US stocks test all-time highs, don’t chase!

This weekend the year of the rooster will be welcomed in by China, the world's second largest economy. At the same time the largest economy enjoys its share market pushing towards record all-time highs. The US market is currently embracing any sniff of good news and ignoring the bad, like potential trade wars with Mr Trump at the helm - we have seen this degree of optimism before and it always runs out of steam at some point. We reiterate our mantra for the coming year:

"Buy weakness and sell strength in 2017" - Market Matters.

We followed this investment theme yesterday by buying ANZ Bank (ANZ) after it had corrected 8.7%, remember we sold Westpac (WBC) earlier in the month into strength, WBC has since corrected over 7% from its January highs. This represents an excellent value-add "switch".

There is a tweak to our view for US stocks, with our preferred scenario now US stocks squeeze to fresh all-time highs over coming days / weeks, probably around 1.5% higher, before retracing ~4%. Importantly we believe there is enough good news baked into current stock valuations that they will not follow through with this current rally.

NB There has not been a fall of over 1% in US stocks since October 11, the longest streak since 2006 and a warning from a statistical perspective.

US Dow Jones Daily Chart

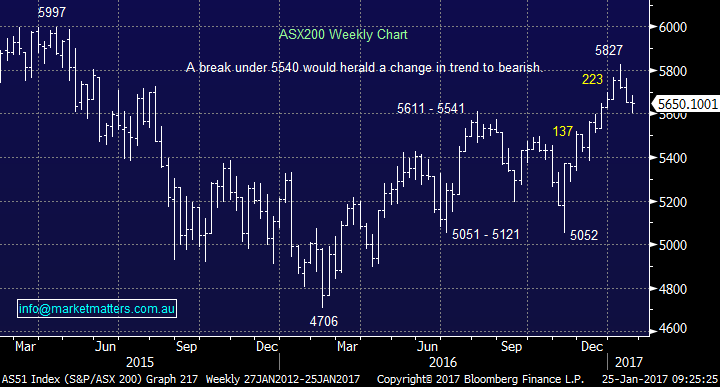

The local market has held the 5600 support incredibly well over recent days and is likely to test 5700 shortly as Australia Day approaches on Thursday. We can see the market range trading between 5600 and 5800 into February hence opportunities to pick up stocks into weakness are still likely, especially taking our view of the US market into account.

ASX200 Weekly Chart

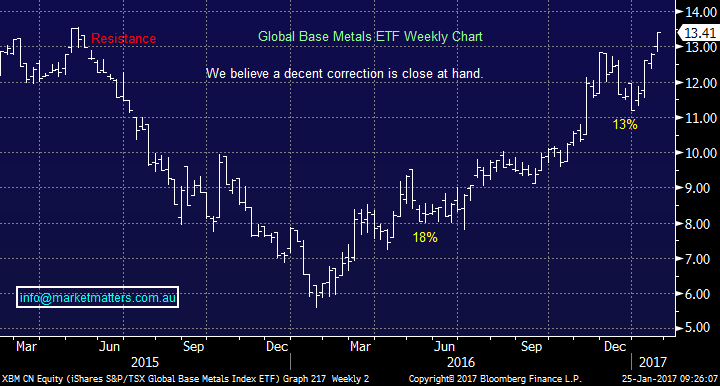

The resources are likely to lead the charge locally this morning, following on from yesterday, with strong gains in metals overnight - BHP is set to open ~$27.40 up 1.5%.

One of our main views for 2017/18 is inflation will pick up strongly as global growth improves, this should continue the outperformance from the resource stocks and we believe the ASX200 will finally outperform the Dow for the first time in 11 long years - unfortunately just as many local retail investors have flocked to passive index funds with overseas exposure. While we remain buyers of resource stocks into weakness we are definitely not buyers of this current leg up and would actually be sellers of it from a trading perspective - remember during the very impressive rally in the Base Metals ETF since January 2016 there has still been both an 18% and 13% correction.

Our view is a far better opportunity will arise in the coming months to gain exposure to the likes of BHP, RIO and S32.

