Clinton now seems a cert paying $1.20 while Trump has blown out to $5.00. US FUTURES are up strongly (DOW +221pts) and it seems some relief is obvious. On our market, we had a range today of +/- 66 points, a high of 5251, a low of 5185 and a close of 5250, up +70pts or +1.35%.

ASX 200 intra-day chart

ASX 200 daily chart

Ingham’s (ING) came on the board at midday today and closed at $3.22 versus an issue price of $3.15, up +2.22% but hardly inspiring given they had to re-price it down from the initial range of $3.57 to $4.14 a share. It’s now reasonably priced (12x FY17 expected earnings) or at least it’s not expensive, however it’s private equity owner TPG retained 47% of the company as opposed to the 24-40% they initially hoped to hold. They either couldn’t sell the remainder, or they thought the pricing was too cheap so they wanted to hold a bigger chunk. Presumably a bit of both but the fact remains they’ve already shown their hand as a seller, and we know there’s 47% of the company that will probably come to market in the next two years which provides a fair amount of overhang for the stock.

Stepping back, we saw two main issues with the float. Firstly, the market is gun shy following Dick Smith, but more importantly, they’re gun shy of the private equity model of buying businesses, stripping out physical assets like property and other tangibles before re-floating at much inflated multiples – which is what TPG have done to Ingham’s. The other issue with Ingham’s is Baiada – it’s competitor. Together they account for 70% of the market and it seems they have a dislike each other – they continue to give up margins to undercut each other and the only beneficiary is the supermarkets. In terms of the Supermarkets, Woolworths, Coles, IGA and two of the big chains in New Zealand comprise over half of Ingham’s revenue. If we include KFC, that numbers ticks up to 70% - which clearly creates a risk.

In short, we think it’s a reasonably business with good market share however margins are low and it’s clearly not as safe as it was when Bob Ingham had it (and was underpinned by property). We’re already seeing a big move away from mass produced, low cost produce / meat and that’s what Ingham’s is known for. At the original pricing it was too rich, although the fact they had to re-price it down told you that. At these prices, it’s reasonable but not yet compelling. Not for us at this stage.

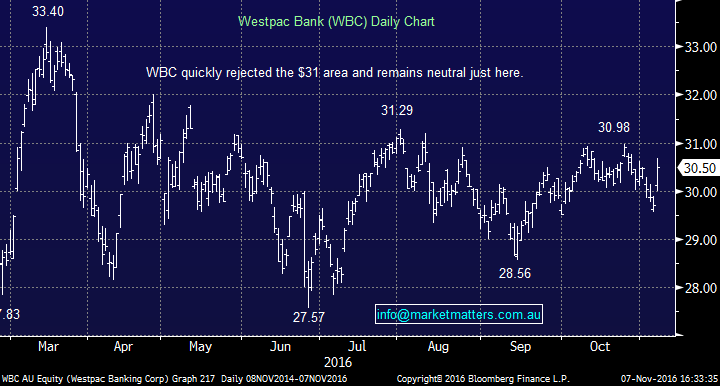

Westpac (WBC) reported today and the numbers were reasonable – which is good in this environment and relative to where banks are trading versus the market. A few main takeaways… full year cash profit of $7,822m, earnings per share of $2.28 and a final dividend of 94cps – which was all OK, Capital was strong with CET 1 at 9.5%, or 14.4% on an international basis. All the Australian banks now sit comfortably inside the top quartile of internationally comparable banks, Net Interest Margin (NIM) up 45bps for the full year which is good, they lowered their return on equity target from 15% (Gail Kelly legacy) to 13-14%, while the payout ratio of ~80%, which is above its sustainable range of ~70%-75%. For that reason, dividends will likely be flat for the next few years so they can ‘grow into them’ but they’re unlikely to be cut.

