Volatility is rising under the hood of the ASX (IVC, PLS, FXJ, DHG)

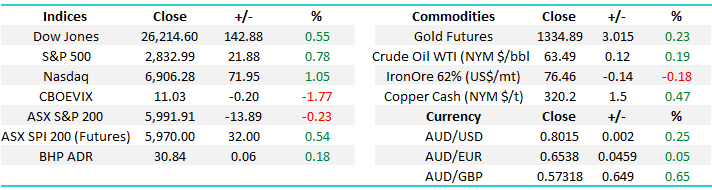

The ASX200 again fell yesterday to close down 13-points, a disappointing -2.6% below the months high especially considering the Dow is trading at all-time highs while I type. This morning we’ve woken up to see the 19th US government shutdown already resolved, as we said previously it’s just an embarrassment as opposed to a meaningful event for the market – it’s hard to believe this farce has happened so many times. However, the approaching debt ceiling discussions which are looming in March / April are far more important, notably so after the recently passed tax cuts – from an historical perspective expect some volatility around this time.

It was interesting overnight to see the International Monetary Fund (IMF) increase its global growth target to +3.9%, the highest rate in 7-years, led by the US following their tax cuts but base metals actually slipped slightly perhaps implying a “rest” is due after a very solid run. They also warned that interest rates may have to be increased faster than many are forecasting and that high asset valuations may lead to a correction in the medium-term – no major surprise here although stocks paid no attention to the negative side of the IMF comments last night! The US mkt is clearly in glass half full mode.

We’ve discussed the common weakness by local stocks into late January and the spike under 6000 we saw yesterday feels like it might be it for a while on the downside. The ASX200 should enjoy an early ~30-points bounce today but our preferred scenario remains a test of the 5925-5950 region in early February. The negative sentiment we saw yesterday was not helped by a few relatively high profile stocks coming under negative news driven pressure, today we will look at 3 of these with an eye to potential buying opportunities looming on the horizon.

NB We have not looked at McGraths as its too hard, in a softening real estate market, board issues, management issues - their troubles could just be beginning with the only caveat being that John McGrath with the help of Private Equity could launch a privatisation, however he’d need to step down from the board before doing so.