IShares ETF Global Base Metals Weekly Chart

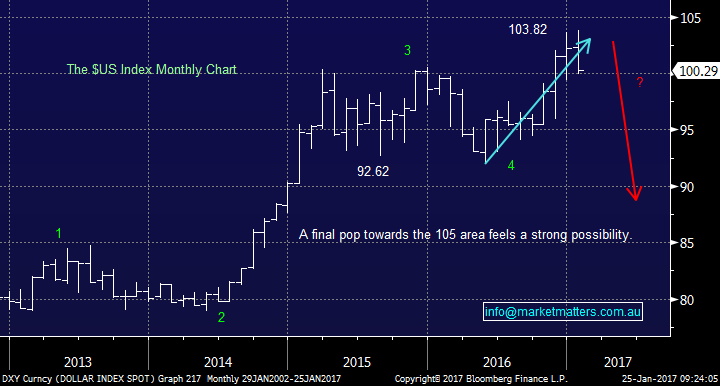

We also continue to believe the gyrations of the $US during 2017 will have an enormous impact on both stock indices and especially respective sectors. The $US has retreated around 4% as many traders were caught in the same obvious trade - "long $US" with interest rates set to rise.

While the index holds the psychological 100 area we can see another rally unfolding towards the 105 area, this would likely see a pullback in both base and precious metals equities to create buying opportunities.

$US Index Monthly Chart

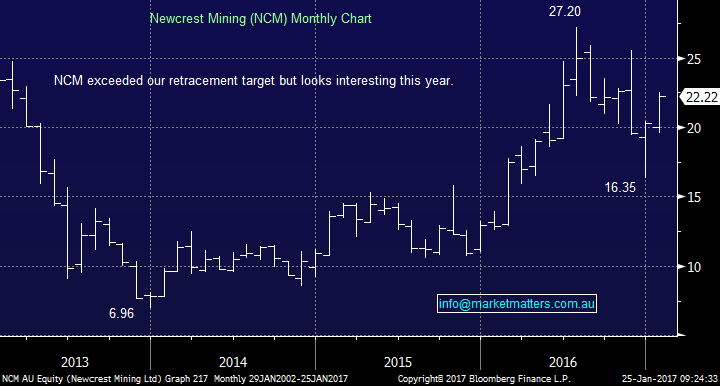

We will look to add to our Newcrest holding into any pullbacks or increase our precious metal exposure via another company like Regis Resources, or Evolution Mining.

Newcrest Mining (NCM) Monthly Chart

Summary

We will continue to buy weakness and sell strength in 2017 until further notice.

**Watch for alerts**

Overnight Market Matters Wrap

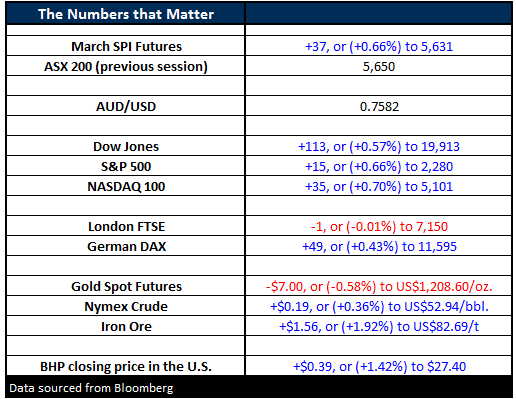

- U.S. stocks rose the most in three weeks, sending the S&P 500 Index to an all-time high, while Treasuries tumbled. Commodities rallied.

- The Dow closed 113 points higher (+0.57%) at 19,913, while the broader S&P 500 rallied 15 points (+0.66%) to 2,281.

- UK’s highest court dealt a blow to Theresa May on Tuesday by ruling the government must hold a parliamentary vote before triggering Article 50 to leave the EU.

- January flash manufacturing PMI beat but December existing-home sales missed.

- US Inventory of existing homes available for sale is at the lowest level since 1999 at 1.65m.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here