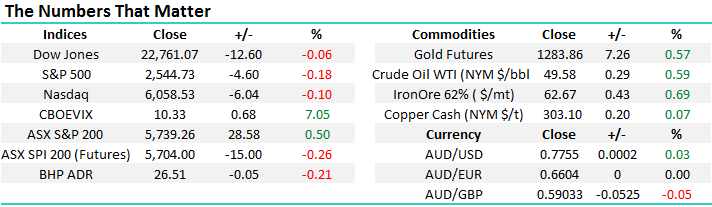

Watching Iron Ore very closely (RIO, FMG, BHP, MQG)

The Australian market maybe moving nowhere as an index but this morning we found ourselves spoilt for choice on topics for this morning’s report with significant action unfolding within the market itself e.g. future takeover targets following Mantra (MTR) yesterday, October being a seasonally strong period for local banks, gold bouncing strongly and iron ore plunging.

We expect to cover all these subjects over the next week but iron ore caught our eye yesterday and although we have discussed the bulk commodity previously over the last month we felt it was an opportune time to update our views following a few subscribers querying yesterday’s weakness in the sector plus quarterly reporting for Australian miners kicking off this week.

Even the AFR reported this morning that short-sellers have increased their position to 9% in RIO Tinto (RIO), the highest on record – in other words a large number of professional traders believe RIO is way overpriced. Clearly the time to keep our finger on the pulse.

The local market is set to open ~20-points / 0.3% lower today but still in the middle of our 21-week trading range.

ASX200 Weekly Chart

Global Indices

US Stocks

US equities were marginally lower last night on a very quiet Columbus Day with healthcare the noticeably weakest sector, while there are definitely no sell signals emerging we would certainly not advocate chasing stocks at current levels.

Overall there is no change to our short-term outlook for US stocks where we are still targeting a ~5% correction for the broad market to provide a reasonable risk / reward buying opportunity.

US NASDAQ Weekly Chart

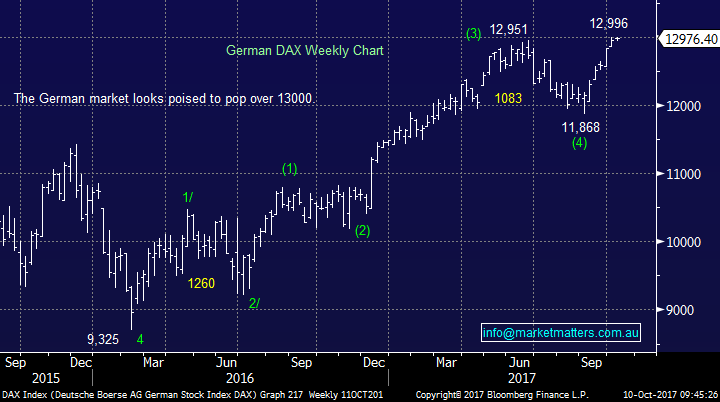

European Markets

The German DAX made fresh 2017 last night but we can see this move failing and a decent correction again unfolding, potentially back under the psychological 12,000 area.

However overall just here we have to remain neutral.

German DAX Weekly Chart

The bulk commodity Iron Ore

With reporting season arriving for the miners this week some large moves may present opportunities - we’ve definitely seen it before! Interestingly Australian miners have only rallied 1.8% from their recent lows compared to 3.6% for the global equivalents, perhaps fund managers want to see some results first, or they are concerned like us that the $A looks likely to fall further. Overall, we like the reflation play moving forward but do currently have a preference for the big cap names BHP / RIO and base metal exposure e.g. Copper and Aluminium.

Moving onto Iron ore which has endured an awful month falling almost 25% and the current momentum / technical picture does look pretty bleak – on balance we definitely expect fresh lows in 2017 and a break of the panic lows in late 2015 cannot be ruled out although we would probably be buyers down there. Hence an often quoted saying keeps coming to mind when we consider the sector:

“The difference between successful people and really successful people is that really successful people say no to almost everything.” – Warren Buffett.

