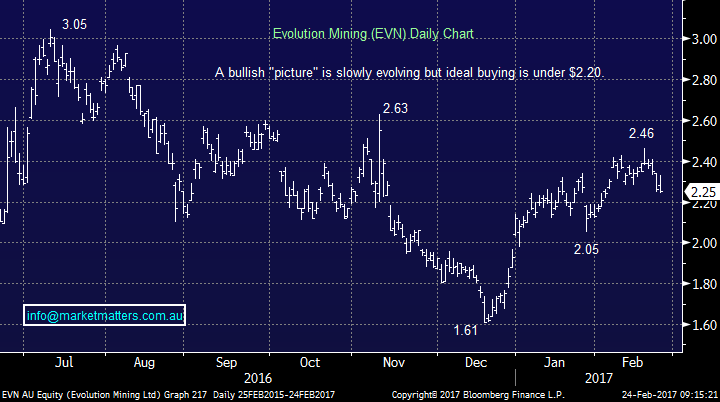

Will the new US Treasury Secretary help our gold plan?

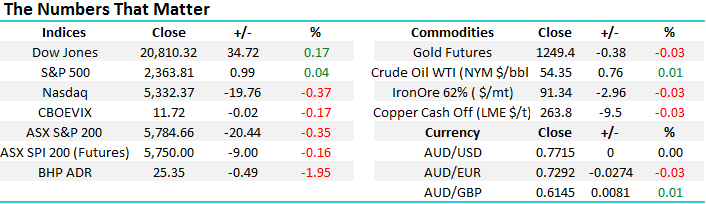

The ASX200 looks set to open unchanged this morning as the Dow enjoys its 10th consecutive positive day but upbeat sentiment is likely to be dampened by the resource sector which continues to be under pressure - BHP is trading at $25.35 in the US, down another 50c, or close to 2%. As the local reporting season draws to a close we again witnessed significant moves on the individual stock level yesterday but it will be a relief to many that normality is likely to return next week e.g. Estia Health +14%, Crown Resorts +7.9% but Ardent Leisure -21.8%.

Today we are going to focus on the gold sector, an area where we are keen to increase our exposure over coming weeks / months. Hedge Fund Manager Steve Mnuchin who Donald Trump has appointed as the US Treasury Secretary stated in his first interview since being sworn in that a strong $US is a reflection of confidence in the American economy and was a "good thing" in the long run – (Wall Street Journal). However in an arguably contradictory view he has also now stated that he expects low interest rates to persist, comments which last night sent the $US lower and gold to its highest level since the November US election. Overall gold has rallied 8% since Mr Trumps victory as it appears some investors are using the precious metal as a hedge against a bad tweet, or obviously something much worse.

The question we continue to ask ourselves is when / how do we add to our Newcrest Mining gold exposure, which we remain happy with.

ASX200 Weekly Chart

When we quickly cast our eyes towards overseas equity markets the German DAX again catches our eye after reaching our targeted 12,000 area before reversing lower. - an 18% rally since the US election. Two things are important to consider when investing through 2017:

- We still have an ultimate target for the German Index ~13,000, or 8% higher.

- Short-term a 5% correction feels close at hand, or even underway.

Hence the message remains the same, until further notice remain core long stocks and tweak portfolios around the edges by primarily "buying weakness and selling strength".

German DAX Daily Chart

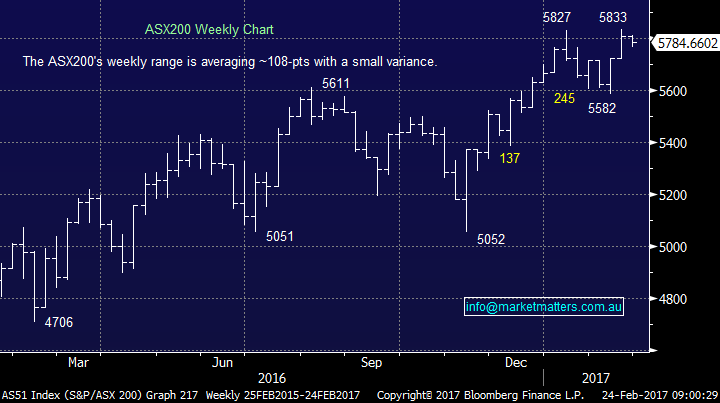

Firstly let's look at the $US when we consider the future direction for gold itself. The $US to rally in 2017/8 remains the most popular view amongst fund managers in a recent survey by Bank of America, yet it still remains negative for the year at the end of February - remember the "pack" is often wrong with markets. The inverse correlation to gold is not as pronounced as we would have thought, especially over the long term, but since mid-2016 it definitely has been in play.

