Using the “FANG” stocks to gauge this share market rout.

The ASX200 looks likely to fall back into the volatility party this morning following the 1032-point plunge on Wall Street overnight. At this stage the market looks set to open down well over 100-points, making fresh weekly lows.

There is no doubt that we have many of the ingredients for a “panic low” as the press embrace this aggressive sell-off – certainly sells more papers than a boring orderly rally! Today’s retest of Mondays lows by global markets is a common characteristic before markets can regain confidence / rally – for the bulls at these levels we do not want to see acceleration lower from here.

At MM we believe subscribers should not panic this morning and we envisage that our buying hat will come back out into this morning’s weakness.

1. We are looking to buy Iluka (ILU) down towards $9.

2. We are looking to buy Alumina (AWC) under $2.20.

3. We may simply add to our BHP and / or RIO if the above 2-stocks fail to reach our buy zones.

4. We are looking to sell our 5% holding in Newcrest (NCM) which should outperform today following golds small rally overnight.

*Watch for alerts.

Today’s report has re-visited the FANG stocks which we covered exactly a week ago and importantly calling them lower. Today we are looking to see if they have now reached our target areas.

We believe the FANGS are often leading indicators and hence should give us a clue to what comes next i.e. Facebook, APPLE, Amazon, Netflix and Google.

ASX200 Daily Chart

Quickly returning to the Emerging Markets Index which we have watched carefully over recent weeks, primarily due to its strong correlation to our resources sector.

1. The EEM has now corrected perfectly into our buy zone.

2. The correlation between the EEM and the likes of RIO is excellent aiding our confidence to buy this aggressive sell-off in resources.

Remember only 10-days ago we were sitting with high cash waiting for this correction in the resources sector, so at this stage were happy

Emerging Markets ETF (EEM) Weekly Chart

Interestingly the Fear Index / Volatility (VIX) is trading significantly below the panic earlier in the week which adds to our confidence in the view that we are seeing a short-term buying opportunity in stocks.

Remember one of MM’s views for 2018 was increased volatility which has clearly played out to-date.

Fear Index (VIX) Daily Chart

The “FANGS”

1 Facebook

Our comment last week - There are definitely no sell signals in FB but if we were long we would take profit on some of our position.

Facebook has now corrected -11% leaving us neutral.

Facebook (FB) US Weekly Chart

2 APPLE Inc (US)

Our comment last week - We can see APPLE trading 15-20% lower over 2018/9.

Market heavyweight APPLE has already corrected -14.5% switching us to neutral from bearish.

APPLE Inc (US) Monthly Chart

3 Amazon.Com US

Our comment last week - Amazon has corrected 5.5% this week, we believe that the correction will eventually be over 10%.

Amazon has now corrected -11.9% leaving us neutral / bullish from bearish.

Amazon US Monthly Chart

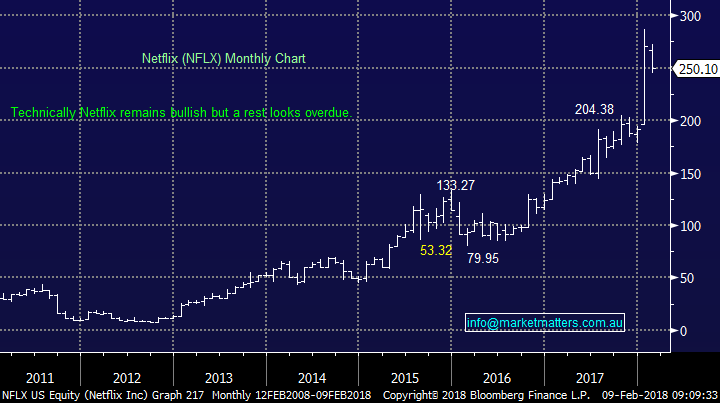

4 Netflix US

Our comment last week - so far, this week Netflix has corrected over 7%, at this stage we would not expect a great deal more.

Netflix has now corrected 14%, we were clearly too optimistic here but are still neutral.