ASX200 Daily Chart

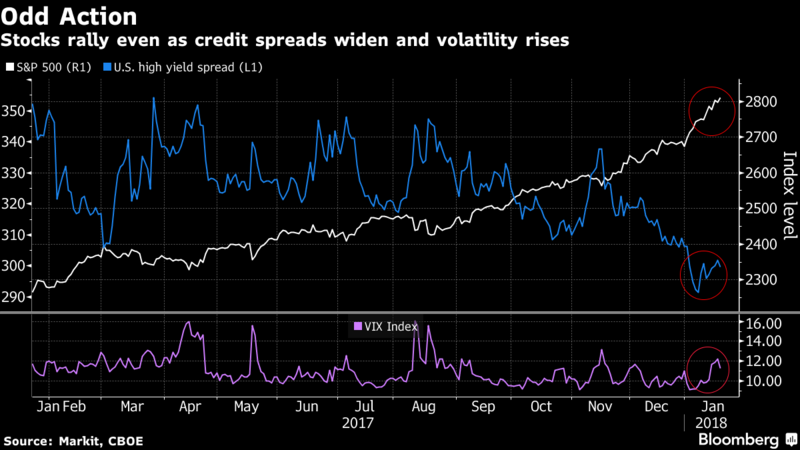

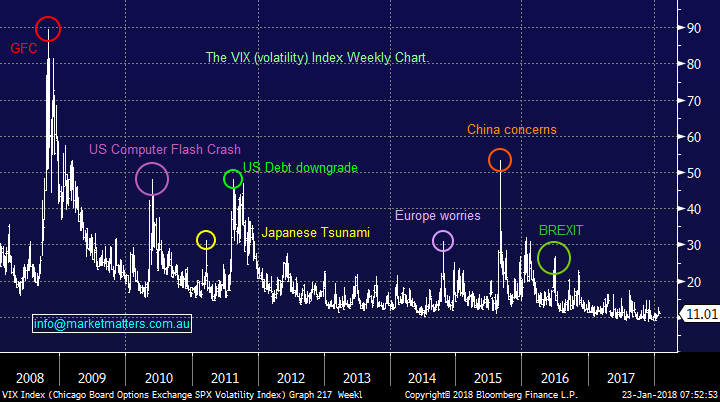

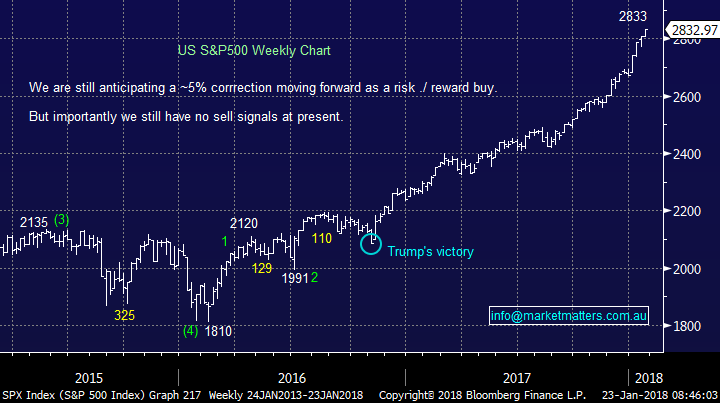

Another aspect around the volatility theme that caught my eye this morning was the widening of credit spreads plus volatility nudging higher, usually a sign that a stock market rally is close to a correction. While we have no sell signals for US stocks at present but remain wary as they enjoy their longest rally in history without a 5% correction.

US S&P500 v Credit Spreads / volatility Weekly Chart

Fear Index (VIX) Weekly Chart

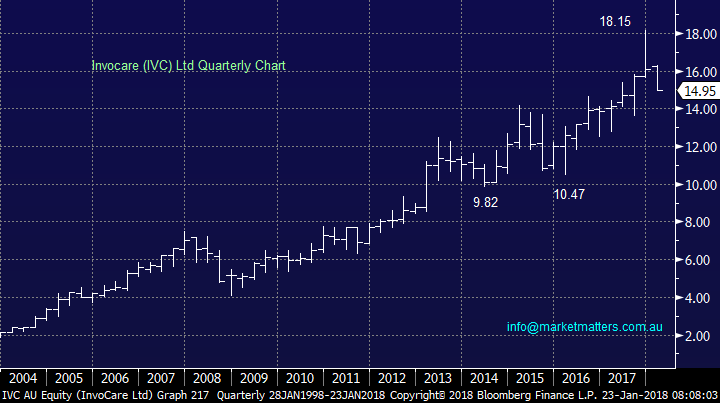

1 Invocare (IVC) $14.95.

Funeral home operator IVC has seen its shares correct over 17% recently with acceleration kicking on the downside yesterday following a profit warning and stock plunge in a comparative operator overseas.

IVC has been an excellent performer over the last decade with an impressive track record of earnings / dividend growth. That said, these trends have a tendency to stall / falter and the risk from a stock perspective comes from the markets imbedded bullish stance, where the market simply extrapolates historical performance into the future and applies a big earnings multiple to it. When performance falters or an external influence arrives that challenges the status quo. Right now it’s on 27x which is rich particularly given it’s no longer the only go-too funeral operator on the ASX. At the end of last year we saw a new operator, Propel Funerals (PFP) list on the ASX and this could be a disruptive influence to Invocare going forward,

At this stage MM is neutral IVC and will stay on the sidelines.

Invocare (IVC) Quarterly Chart

2 Pilbara Minerals (PLS) 94c.

PLS is a WA based mining and exploration company developing lithium and tantalum projects in the Pilbara. The whole lithium sector has taken a hit over recent days allowing us to buy ORE while we’ve also seen PLS down 25% from last week’s high.

This is not a sector / stock for the faint hearted but we could buy PLS as an aggressive trade under 90c, with stops under 80c.

