Will the other miners follow Fortescue with more dividend bonanzas?

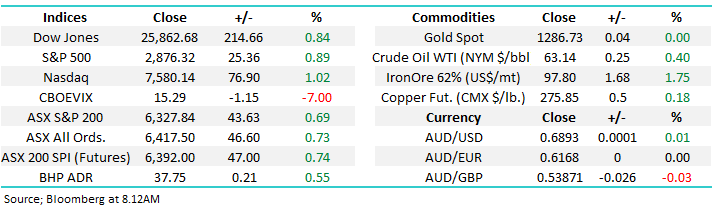

The ASX200 rallied strongly yesterday afternoon even with Westpac (WBC) trading ex-dividend 94c fully franked. There was strength across the whole market with over 75% of the index closing up on the day, but the Energy Sector was the standout winner rallying +2.2%, however we felt it was the underlying tone of 2019 “ a clear absence of selling” that appeared to be the main contributor to the +0.7% gain. This morning we are seeing the latest Ipsos poll telling us that Labor is heading for a narrow victory tomorrow which may jeopardize the implementation of their franking credits policy, perhaps some fund managers got a sniff of the result early although Sportsbet still has the election as a no contest.

We now have 3 factors pushing local equities higher with fresh decade highs only a solid few days away:

1 – Following yesterday’s employment data the futures market is calling a rate cut next month as a 50-50 scenario, its become a case of when not if – the post GFC rally has been fuelled by low rates and more petrol’s going onto the fire.

2 – Global equities have relaxed around US – China trade and are anticipating an amicable (ish) outcome moving forward.

3 – There’s a glimmer of hope that Labor may struggle with the implementation of their new franking credits policies.

This morning’s note wouldn’t be complete without a mention of the passing away of iconic Australian Prime Minister Bob Hawke, I don’t know a person who doesn’t have a soft spot for the larrikin Labor leader whatever their political leanings – the comment I have heard the most over recent weeks was I actually wish there was a leader like Hawke to vote for on Saturday. Goodbye Bob thanks for your hard work for our great country. Here’s a quick video worth a look of Bob at his finest.

https://m.youtube.com/watch?v=YMa0j5A3nWw&feature=youtu.be

This morning the ASX200 looks set to flirt with the psychological 6400 area, levels not witnessed for over 12-years and as we’ve been spouting recently markets that don’t fall on bad news are strong – stocks have largely ignored the combination of US & China trade concerns and the likely Labor victory on the weekend leading to the changes with franking credits benefits.

No change, MM believes any further weakness in stocks is a buying opportunity, especially in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight US stocks bounced back ~0.8% and the SPI futures are calling the local index to open up close to 50-points but with BHP only rallying 20c in the US it looks likely that some bank buying and more broad based strength is going to surface this morning.

In today’s report we are going to look at 4 major resource stocks as we contemplate if any of them will follow in FMG’s footsteps with a special dividend.

ASX200 Chart

Yesterday’s unemployment data which showed our jobless rate surprisingly tick up to 5.2% intensified the markets belief that the RBA would be cutting interest rates sooner rather than later. The volatility of the last few years has clearly illustrated that Australian and global equities are only struggling when interest rate rises are perceived to be on the cards, not cuts.

Australian 3-year bond yield Chart

At MM, we have been discussing the $A for most of the year and our prognosis has not changed, we are bullish medium-term, a clear contrarian view.

However in the short-term we have been debating whether the panic low in January down towards 67c was it, or whether would we see another attempt a fresh decade lows. At this stage especially following yesterday’s employment data and subsequent dip under 69c by the “little Aussie battler” the later feels far more likely which should be supportive short-term for our US earners e.g. ResMed (RMD) and Macquarie Group (MQG).

MM still believes the $A will see 80c before 60c but a break to fresh 2019 lows now feels very likely.

The Australian Dollar ($A) Chart

Will some other major miners follow FMG’s lead with special dividends?

Yesterday we saw iron ore prices in China soar to fresh highs as the supply constrictions that we have discussed in recent reports continue to bite. Steel production continues at a strong rate and some there is a growing belief that Chinese Steel producers have underestimated the impact of Vale’s lost tonnage.

This elevated price for the bulk commodity enabled Fortescue (FMG) to announce this week a whopping special 60c fully franked dividend to be paid next week – before both the EOFY and risks from the potential new Labor governments changes to franking credit policies.