Netflix (NFLX) Monthly Chart

5 Google US

Our comment last week - Google has corrected only -1.4% so far, we would be keen buyers around 1110, or 6% lower if weakness does unfold.

Google has now corrected -15%, further than we expected, we would be buyers between current levels and 950.

Google Inc – Class A Monthly Chart

Conclusion (s)

Last week we were standout bears on the FANG’s making some pretty aggressive calls e.g. Amazon was set to fall over 10%.

While the speed of the decent has been huge our negative calls have been satisfied, time will tell if we were bearish enough!

The Emerging Markets have reached our buy area perfectly strongly implying that Australian resources are a buy at today’s levels.

Global Indices

US Stocks

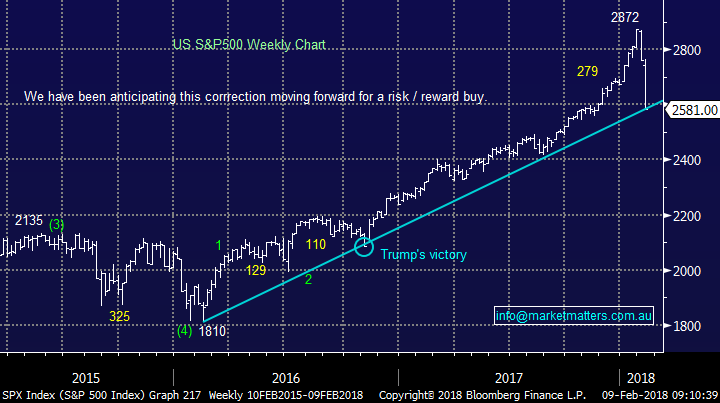

Our target for the current gut wrenching weakness in US stocks is currently being tested i.e. the S&P500 testing its long-term trendline ~2600.

US S&P500 Weekly Chart

European Stocks

No major change with our preferred scenario for the German DAX a correction back towards the 12,000 area for excellent risk/reward buying unfolding as I type.

German DAX Weekly Chart

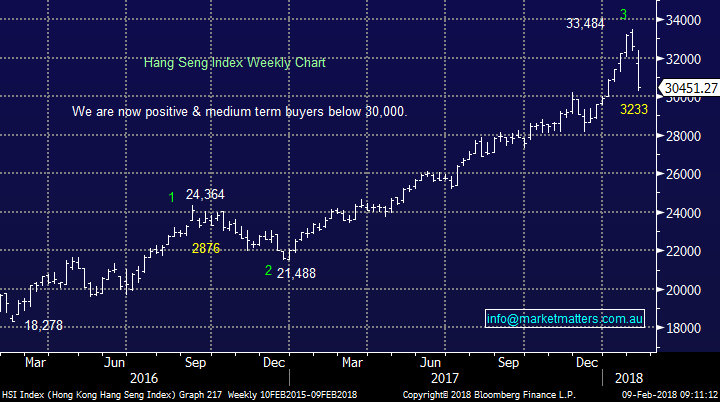

Asian Stocks

Similarly, to western global indices the Hang Seng has corrected ~10% and is looking to open in our buy zone this morning.

Hang Seng Weekly Chart

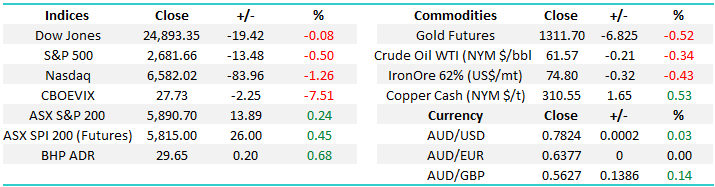

Overnight Market Matters Wrap

· Investors were reminded of what the repercussions maybe on the US economy should interest rates rise, with the major equity indices selling off aggressively once again this week.

· In the Eurozone, Bank of England officials indicated that rates would have to rise earlier and by a greater degree than they had foreseen in November. European stocks fell circa 2%.

· LME metals were mixed, oil fell to a one month low, while iron ore and gold were close to flat.

· The March SPI Futures indicating the ASX 200 to open 147 points lower towards the 5745 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/02/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here