We’ve seen extreme “Fear & Greed” already in 2018!

Greed has an amazing way of unravelling itself in almost the same manner every time, whether its Bitcoin, tulips or stocks. When investors start believing they cannot lose the writing is already on the wall and it’s just a matter of time until the chickens come home to roost. As last Christmas approached we were inundated with stories of Bitcoin and the millionaires its was spitting out on a regular basis from all walks of life, this morning just a few weeks later and the major crypto currency has corrected 70% and funnily the stories have vanished from the press!

At MM we have been looking for a decent correction from US equities to produce a buying opportunity and it currently feels that is exactly what we have experienced over the last 48-hours. This period of volatility / weakness may have a little further to run but at this stage we believe it’s an excellent short-term buying opportunity. Note we say short-term and we will elaborate later in the report. Remember what MM has been targeting:

- MM has been aware that since the GFC the ASX200 has formed a low for the first quarter of the year in early February.

- MM has been looking for a “warning” for global equities before a potentially major bear market later in 2018/9.

- MM has been looking for a decent correction for US stocks, ideally to test the long-term uptrend – see later chart.

At this point in time all 3 are on track. Hence yesterday MM was very active in the market:

Growth Portfolio: Purchased RIO, OZ Minerals, Janus Henderson, Macquarie Bank while reducing our Newcrest Mining, net we reduced our cash position to just 6%. The order for AWC that was not filled yesterday is now cancelled.

Income Portfolio: Purchase BHP reducing our pure cash position to just 5%.

Potential activity today:

- Selling the balance of our Newcrest Mining (NCM).

- Buying will depend on individuals stock performance following the Dows 567-point rally overnight.

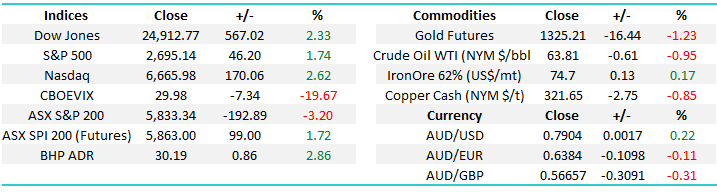

Local Index

We have been targeting the 5900-5950 region to again go overweight local stocks, this was clearly exceeded yesterday as US stock futures were almost limit down in the Asian time zone creating panic across my Blomberg terminal. The technical pattern is not as clear locally as on some o/s markets but our ideal scenario is a rally potentially towards 6250 before major alarm bells ring, obviously short-term the 6000 area is likely to become a bit of brick wall of resistance.

ASX200 Weekly Chart

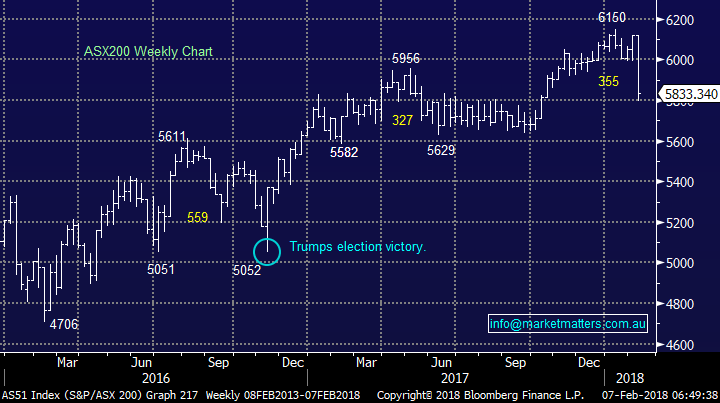

Global Indices

The broad US S&P500 had corrected almost 10% at one stage last night before rallying an impressive 3.9%. Takeout’s following the last few days panic selling.

- The US S&P500 has now corrected -9.7% but has bounced strongly from its long-term trend line support.

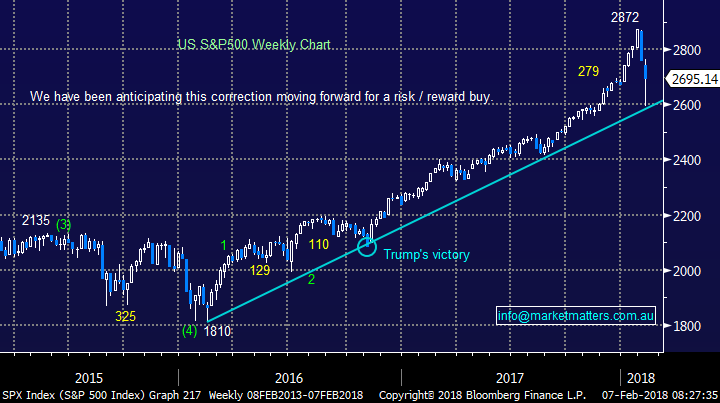

- We had wanted the Fear Index above 20 before a potential low was in place, overnight it traded over 50 before closing back under 30.

