Who might be next after Healthscope? (BHP, RIO, AAPL.US, HSO, OZL, CGF, TWE, NUF, VOC)

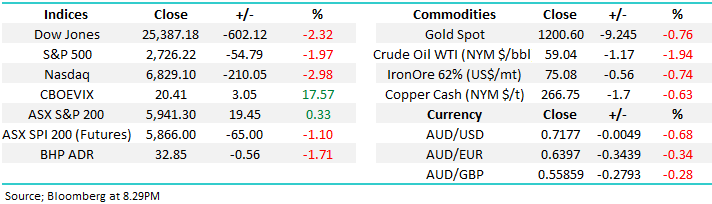

The ASX200 enjoyed another strong day, shaking off weakness in overseas markets on Friday night, worrying signs around BREXIT and ANZ Bank (ASX:ANZ) / Macquarie Group (ASX:MQG) both trading ex-dividend. While the strength was led by Commonwealth Bank (ASX:CBA) the market simply felt devoid of any major selling. What caught our eye was the lack of excitement for the high growth / valuation stocks with Afterpay (ASX:APT), Xero (ASX:XRO) and Wisetech (ASX:WTC) all 3 in the markets top 10 worst performers – MM only has interest in this sector into major weakness.

A good illustration of the markets overall internal strength was on a day when the gains were limited to under 20-points, only 30% of the ASX200 closed in the red. The market closed at the same levels as mid-October, leading to some pressure on the “shorts” – the market was basically unchanged at 3pm when the covering appeared to kick into gear.

At this stage of today’s report, I would like to reiterate a thought I have expressed a few times recently:

“I do feel a lot of investors / fund managers are highly cashed up and the path of most pain may be a rally into Christmas.”

A steady prolonged grind higher will certainly hurt the fund managers / investors who felt clever in mid-October, they won’t be forced into action by a sharp rally, but the market will slowly but surely get away from the them if it climbs over this current wall of worry – I’m thinking out loud here. We continue to advocate buying of weakness / selling of strength as we see an almost rotational style move higher into Christmas.

We have been short-term positive the ASX200, initially targeting a break above 5900 which was achieved last week, we are staying bullish into Christmas – a definite contrarian view.

MM remains mildly bullish the ASX200 into 2019, but a classic seasonal pullback towards 5800 cannot be discounted.

The local market is starting to feel like a student approaching their HSC exams with another definite “test” of its resolve this morning, following a 600-point overnight drop by the Dow, but the weakness was led by the NASDAQ which fell a painful 3%. The ASX200 looks set to open down around 1.2% with Westpac (ASX:WBC) trading ex-dividend and BHP closing down 1.71% in the US.

Following yesterday’s “gazumping bid” for Healthscope (ASX:HSO) by Canadian giant Brookfield, today’s report is going to look at 5 other stocks we believe may be in the firing line of suitors.

A subject we have looked at previously, but there’s nothing like a bidding war to get our mind ticking – we believe the key is to buy a stock / business you like with the potential for a takeover cream on the cake i.e. as opposed to the more dangerous route of just searching for vulnerable entities.

ASX200 Chart

BHP Billiton (ASX:BHP) & RIO Tinto (ASX:RIO)

We have discussed recently our current preference for RIO over BHP for the last couple of months and I noticed yesterday BHP only closing unchanged while RIO rallied $1.35 / 1.66%, our call feels on point at the moment.

MM remains bullish RIO, targeting the $90 area, or ~9% higher.

RIO Tinto (RIO) Chart

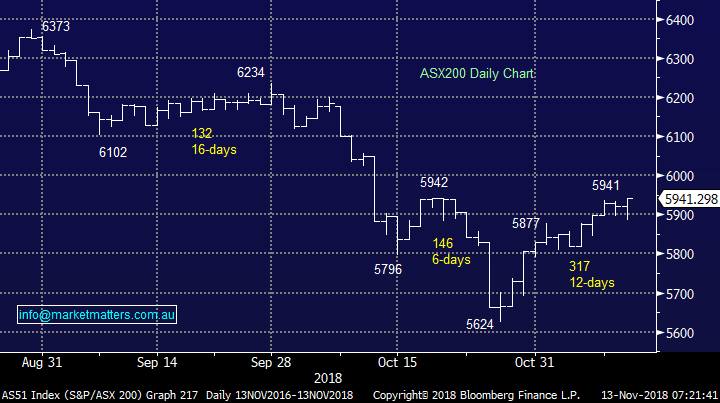

This morning I can sense a number of investors will instantly become very nervous when they wake to see the Dow close down 600-points, but I would remind subscribers that in the Weekend Report, our preferred scenario was the US S&P500 would pull back towards the 2700 for a good risk / reward buying opportunity, this morning we’ve simply see most of this move unfold.

