What are our likely next moves?

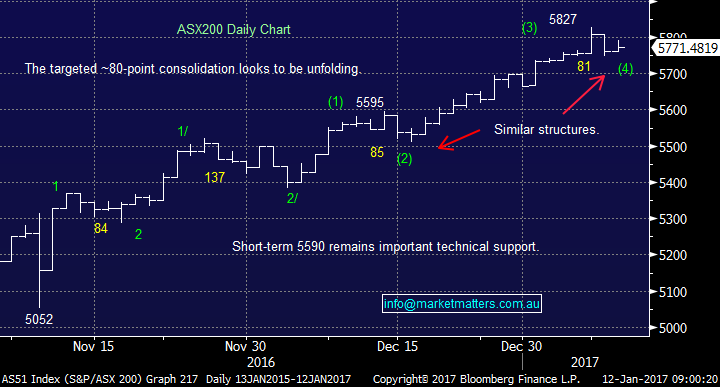

The local equity market continues to follow our roadmap which targets the 5850-5875 area before a decent pullback. The local market is looking to open a modest 105-20 points higher this morning as overseas markets appear to have taken the much anticipated speech by Donald Trump mostly in their stride. Three small take outs that caught our eye from the market's reaction to the president elect:

- The Dow rallied 98-points implying to us that traders went short beforehand looking for some potential fireworks which have not materialised, this now strongly implies a break over 20,000 for the Dow is still on the cards.

- The $US weakened a touch which ties in with our view that the market is long the $US so a decent correction feels a strong possibility.

- The US drug makers got sideswiped by Mr Trump and it will be interesting to see if any local stocks suffer the same fate.

We are looking to make some changes to our current portfolio so thought today would be an ideal opportunity to outline our anticipated moves and the reasoning prior to alerts dropping into subscribers inboxes.

ASX200 Daily Chart

We are currently sitting on 26% cash after recent small purchases of Newcrest Mining (NCM) and Platinum Asset Management (PTM) , plus we have opened a trading call spread in RIO Tinto (RIO).

Our holdings are as follows:

1. QBE Insurance (QBE) $12.41 - Our QBE position has looked after us basically from day one, we anticipate some consolidation short-term if our weaker $US plays out but we maintain our bullish outlook through 2016. Hence we intend to hold QBE until further notice.

2. Macquarie Group (MQG)$86.75 - MQG recently got very close to our $90 target area but has since pulled back 3% fairly aggressively. We may take profit on this MQG position if the ASX200 rallies to fresh 2016 highs as expected.

3. Healthscope (HSO) $2.38 - HSO is slowly recovering after the market rerated the stock last October. We remain very comfortable with the long term outlook for HSO and still intend to add to our position if the stock tests the $2 area.

4. Mantra Group (MTR) $3.04 - MTR continues to disappoint / frustrate us. We are likely to take a 8-9% loss on this MTR position in the near future.

5. Origin Energy (ORG) $6.93 - ORG has been an excellent investment for MM to-date and the stock is rapidly approaching our ~$7 target area. We are looking to take a ~30% profit on this position in the near future.

6. Suncorp (SUN) $13.74 - We remain very bullish SUN targeting $15.50-$16. The stock, like the ASX200 short-term, is following our roadmap perfectly and when / if SUN trades over its 2014 high significant alarm bells will be ringing that our forecasted major stock market top is close at hand - interestingly on a relative value basis to its piers we believe SUN should already trading over $15.

Suncorp (SUN) Monthly Chart

7. Vocus Communications (VOC) $4.42 -VOC was our clear Achilles heel in 2016 but after last year's savage sell off the stock has recently found a little love bouncing ~20%. Ideally we will exit this position for a painful loss around $5.50.

8. CSL Ltd (CSL) $103.87 - CSL is our one holding that may be sold off today after Donald Trump's speech last night, it will be interesting. CSL remains a great company that we love but our entry into weakness was clearly a touch premature. We remain buyers under $90 and sellers around $110.

9. Commonwealth Bank (CBA) $85 - CBA is currently our only exposure to the "Big Four" local banks and although we believe a pullback is likely we are happy holders, especially with February's chunky dividend looming.