Westpac (WBC) Daily Chart

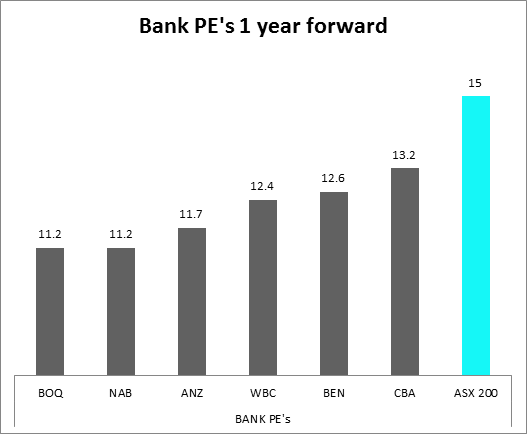

In our view, the majority of things going against banks in the near term, like capital and low interest rates are turning. Volume growth will be harder to come by and bad debts will probably rise BUT if GDP growth picks up domestically, bad debts shouldn’t become too much of a problem + it seems likely capital is OK, so we’ll probably get earnings per share growth again in 2017 and beyond + overlay that with very reasonable PE’s as per below, the argument for being long banks overall , with some tweaks around timing we can achieve good returns.

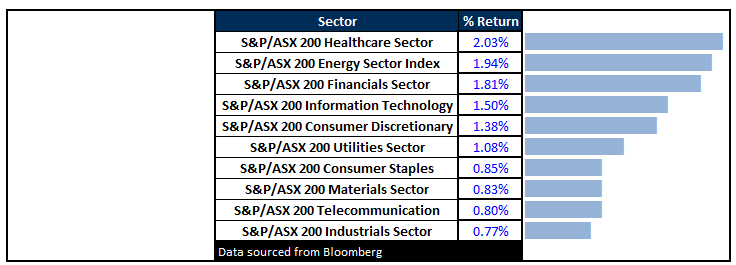

Sectors

Healthcare was the strongest sector today which is interesting given it was ‘risk on’. Ansell (ANN) had a good day and put on 3.24% - as we’ve written recently, Healthcare enters a seasonally strong period now. Energy stocks also strong with Origin (ORG) up +3.87% the best of the majors BUT it was also strongest (in relative terms) when the market was weak – a good sign.

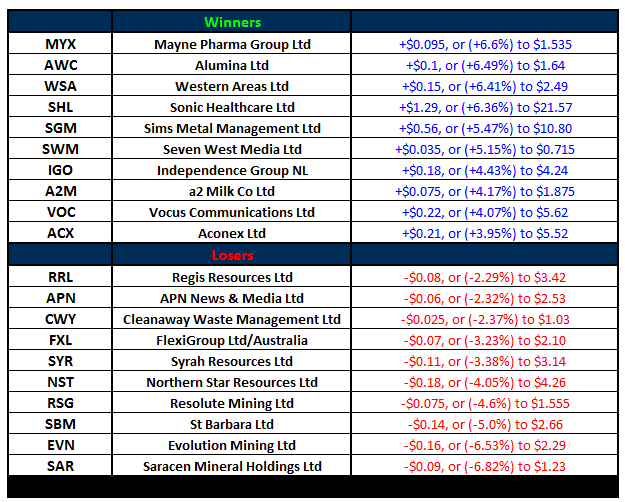

ASX 200 Movers – Golds give back recent strength

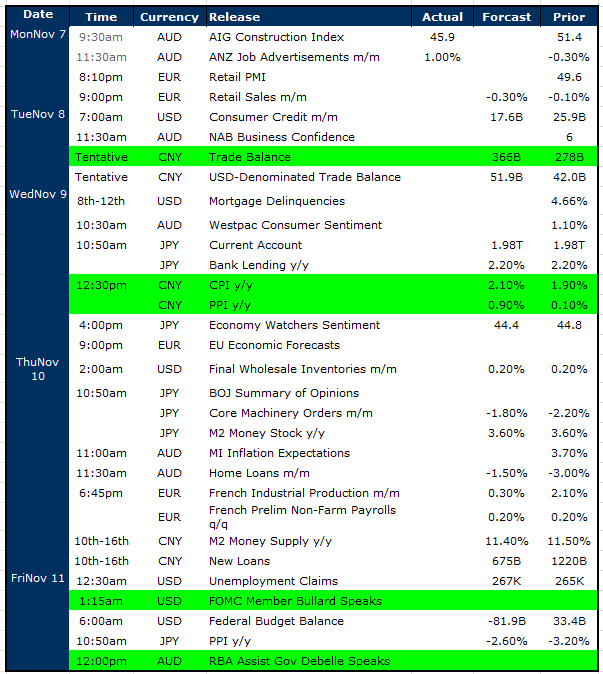

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

FUTURES strong….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/11/2016. 5.30P.M.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here