The decline overnight was focused in the previously high flying tech sector as concerns over iPhone demand accelerating dragging chip provides lower along with Apple which declined 5% to $US194 – we like the stock into weakness around $US200.

US S&P500 Chart

Apple (US:AAPL) Chart

5 Potential takeover targets

Yesterday we saw BGH Capital and Australian Super receive a 1-2 with double takeover rejection in just one day, with Healthscope (ASX:HSO) and Navitas (ASX:NVT) the respective culprits.

This was great news for MM who went long HSO, and then held in the face of adversity, looking for a takeover battle to ensue. Hopefully there are a few more chapters to unfold in this story as BGH / AusSuper are clearly keen to acquire the private hospital operator.

Either way there’s clearly a bucket full of cash looking for a home with Australian stocks currently on the menu – BGH have a $2.5bn war chest and AusSuper obviously substantially more.

The question is where will these 2, plus others, be looking to satisfy their substantial appetites.

Healthscope (ASX:HSO) Chart

Most of the 5 what we have discussed below is definitely not reinventing the wheel stuff, but worth reconsidering as M&A activity appears to have further to unfold as businesses hunt for growth.

1 OZ Minerals (ASX:OZL) $9.36

Miners have been building a significant war chest after holding back spending over the past few years and some could be about to unleash o portion of this into M&A. While heavyweights BHP and RIO are clearly returning much of their funds directly to shareholders, much to the market’s appreciation, there are plenty of smaller and overseas players that may take a different direction. In the mining sector the key targets are long life assets where the value ‘in the ground’ is being under appreciated by the market and/or resource projects that offer synergies for a suitor, whether it be scale, geography, ability to optimise product etc.

OZL has corrected against a backdrop of a ~20% pullback in copper as the markets fixate on a US recession in 2019/20, this is likely to catch any potential suitors eye.

Technically the stock does unfortunately look average with a potential $7 target – this is the areas where we would like to be buyers, but that’s a lot lower than current prices.

Copper business, OZL would be an ideal target for a northern hemisphere producer.

OZ Minerals (ASX:OZL) Chart

Copper Chart

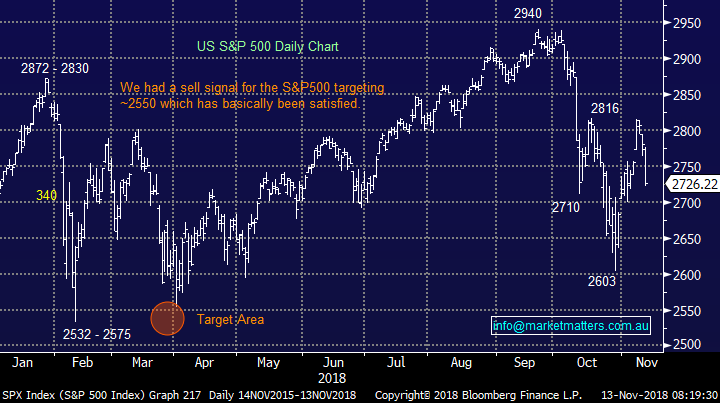

2 Challenger (ASX:CGF) $9.84

CGF was a market darling since the GFC, but 2018 has been unkind to the stock as its fallen over 30%, significantly underperforming the market.

The annuities business has struggled this year for a number of reasons, however more recently news that the introduction of comprehensive income products for retirement (CIPR) has been pushed back to 2022 has been the catalyst for the bears. That’s not long in the scheme of things and maybe providing an excellent opportunity.

MM likes CGF just a few % lower, likely to be achieved today.