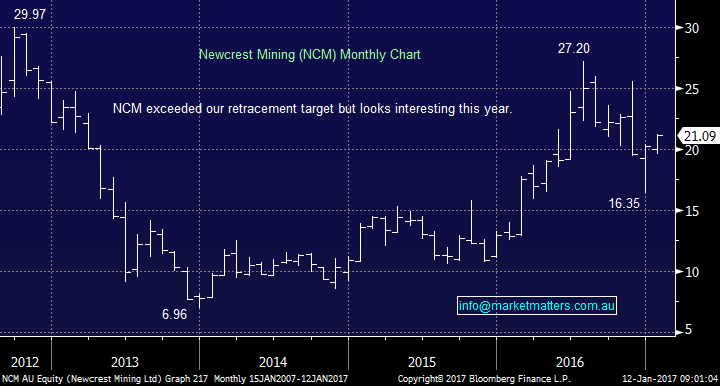

10. Newcrest Mining (NCM) $21.09 - NCM is our short-term position following our view that the $US is due for a correction, a move which is highly likely to send the gold price higher.

Newcrest Mining (NCM) Monthly Chart

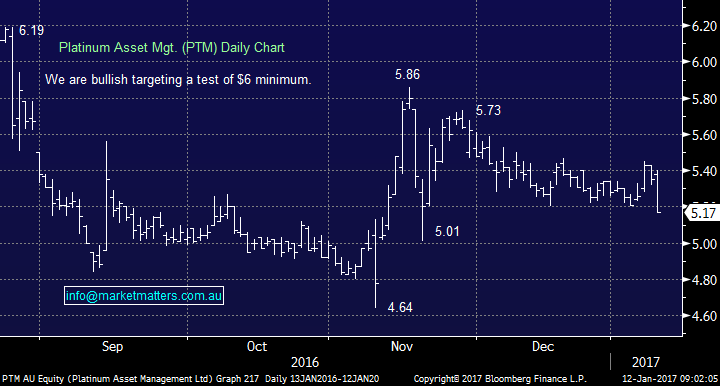

11. Platinum Asset Mgt. (PTM) $5.17 - After yesterday’s fall our entry to PTM feels a little early, fortunately we took a small position due to this potential eventuality. We will look to add to our investment under $5 but short term traders should exit PTM if it cannot close over $5.20 today.

Platinum Asset Management (PTM) Daily Chart

Summary

- We are very likely soon to be sellers of ORG and MTR, plus MQG into strength, especially if it coincides with the ASX200 making fresh highs for 2016.

- This will potentially will take our cash position over 40% if we ignore our market exposure via RIO call spread.

- We are unlikely to be buyers of equities short-term given our recent activity

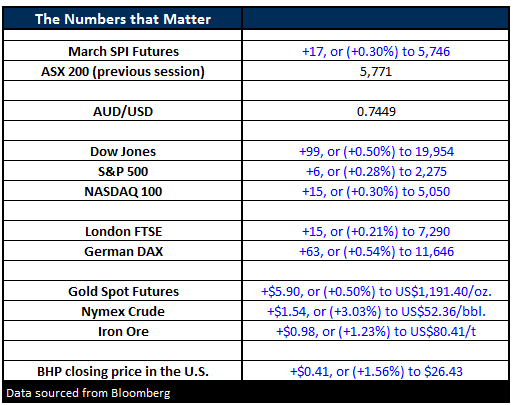

Overnight Market Matters Wrap

- The US share market indices closed in positive territory overnight, with the Energy sector being the market darling overnight.

- The Dow closed 99 points higher (+0.5%) at 19,954, while the broader S&P 500 closed up 6 points (+0.28%) at 2,275.

- As mentioned, the energy sector rallied, with crude oil up 3.03% this morning to US$80.41/t. after a report disclosed US refineries processed a record amount of crude last week- Bloomberg.

- The ASX 200 is expected to test the 5,800 level again this morning as indicated by the March SPI Futures settlement.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/01/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here