When will be the time for the “BIG” switch

The ASX200 slipped again yesterday closing down -0.24% for the day, making it a fall of -0.7% for the week to date – so much for Mondays exciting open following the Dows 440-point surge. We said in the Weekend Report that it was “a potentially dangerous feeling!” for the bulls when US stocks rallied so hard setting the ASX200 up for a storming open on Monday.

The local market is primarily being battered by the Banking Royal Commission with CBA down almost $2 from its high on Monday i.e. 2.4%. Markets hate uncertainty and it’s going to be a while before banks are no longer front-page news in the AFR. We would now not be surprised to see CBA test $73, unfortunately another 3-4% lower.

Following Wednesdays close by the ASX200 below 5950 we are now short-term neutral local stocks needing a close back above 6030 to switch us bullish.

· MM is currently a seller of strength in stocks, not a buyer of weakness.

Today’s report will briefly look at our successful ORE-KDR switch this year and then more importantly a potentially big opportunity looming from resources into banks i.e. looking to use the negative news engulfing our Banking Sector to add value to our portfolios.

ASX200 Chart

Overnight the US market was pretty quiet with the broad S&P500 closing basically unchanged, we are certainly getting the choppy consolidation that we targeted back in February with US stocks now trading sideways for 5-weeks since the early February -11.8% plunge.

US S&P500 Chart

Switching stocks / sectors

At MM we are constantly on the lookout for ways to add value to both of our portfolios, above simply buying a “balanced portfolio”. It actually always amazes me the huge fees some investors pay to be simply put into a portfolio which basically mirrors the ASX200.

We regularly consider switches between both stocks and sectors but interestingly the most common area people often consider regularly throws up the least opportunity i.e. between the “big 4” banks…...over the last year the best has been NAB at -7.1% and the worst Westpac -13.3% but within the same sector CYB Plc is actually up +29%!

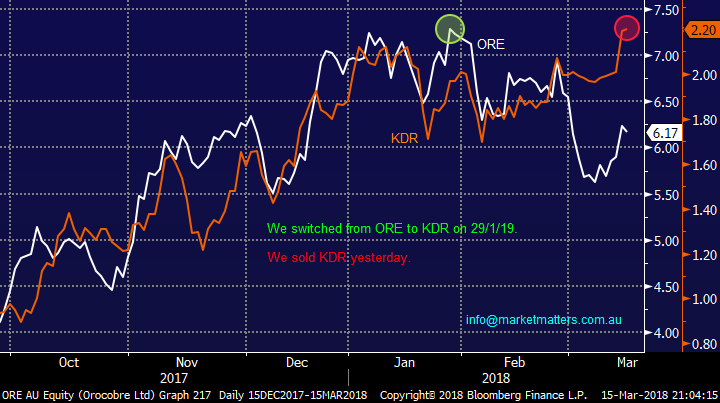

Not surprisingly we find more opportunities between sectors than within them and this is reflected by our alerts over recent years. However, this year we did enjoy a successful switch within the lithium sector and we have briefly explained some of our thoughts below.

MM Switch within the Lithium Sector

At MM we are bullish the lithium sector but acknowledge it’s both volatile and in the mature stage of a bullish advance since early 2017, hence we are both buyers of weakness and sellers of strength.

· We bought ORE on the 19/1 when the stock fell over 10% following its capital raising.

· We followed this up on the 29th of January switching our ORE holding to KDR when ORE surged to fresh all-time highs while KDR remained fairly subdued.

· Yesterday we sold KDR for a ~21% profit as it made fresh all-time highs.

While it’s easy to pat ourselves on the back over a ~36% profit from the respective plays / switch it’s important to acknowledge the 2-points which underpinned our view:

1. Our overall bullish outlook towards the lithium sector has proven correct to-date.

2. The fortuitous capital raising by ORE enabled the initial good risk / reward entry into that stock, which was the platform into the sector

This remains a sector that MM likes and will continue consider buying weakness when it unfolds but remember this is undoubtedly an extremely volatile area of the market.

When we look at the following comparative chart of the ORE and KDR share prices it’s pretty easy to understand our respective actions.

If we were not in distinct “sell mode” MM would be actively looking to buy ORE but because of our overall market view we are likely to be patient, however ORE now looks better value at yesterday’s prices.