Challenger (ASX:CGF) Chart

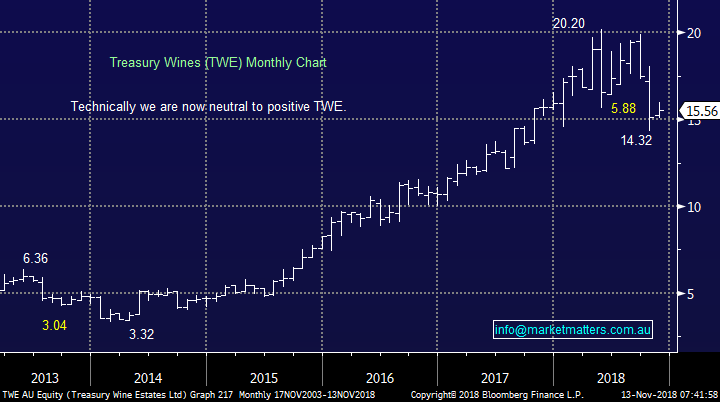

3 Treasury Wines (ASX:TWE) $15.56

Chinese buyers are a possible suitor for TWE which would make a logical "strategic fit" for a cashed up Chinese company as sales of its premium brands grow even as China’s future scares many. State-owned COFCO Group has been touted as a potential buyer in the last year. The recent weakness in the stock has been triggered by a disappointing decline in US wine exports, an area TWE was looking for future growth – Asia remains strong.

TWE is now trading on an Est P/E for 24.7x showing there’s still plenty of optimism in the stock, although we have seen a big P/E re-rate down from its 2 year high of 32.6x and a discount v its 2 year average of 27.9x.

TWE Valuation Bands

MM likes TWE around $15 on a risk / reward basis but we remain cautious on growth stocks hence any purchase would likely be relatively small.

Treasury Wines (ASX:TWE) Chart

4 Nufarm (ASX:NUF) $5.86

Another stock that maybe on the Chinese menu is fertiliser producer, Nufarm as demand from the world’s second largest economy for Australian crop’s increases. NUF has endured an awful year with the stock plunging following a capital raising to repair balance sheet damage caused to the severe Australian drought.

Chinese generally play a “long game”, so this short term weather issue may be viewed not as a concern but an opportunity.

NB Rival Orica (ASX:ORI) is currently one of MM’s favourite stocks at present that we don’t own – see Weekend Report. Also worth noting that Incitec Pivot (IPL)reported full year results this morning and they were about a 4% miss.

We like NUF in a takeover basket, but cannot buy it for its own fundamental reasons today.

Nufarm (NUF) Chart

5 Vocus Group (ASX:VOC) $3.54

Not one that’s been talked about recently but following the merger between Vodafone and TPG Telecom we ponder if suitor’s will return to Vocus (ASX:VOC) as the telco space has found a modicum of love.

Back in 2017 KKR / Affinity partners offered $3.50 a share in an unsuccessful bid for VOC, will they return like we saw with HSO?

MM likes VOC around current levels on a risk / reward basis as a trading vehicle.

Vocus (ASX:VOC) Chart

Conclusion

While we are net positive the 5 stocks considered today as potential takeover targets, our preferred into current weakness is Challenger (ASX:CGF).

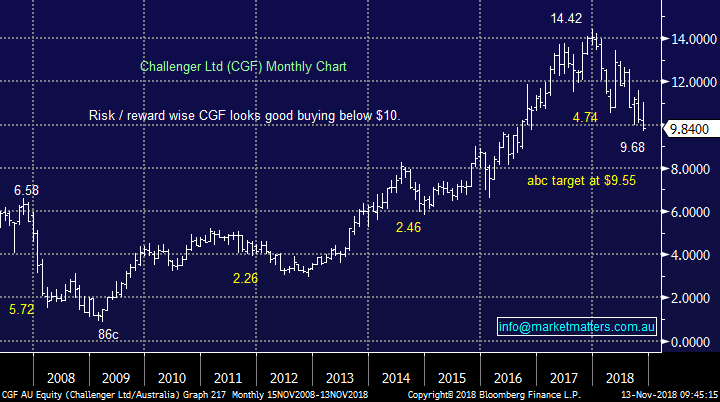

Overnight Market Matters Wrap

· The US continued from last Friday’s sell off and started the week poorly with the majors all in the red sea, particularly by the tech heavy, Nasdaq 100 as selling was predominantly seen in Apple (AAPL.US)

· Metals on the London Metal Exchange were weak, iron ore lost ground, while crude oil continued its slide to the downside – its 11th consecutive loss!

· BHP is expected to underperform the broader market today after ending its US session down an equivalent of 1.71% from Australia’s previous close, while Westpac (WBC) is trading ex-dividend for the amount of $0.94 a share.

· The December SPI Futures is indicating the ASX 200 to open 74 points lower towards the 5865 level this morning, losing yesterday’s gains and more.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.