Pilbara Minerals (PLS) Weekly Chart

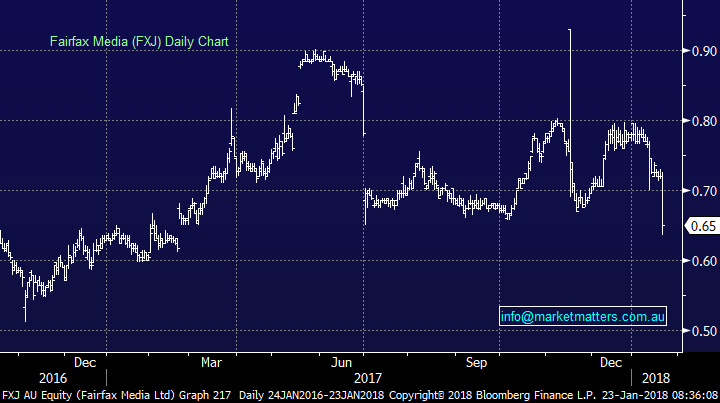

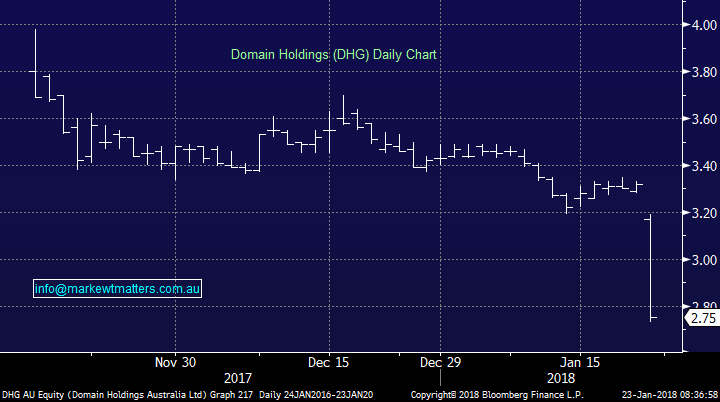

3 Fairfax (FXJ) 65c & Domain Group (DHG) $2.75.

FXJ and DHG were both smacked yesterday following the shock resignation of DHG’s CEO due to family commitments, they also updated guidance which showed 13% total revenue growth which was in-line with expectations. With the housing market cooling there are logical arguments both for and against Realestate.com and Domain Group but they both trade on a valuation over 30x which concerns us as interest rates rise. Simply, a lot of blue sky is already priced in!

While we are happy to be on the sidelines for now on both Domain & Fairfax, DHG may present an opportunity if continued weakness unfolds. Simply, we’re not sure we buy the ‘family commitments’ rhetoric coming from the Domain Chairman yesterday, and clearly the market has a similar concern. Antony Catalano was the driving force behind Domain, has been instrumental in its development and success to date, and just 2 months after listing on the ASX resigns without prior warning.

Fairfax Media (FXJ) Daily Chart

Domain Holdings (DHG) Daily Chart

Conclusion

At this stage MM has no interest in IVC, FXJ and DHG but we could buy PLS as an aggressive/ high risk trade under 90c with stops under 80c

Global markets

US Stocks

The S&P500 has continued its record breaking advance and with no sell signals at present investors should be long, or out.

US S&P500 Weekly Chart

European Stocks

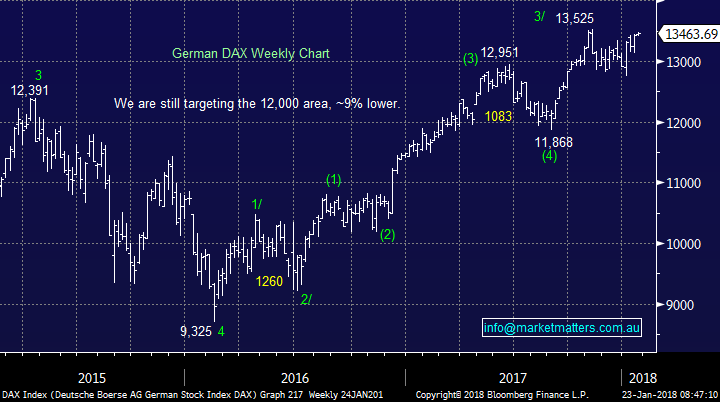

European stocks look set to make fresh recent highs the big question is will they fail or kick on. At this stage we are sitting on the fail side but only just!

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US equity markets commenced the week in positive territory after the US senate voted to terminate the US Government shutdown which lasted 3 days.

· Investors will be watching the US reporting season which gets busy this week with more than 300 companies set to report, of particular interest will be the companies’ thoughts in the looming tax cuts and how they will help shareholders. – QBE this morning noted that it sees a $230m write down due to the reduction in US company tax rates.

· Most metals on the LME were better with aluminium the stand-out. Oil is slightly better, while iron ore fell a touch.

· The March SPI Futures is indicating the ASX 200 to open 34 points higher towards the 6025 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here