Orocobre (ORE) v Kidman Resources Chart

When to switch from Resources to Banks.

Often the best way to add value to an Australian equity portfolio is by getting the correct exposures to our heavyweight Banking and Resources Sectors, they regularly trade in a completely different manner:

· BHP fell from $37 to $14 from 2014 to 2016, at MM we got this one correct but did start buying BHP a touch early ~$20.

· During the same time CBA only fell from around $81 to $80, while also paying far more attractive dividends than BHP.

In early 2016 our resources stocks, including heavyweights BHP and RIO, were reviled by many local investors following their 2-year plunge but as is often the case the masses proved to be wrong i.e. people are the most bearish at the bottom.

Since early 2016 the miners have certainly worn the “top performers” hat.

· Since Jan 2016 CBA is down ~$2 while BHP has doubled!

It’s very easy to see how significant value can be added to a local portfolio by holding the correct exposure / balances to banks and resources.

If we compare CBA and RIO in a chart this is only the second time in 5-years where RIO has traded above CBA whereas we’ve regularly seen CBA trading ~$30 higher than RIO. This obviously throws up some initial alerts around a potential switch / reweighting.

Commonwealth Bank (CBA) v RIO Tinto (RIO) Chart

There are numerous pros / cons for both sectors at present:

Banks – Have limited growth at present but have plenty of scope to reduce costs, they are currently under pressure due to the Royal Commission but this will be next year’s fish and chip paper. They are already paying healthy sustainable fully franked dividends and as businesses they should benefit from rising interest rates – offsetting that to some degree, some pundits are calling a crash in our property market which would clearly rattle the banks.

Resources – They are in an excellent place at present resembling cash cows as they both buy back stock and increase dividends. The global economy is strong at present led by China but when this slows resources will struggle. Currently the market’s focusing on rising inflation and historically this is good for resources.

It’s easy to talk yourself into both camps but at MM we believe the time to switch into banks is on the horizon but has probably not yet arrived.

1. The Banking Royal Commission is likely to keep knocking the banks in 2018 and remember they usually fall badly in May, and to a lesser extent June.

2. At MM we are still looking for one more spike higher in risk / emerging markets which is usually bullish resources.

3. If we are correct and markets have got a tough few years ahead we feel that the underperforming, high yielding banks, may be better insulated i.e. they have significant bad news built into their price.

Conclusion (s)

We believe the time to switch from resources to banks is on the horizon but probably not here just yet:

1. We are watching the Resources / Banks closely but not pushing the button just yet – watch this space!

2. In the lithium sector we may consider switching back into ORE depending on the relative performance at the time

Global Indices

US Stocks

The US market remains very choppy and while ideally we are still looking for fresh all-time highs moving forward we are becoming increasingly aware of our longer-term call for a +20% correction starting this year.

US Dow Chart

US S&P500 Chart

European Stocks

No change, we are now targeting around the 14,000-area for the German DAX before we will turn bearish.

German DAX Chart

Asian Stocks

Similarly, to western global indices the Asian markets / EEM corrected over 10% and now look good from a risk / reward perspective for fresh highs in 2018 - the more time the market can spend around 49 the stronger it will look technically to us.

Emerging Markets (EEM) ETF Chart

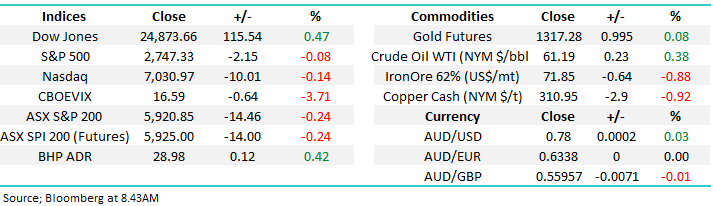

Overnight Market Matters Wrap

· The US markets closed mixed overnight with the industrial sector leading the pack, while the materials sector weighed to the downside.

· Asian markets fell for the third session in a row as Trump sought to enforce fresh tariffs on China. European markets traded higher, whilst the Russian rubble falls to its lowest in the month amid sanctions in charges of interfering in the 2016 US Election.

· BHP is expected to continue its bounce from underperformance earlier this week, after ending its US session up an equivalent of 0.42% higher from Australia’s previous close.

· The March SPI Futures indicating the ASX 200 to open 14 points higher towards the 5935 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/03/2018. 8.43AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here