Three clear standouts over the last 18-months:

- When the $US declined ~7% in early 2016 gold rallied ~$US200/oz.

- As the +10% rally in the $US unfolded through 2016 gold then turned down ~15%.

- As the $US corrected ~4% in 2017 gold has rallied $US100/oz.

This inverse correlation again kicked in last night with gold rallying strongly to $US1250/oz while the $US pulled back only marginally. Our view remains that the $US will fall over 10% in 2017/8 but we are 50-50 whether it can pop to fresh recent highs first, hence our quandary.

The $US v Gold Daily Chart

Let’s now move onto the 2 gold stocks that are the front runners to become additions to the MM portfolio, assuming we do not increase our Newcrest Mining (NCM) holding.

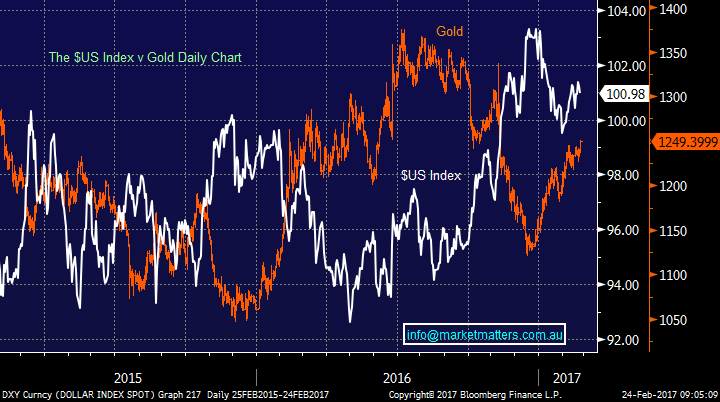

1. Evolution Mining (EVN) $2.25

EVN is an Australian based gold mining company with a market cap around $3.7bn. It owns and operates six gold and silver mines in Queensland and WA. Interestingly, their major shareholder is the Sawiris Family which is a very wealthy (~36bn) Egyptian family that have diverse investments through Telco companies, Hotels, Constructions etc. They own around ~27% of EVN. Evolution reported their half year 2017 numbers earlier this month and the result was very good, not just in terms of earnings upside which was very strong, but commentary around the potential mine life extension of their Cowal mine which they acquired in 2015, with the Government extending the licence by ~8 years - a good outcome and helps with the longevity issue faced by all gold companies. Operationally, EVN are kicking goals and the higher gold price is obviously a tailwind.

Technically we like EVN but our ideal buying region remains closer to the $2.10 area. It's encouraging to see the stock has drifted lower over past weeks even as gold remains strong.

NB. EVN Goes ex-dividend today, 2c unfranked.

Evolution Mining (EVN) Daily Chart

2. Regis Resources (RRL) $3.47

RRL is an Australian gold production and exploration company, with the focus of its operations in WA. They reported a few days ago and although the report was broadly inline with no major surprises, it’s wasn’t as clean as EVN. Production was lower than expected but that was offset by a higher realised gold price and they did maintain full year production guidance, however they don’t have a ‘free kicker’ that EVN might with extensions to existing assets.

Technically we like RRL at lower levels, ideally we can buy into some weakness around $3.20, however our preference at this stage would be for Evolution.

NB. RRL goes ex-dividend on the 7th of March, 7c fully franked which puts the stock on a healthy 3.7% grossed yield.

Regis Resources (RRL) Weekly Chart

Conclusion

We remain keen buyers of both EVN and RRL but ideally around $2.10 and $3.20 areas respectively, with a preference for EVN

- We also will consider some option plays in the sector for the more adventuress subscriber.

Overnight Market Matters Wrap

- The US major share market indices closed mixed again overnight, with the NASDAQ 100 underperforming the rest, down 0.37%

- Oil gained 1.44%, as US inventories declined, while Iron Ore followed Asian lead, ending down 3.14%.

- A soft start is expected this morning, with the March SPI Futures indicating the ASX 200 to open slightly lower.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here