- We have been targeting a warning for complacent equity investors over recent months and its certainly manifested itself over the last few days.

Overall US stocks are now in the area where we can see a low forming and our opinion is they will be higher in say 1 months’ time.

US S&P500 Weekly Chart

US Fear Index (VIX) Weekly Chart

Similar to both 2010 and 2014 we believe that US stocks have given the market a relatively friendly warning in the form of a 9.2% correction for the broad Russell 3000 Index – a nudge around what could be on the horizon. At this point in time I expect investors to slowly forget the last few days and refocus on all the bullish fundamental reasons to be in stocks ideally pushing global markets back up to fresh all-time highs before buying the dip will become very dangerous. MM view from here:

- Global markets are likely to regain their bullish euphoric mood to push prices back to all-time highs.

- Following later in 2018/9 we will see a ~20% correction back to the lows of 2016 i.e. recent buying is relatively short/medium term in nature.

Russell 3000 Quarterly Chart

US Dow Jones Weekly Chart

Moving onto 3 other important indices we watch carefully for clues to the overall direction for stocks:

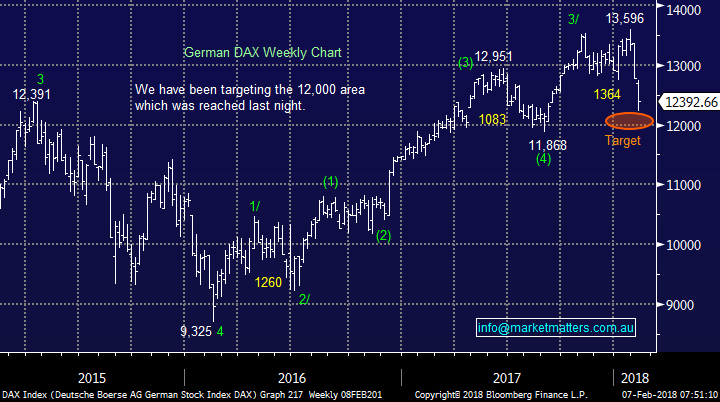

- We have been targeting ~12,000 for the German DAX for many weeks and this was achieved last night.

- The Hang Seng looks to have reached our target area in the last 24-hours.

- The Emerging Markets Index has corrected 9.4% into our “buy zone” before rallying very strongly.

All 3 indices are still saying it’s time to stand up and show some courage – at this stage we will be staying long stocks for at least a few more months.

German DAX Weekly Chart

Hang Seng Weekly Chart

Emerging Markets ETF Weekly Chart

Conclusion

No change, at this stage on the macro level, MM remains keen to accumulate stocks into weakness and sell gold (NCM) into strength.

Watch for alerts.

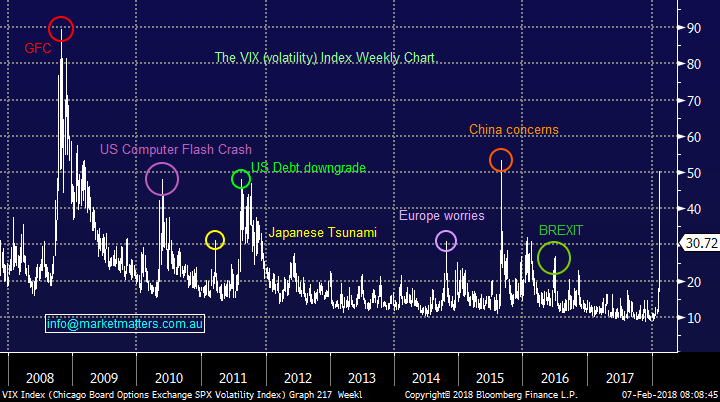

Global markets

US Stocks

The US NASDAQ corrected 9.3% before surging almost 5% off the lows this morning – we believe there’s a good chance the rally to fresh all-time highs is already underway.

US NASDAQ Weekly Chart

European Stocks

European stocks made fresh recent lows overnight as expected, a rally back over 3650 will look great for fresh all-time highs in 2018.

Euro Stoxx 50 Weekly Chart

Overnight Market Matters Wrap

· The US equity markets posted its biggest rally in 15 months overnight, recovering some of its previous aggressive selloff.

· Risk was certainly back on the table, with the Materials sector up 2.81% and BHP ending its US session up an equivalent of 2.86% from Australia’s previous close.

· The March SPI Futures indicating the ASX 200 to open 92 points higher this morning towards the 5925 area.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/02/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here