Iron Ore Monthly Chart

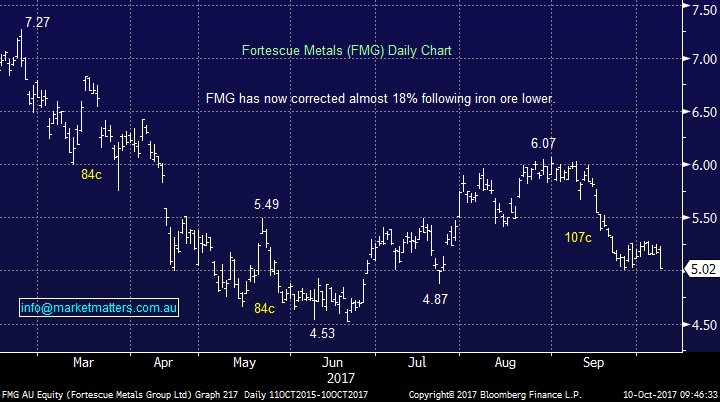

Iron ore producer Fortescue (FMG) has as we would expect tracked the price of the underlying bulk commodity extremely well and is currently sitting on major support at $5. FMG has undoubtedly been our most successful vehicle since our inception at MM and subsequently we are always looking for opportunities closely but it just doesn’t feel right at the moment. Our preferred scenario (s) at present:

1. FMG will break $5 support and initially test a few % lower.

2. We do believe FMG will test the $4.50 area in the months / year ahead.

3. Ultimately a fall towards $3.50 cannot be ruled out if iron ore does test its 2015/6 lows.

We are happy observers for now and unlikely to be active in the foreseeable future.

Fortescue Metals (FMG) Daily Chart

Rio Tinto (RIO) has managed to rally since March aided by capital management decisions ignoring the plunge in iron ore, which is impressive considering over 70% of its earnings comes from iron ore. To be specific, over the last 7 weeks RIO has rallied 10% while iron ore fell over 20%, it’s easy to understand the logic of the short sellers who believe the disconnect cannot continue even with the share buyback supporting the stock. As a comparison the short position in BHP is under 2% and that of FMG under 4%, no doubt who the target is with RIO at 9%!

We like RIO moving forward but at this stage would be looking for sub $65 before we start accumulating.

Rio Tinto (RIO) Weekly Chart

BHP remains almost 4% below where we took a nice profit, we continue to look for further weakness to recommence buying the stock.

Ideally, we will start buying BHP around $25.

BHP Billiton (BHP) Weekly Chart

A Portfolio purchase MM is considering

Over the last few weeks we’ve touched on our desire to buy Macquarie Group (MQG) but frustration at missing the ~15% rally from just over $82. However, we have also cautioned subscribers about purchasing stocks “for fear of missing out” (FOMO) e.g. A2Milk yesterday. Hence our quandary!

We particularly like MQG’s overseas earnings as we feel the $A is vulnerable to further declines. Like the rest of our banking sector MQG will probably get a sentiment move in one direction from Bank of Queensland’s report on Thursday. MQG will also go ex-dividend in November like much of the banking sector and hence may be supported into the pay day, although unlike the “big four” its dividend is under 50% franked.

On balance we are likely to buy a small position in MQG if the opportunity arises under $92 leaving plenty of ammunition to average into any further weakness if it unfolds.

Macquarie Group (MQG) Monthly Chart

Conclusion (s)

No major change, remain flexible and be prepared to “tweak” portfolios when appropriate and this may well become one of the most exciting periods from investing we’ve ever witnessed.

We like BHP and RIO into weakness but not pure iron ore play FMG at this stage.

We continue to like MQG and may commence accumulating the stock under $92.

*Watch for alerts.

Overnight Market Matters Wrap

· US markets drifted lower overnight on light volume with trading affected by the Columbus Day holiday which saw equity markets open and bond markets closed.

· Gold and oil were both firmer and other commodities mixed as tensions rose between the traditional allies, US and Turkey, leading to both suspending visitor visas, a move which saw the Turkish market and currency plunge 3%

· US quarterly earnings season kicks off later this week with the investment banks JP Morgan, Citigroup and Bank of America among the first to report.

· Locally today the NAB business survey will provide a gauge on the underlying business conditions. The A$ was little changed at US77.6c while RIO fell 2% in US trading despite a slightly firmer iron ore price.

· The December SPI Futures is indicating the ASX 200 to open 20 points lower towards the 5720 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here