Index flat, Stocks mixed (WBC, GMA, ORI, MFG)

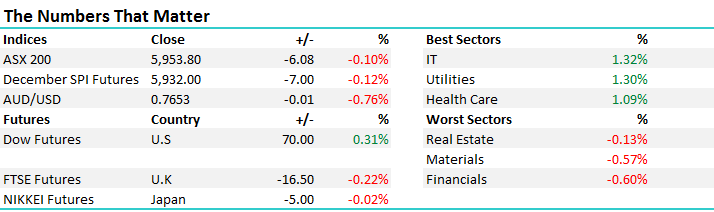

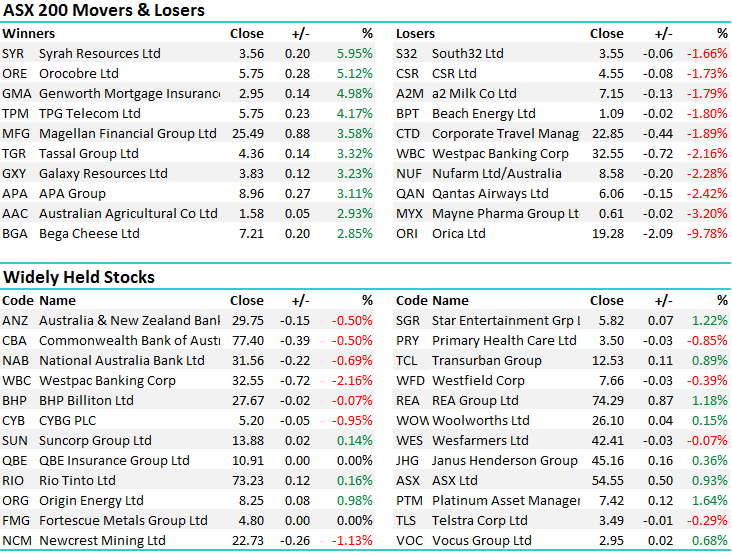

The strong lead from futures failed to lift the market today as the index tracked lower throughout the day to close marginally down on a day that lacked any real direction. Reporting season continued to offer some stock specific risk as more companies posted both FY17 and 3Q17 updates which we will touch on later. Tech outperformed the market today, while financials lagged lead by Westpac falling 2.16%. Overall a range today of +/- 21points, a high of 5966, a low of 5957, and a close of 5953, down 6pts or -0.1%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

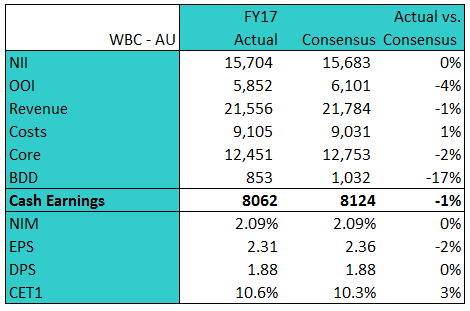

Westpac (WBC) reported FY17 numbers today and followed the lead of NAB, posting a 1% miss on cash earnings, hurt by an increase in costs and lower markets income, but helped a significant beat in bad and doubtful debts. It is important to note that the much talked about Bank Levy was applied to the last quarter of FY17 and cost WBC “just” $67m which is less than 1% of revenue. Despite the miss on costs, WBC has not announced a similar cost cutting plan like NAB.

WBC fell 2.16% today after the result, it goes ex-dividend for 94c on the 14th of November. We own WBC in the Growth Portfolio.

Westpac (WBC) Daily Chart

Orica (ORI), the mining services and chemicals company also disappointed the market this morning, announcing a 1% fall in revenue as it forecasted a lag between the recent uptick in mining activity to flow through to demand for its services. Orica also noted that it faced increased costs from supplies that it would not be able to recover from existing contracts. ORI fell sharply on the back of the result to close down almost 10% on the day.

Orica (ORI) Daily Chart

In better news, Magellan (MFG) announced a very positive monthly FUM update with $1.8bil net inflows across each of its platforms. The retail inflows were particularly outstanding, growing by $1.6bil after falling the month prior. The global fund also seemed to perform strongly over the month, estimated to have beaten its benchmark by 0.8%. MFG closed 3.6% higher today to $25.49, a far cry from the October lows of sub $23.

Magellan (MFG) Daily Chart

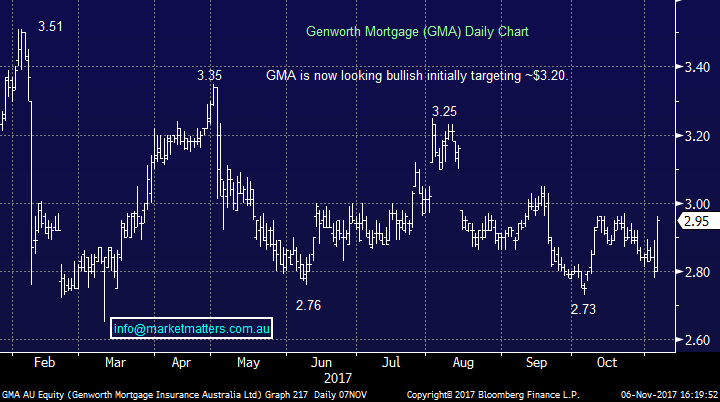

Genworth (GMA) announced a 3rd quarter update on Friday morning, however the share price didn’t react until today’s session, spurred by another positive note out of Macquarie’s research team. Despite a fall in the Mortgage Insurers net profit, the result was underscored by an improvement in delinquencies, falling from 42.6% to 37% between the second and third quarters. The low bad and doubtful debts clearly helping both the banks and mortgage insurers here. We own GMA in the MM Income portfolio, which today closed 5% higher to $2.95.

Genworth Mortgage (GMA) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions have traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/11/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here