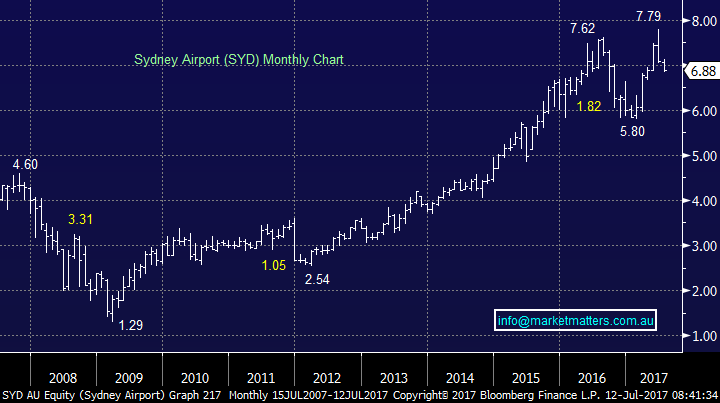

Yield Stocks – Hold or Fold?

US stocks ended little changed overnight however there was obvious intra-day volatility with the Dow Jones being down ~130pts at one stage before rallying into the close. More Trump emails and links to Russia not helping confidence however the headlines seem to get the short term spotlight before traders realise there is more important things to concentrate on - corporate earnings and the like!

One aspect that is glaringly obvious at the moment has been a lack of volume and a lack of conviction in this market. It seems we’re in a holding pattern ahead of US earnings - here’s a quick snapshot of volumes around the globe – most major markets a long way below averages. The New York Stock Exchange was -40% below the 20 day average overnight, the NASDAQ was 30% below while yesterday our market was down 24% on its 20 day average in terms of volume.

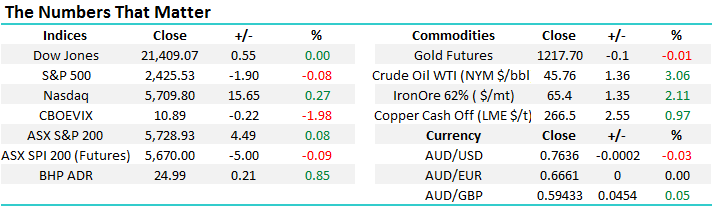

As we suggested yesterday, we tend to think the short sharp run up in global interest rates needs a pause and that happened overnight with the US 10 year yield drifting back from 2.39% to 2.36%. Clearly we think US rates go higher over time and we’ve written about this theme at length, however the big sell off in bonds (which pushed yields higher) was aggressive, and looks to have run its course in the short term.

US 10 Year Yield Daily Chart

If US rates stay stable for a period, or actually track lower in the short term, does this set us up for a bounce in the yield names that have clearly been under pressure? And if so, is this a BUY weakness sort of play or SELL Strength?

Property

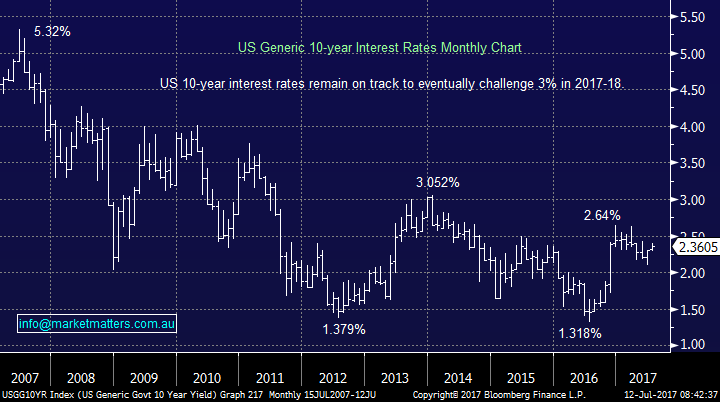

The ‘pin up’ property stock has typically been Westfield (WFD), however a few years ago they broke up their US assets with their Australian ones. Westfield now is a US exposure while Scentre Group (SCG) holds the Australian assets. Both stocks performed very strongly into the middle of 2016 and have since rolled over, with Westfield down by 30% in that time - the stock closing at its lowest level since 2014 yesterday. The peak in Westfield’s share price on the 26th July 2016 at $11.14 was 20 days after the low in US interest rates on the 6th July 2016.

If US Rates stay stable, or pullback in the very short term then we may see a bounce in WFD and other property stocks. This would create a selling opportunity.

Westfield (WFD) Monthly Chart – $7.78

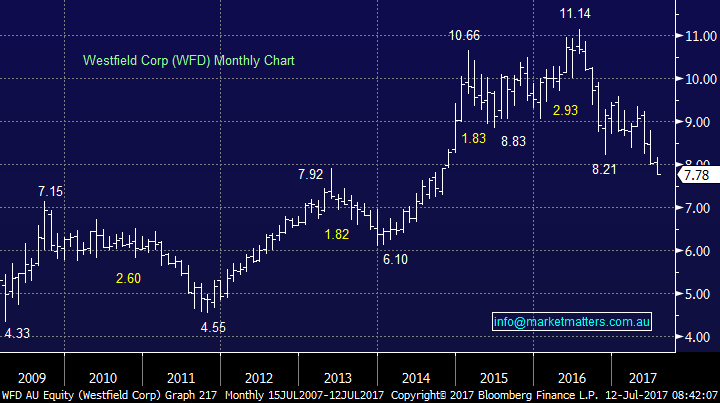

Infrastructure

Many investors have fallen in love with the likes of Transurban (TCL), Sydney Airports (SYD) and APA Group (APA) over the past few years. The operating environment for these companies has been excellent. A thirst for yield, strong underlying corporate performances, low interest rates reducing the costs of borrowing and importantly, allowing investors to ‘justify’ big valuations for the assets has seen the likes of Sydney Airports trade from $3.00 5 years ago to a high near $8.00 in June this year.

Last year when interest rates started to move higher, Sydney Airports dropped sharply, down around 30% in a heartbeat and we called that move well. We also bought Sydney Airports near the low and made money from a counter trend move however we underestimated how quickly the stock would come back into favour as the move higher in interest rates stalled.

Now we find ourselves back in the same boat, with interest rates globally moving higher and as a consequence we should see continued weakness in Sydney Airports and other infrastructure plays over time. In the short term though, a bounce back up into the mid $7’s seems a likelihood, which would create another selling opportunity for a deeper correction towards ~$5.50. Clearly, we think this is a sell strength sort of story.

Sydney Airport (SYD) Monthly Chart – $6.88

Conclusions

We have no interest in property and infrastructure stocks given the longer term picture for global interest rates – going higher

In the very short term , a bounce in these stocks would be an opportunity to sell

Overnight Market Matters Wrap

· Another uneventful day in the US overnight, with the majors ending the session pretty much unchanged from the previous day and volume like Australia, way below average!

· Investors seem to sit on the sideline until they see further confirmation on where the US Fed’s stance on the economy is heading.

· Iron Ore continued its resilience, rallying 2.11%, with BHP in the US indicating to outperform the broader market after ending its session up an equivalent of 0.85% from Australia’s previous close to $24.99.

· The June SPI Futures is indicating the ASX 200 to open marginally lower this morning, around the 5725 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2017. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here