When will we revisit the Healthcare Stocks?

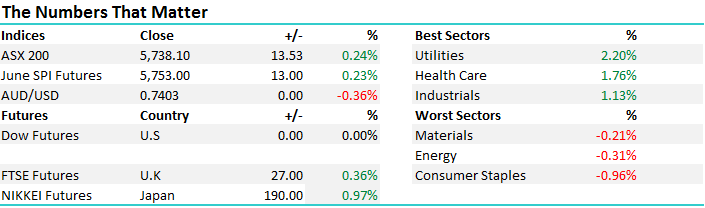

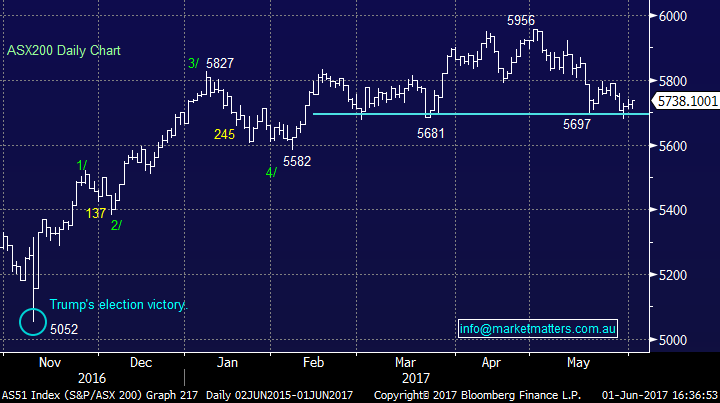

May is finally behind us and most of you now know it was the worst month in 1 ½ years falling -3.4%, the decline looks worse when compared to the Dow which rallied +0.3% and the NASDAQ an impressive +3.7%. The “sell in May and go away” affect has started on the right footing but as the following seasonal chart illustrates June is historically likely to add to these losses, before July finally puts a smile back on investors faces.

The average pullback since the GFC during May-June is 6.9% hence statistically we are only around half we through a “normal” correction.

Playing with numbers / statistics we can virtually always make a point but one of our favourite ways to illustrate why holding large cash levels this time of year makes sense is when we look at the Dow going back to 1950.

-Since 1950 the average annual return from May-October is well under 1%, conversely between October and April its approaching 8%.

ASX200 Annual Seasonal Chart

US stocks were pretty quiet last night, basically closing unchanged, recovering well following a bad result from US bank J P Morgan which fell ~2%. We must remain short-term bullish the S&P500, while it can hold over the psychological 2400 area.

US S&P500 Weekly Chart

We mentioned the healthcare stocks in yesterday afternoon’s report, following a leaked report surrounding the Government planning to abolish the private health insurance rebate. The Government have since rejected the rumour, but we believe the regulatory risk does exist in the sector as Australia fights to balance its books – just ask the banks! Recently, Theresa May the UK’s prime minister has come under flak from a proposed tax to make people pay for their own aged care if they have over 100,000 pounds in assets, it’s been branded the “dementia tax”. The point being, many developed world governments, including Australia, are wrestling with different ideas to put their respective country on a better financial footing and it’s unlikely any of the pending actions will be welcomed by individuals or businesses alike.

Today we are going to briefly look at 3 stocks in the space but when we look at the healthcare index as a whole it looks ready for a ~2-year consolidation following its very strong rally since 2011.

ASX200 Healthcare Sector Monthly Chart

1 CSL Ltd $129.29 – CSL is now trading on a 32x valuation based on estimates of 2017 earnings hence our concern that the stock is priced for perfection. CSL has been a simply wonderful business for many years and although we took profit on our position too early in the recent leg higher we are comfortable being observers for now. Simply CSL is expensive and most investors are already long hence we believe this creates significant risk to the share price in 2017/8.

CSL Ltd (CSL) Monthly Chart

2 Ramsay Healthcare (RHC) $68.93 – RHC is now trading on a 26.2x valuation based on 2017 earnings, we took a small profit on our position in April ~$70.50 and continue to feel very comfortable with this exit seeing risks to the downside with our target well under $60.

Ramsay Healthcare (RHC) Monthly Chart

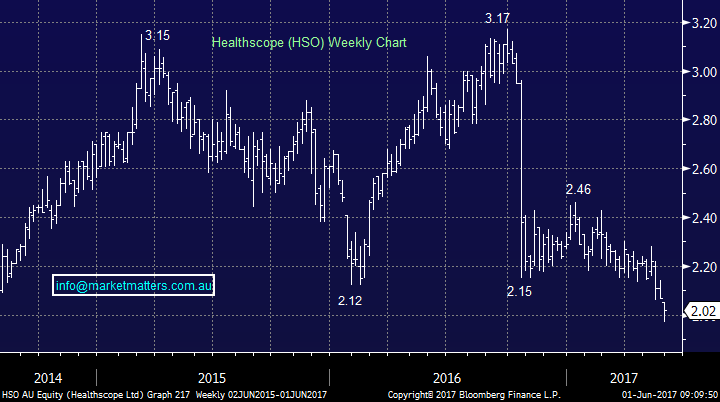

3 Healthscope (HSO) $2.02 – HSO is now trading on a 19x valuation based on 2017 earnings, we sold our position ~$2.33 or over 13% higher. Our plan had been to re-establish our position around $2, where we are today, but something “feels wrong in the stock” and we question whether another downgrade is looming. We will pass for the time being.

Healthscope (HSO) Weekly Chart

Conclusion (s)

We believe its unlikely MM will be buying major exposure to the healthcare sector in 2017, but an individual situation may potentially tempt us.

Overnight Market Matters Wrap

· As mentioned, the US markets closed marginally lower, recovering well off its low after JP Morgan reported a lower trading revenue in the second quarter – expect weakness in the financial sector, particularly with Macquarie Group (MQG).

· Gold and copper were better, while oil and iron ore fell more than 2%. BHP is expected to underperform the broader market, after ending and equivalent of -1.14% lower in the US from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 5 points higher towards 5,730 this morning, however the weakness is expected to dominate.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here