Iron Ore (CNY/tonne) Chart

1 BHP Billiton (BHP) $37.54

BHP looks very capable of paying a special dividend at some point given the earnings uplift coming from higher Iron Ore prices, particularly as they sit on a franking credit balance in excess of $12bn – but it would of course lead to an increase in the companies debt levels. Also with a large percentage of overseas investors on its register due to its multiple listings the impact is diluted somewhat, but still beneficial.

Technically BHP looks excellent targeting fresh highs above $40 – remember there’s nothing wrong with buying stocks near their highs, statistically it’s actually a better play.

MM is bullish BHP at current levels.

BHP Group (BHP) Chart

2 RIO Tinto (RIO) $99.28

MM recently bought RIO for the Income Portfolio and its clearly rallied nicely so far, RIO also looks very capable of increasing dividends overall or paying a special at some point – they too sit on a big franking credit balance in excess of $8bn. However like BHP with a large percentage of overseas investors on its register due to its multiple listings the impact is diluted somewhat plus net debt would ultimately rise.

Technically RIO looks excellent targeting fresh highs around $105 – again, remember there’s nothing wrong with buying stocks near their highs, statistically it works.

MM is bullish RIO initially targeting the $105 area.

RIO Tinto (RIO) Chart

3 Iluka (ILU) $8.85

MM bought mineral sands operator ILU recently for the Growth Portfolio and like RIO its traded nicely of late, however ILU is not a candidate to pay higher dividends at this point - incidentally they only have a franking credit balance of almost $30m, clearly much smaller than both BHP and RIO in both absolute and percentage terms.

We like ILU for other reasons outside of dividends / capital returns.

MM remains bullish ILU targeting a break above $10.

Iluka Resources (ILU) Chart

4 South32 (S32) $3.52

S32 has been one of the few miners MM has not been keen on during much of 2018/9 and the stocks performance has justified our caution. The company has a franking balance in excess of $50m which represents 0.3% of the companies market cap basically enough to frank its ordinary dividends.

Technically MM is neutral S32.

MM is neutral to slightly positive S32.

South32 (S32) Chart

Conclusion (s)

Of the 4 stocks we considered today all could surprise positively on the dividend front but our preferences in order are BHP, RIO, ILU and S32 – note we remain bullish the sector.

Also don’t underestimate FMG, they could go again in 2019 although it feels like Twiggy will have one eye non Bill Shorten’s policies assuming he’s elected.

*Watch for alerts.

Global Indices

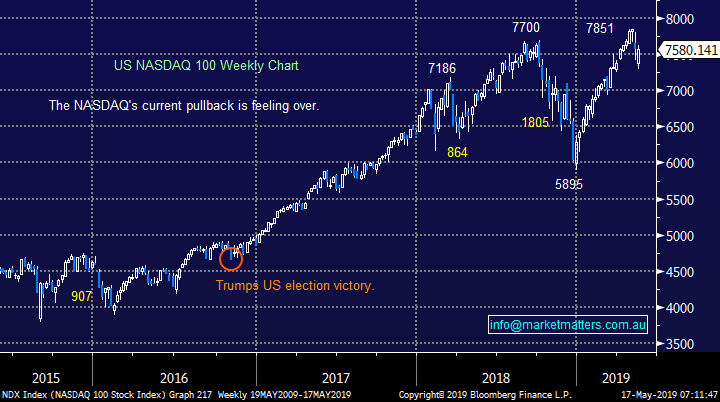

US stocks rallied for a 3rd straight day last night and if they can close around here by the end of the week its feeling like were off to fresh all-time highs.

US stocks continue to feel like it’s time to be accumulating for a final push higher.

NASDAQ 100 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks but the tone is improving fast.

German DAX Chart

Overnight Market Matters Wrap

• The US rallied for its third consecutive session overnight, with sentiment boosted by both stronger than expected housing data and quarterly earnings from Walmart and Cisco Systems which beat expectations. The three key indices posted gains of just under 1% , and have now recovered virtually all of last Friday’s wipe out resulting from the US and China tariff increases.

• Crude oil strengthened on fears that rising Middle East tensions will curtail supply following the drone attack earlier this week on a Saudi pipeline. Commodities were also slightly firmer led once again by iron ore which rallied further and is now nudging a 5 year high of US$100/tonne as supply shortages caused by Brazilian miner, Vale’s tailings dam disaster earlier this year, continue to bite.

• The June SPI Futures is indicating the ASX 200 to open 58 points higher towards the 6385 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.